Quoc Cuong Gia Lai JSC (Stock Code: QCG, HoSE) has announced a Board of Directors resolution approving the issuance of shares to pay dividends for 2021.

The company plans to issue over 27.5 million QCG shares as dividends for 2021, with a ratio of 10:1, meaning shareholders holding 10 shares will receive 1 new share. The total issuance value, based on the par value, exceeds VND 275.1 billion, funded from undistributed after-tax profits as of December 31, 2024, according to the audited 2024 consolidated financial report.

The issuance is scheduled for Q1/2026, upon receiving confirmation from the State Securities Commission (SSC) that all required documents have been submitted.

Illustrative image

If successful, the total number of outstanding shares will rise from over 275.1 million to more than 302.6 million, increasing the chartered capital from over VND 2,751 billion to over VND 3,026 billion.

In other news, on November 26, 2025, Quoc Cuong Gia Lai finalized its shareholder list for the first written shareholder consultation of 2025. The consultation, scheduled for December 2025, will address matters within the authority of the General Meeting of Shareholders, as per the company’s charter.

Regarding business performance, in the first nine months of 2025, the company reported net revenue of nearly VND 354 billion, a 45.4% increase compared to the same period in 2024. After-tax profit reached nearly VND 34.1 billion, approximately four times higher than the previous year.

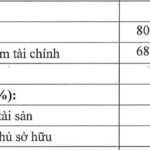

As of September 30, 2025, total assets slightly decreased to approximately VND 8,761.3 billion. Long-term work-in-progress assets accounted for VND 5,402.3 billion (61.7% of total assets), and inventory stood at over VND 1,177.1 billion (13.4% of total assets).

On the liabilities side, total debt was nearly VND 4,150.7 billion, down 3.7% from the beginning of the year. This includes a VND 1,982.8 billion receivable from Sunny Island Investment JSC for the Phuoc Kien project, representing 47.8% of total debt.

Additionally, the company recorded loans from related enterprises and individuals totaling over VND 1,197 billion. Notably, a VND 507 billion loan from Ms. Lai Thi Hoang Yen, daughter of Chairman Lai The Ha, and a VND 527 billion loan from Mr. Lau Duc Duy, brother-in-law of CEO Nguyen Quoc Cuong.

Phú Mỹ Tops Urea Market Share, Aims for Billion-Dollar Revenue

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCO – Phu My, HOSE: DPM) is entering a strategic acceleration phase. Building on its leadership in the domestic urea market, the company aims to expand into the chemicals and petrochemicals value chain, with a focus on green products such as clean ammonia and hydrogen.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.