At AK FOOD Company’s factory in Tan Binh Industrial Zone, Ho Chi Minh City, production is in full swing. Ms. Nguyen Thi Thu, CEO of AK FOOD, shared that the company is working overtime to meet the Tet market demands. She emphasized that capital is the lifeblood of any business.

Many businesses require capital to purchase additional raw materials and hire more labor to boost year-end production (pictured at Saigon Food Company). Photo: U.P

Collateral Barriers

As the year-end approaches, AK FOOD, like many other companies, needs capital to pay suppliers and invest in factory construction. “With rising bank interest rates, we’ve paused new plans recently. Additionally, collateral requirements are significant hurdles preventing us from securing sufficient capital for production. We hope to access more preferential bank loans to support peak Tet production and future export market expansion,” said Ms. Thu.

Since early November, many banks have raised savings interest rates to attract deposits, sparking a new funding race. Experts predict that as year-end loan demand surges, deposit rates may rise further, increasing lending rate pressures.

Tan Dong Production and Trading Co., Ltd. (Tam Binh Ward, Ho Chi Minh City) is also navigating capital challenges. Annually, the company exports nearly 300 agricultural products to multiple countries, generating around $5 million in revenue. Representatives stated that stable credit access could double or triple revenue by expanding raw material sources. However, the primary obstacle remains collateral. Current USD loan rates are at 6%, while VND rates range from 8-10%. “As the supply chain leader, we support hundreds of suppliers and thousands of farmers. Access to export contract-based loans would enable us to expand boldly,” said a Tan Dong representative.

Small businesses face similar struggles. Duc Phuc Food Production (Tan An Hoi Commune) is juggling Tet orders for candies and jams. Owner Nguyen Thi Chin noted that customers often pay only a small deposit, while raw material and labor costs must be covered immediately. Lacking collateral, she resorts to high-interest non-bank financing. “A 5-5.5% interest rate would allow small businesses like ours to breathe,” Ms. Chin said.

The textile industry faces even greater pressure, with companies investing in green transitions, Tet orders, and next year’s raw material reserves. Vietnam Textile and Apparel Association leaders acknowledged that businesses struggle to secure loans due to insufficient collateral and financial reporting.

Nguyen Phong, owner of a processed seafood distributor in Ho Chi Minh City, noted that year-end capital needs double. “From October to December, export volumes can increase by hundreds of tons monthly. Short-term capital is essential for handling orders and ensuring output,” he said. His company has secured only 50% of required funds, despite planning since Q3.

In the rubber and plastics sector, rising input costs and loan rates force many companies to reduce profits to retain customers. Nguyen Quoc Anh, Chairman of the Ho Chi Minh City Rubber and Plastics Association, said year-end raw material purchases require loans, but collateral standards often prevent access.

Even tech startups, whose assets are primarily intellectual, face expansion barriers. Hoang Long, founder of a green tech startup, noted that intangible assets are often undervalued, excluding them from bank loans and forcing reliance on personal assets.

Cao Ngoc Dung, Chairwoman of the Ho Chi Minh City Women Entrepreneurs Association, observed that despite slight economic recovery since September, businesses remain cautious about loans due to weak purchasing power and debt repayment concerns.

Many Incentives, but Financial Resilience Required

Tran Viet Anh, Vice Chairman of the Ho Chi Minh City Business Association, noted that healthy competition among credit institutions has kept interest rates favorable. Banks offer flexible policies and reasonable rates, especially in the critical year-end production period. Success hinges on businesses’ financial strength and preparedness.

Nguyen Van Hung, Director of Thien Y Food Company (Ba Diem Commune), stressed that effective operations build bank trust, enabling capital access. Current business loan rates range from 5.8-10%. Year-end is prime time for food companies to ramp up Tet production.

Nguyen Duc Lenh, Deputy Director of the State Bank’s Zone 2 Branch (Ho Chi Minh City and Dong Nai), reported that by late October, foreign currency loans exceeded 252 trillion VND, with 162 trillion VND for exporters. Banks continue offering short-term VND loans at 4% to support five priority sectors, including exports. “Credit institutions are enhancing industrial zone connections and disbursing preferential loans for forestry, seafood, and processing to boost growth and supply chain integration,” Mr. Lenh added.

Hyosung Chemical Plant in Cai Mep Accumulates Losses Exceeding 19,000 Billion VND

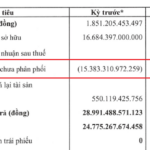

Hyosung Vina Chemicals (Hyosung Vina Chemicals Co., Ltd.) reported continued losses in the first half of 2025, pushing its accumulated deficit to over 19.2 trillion VND, surpassing its chartered capital. The company’s equity remains positive solely due to foreign exchange rate differentials.

Over 4 Million Trillion Dong in Real Estate Credit: What Could Happen Next?

As of the end of August 2025, real estate credit outstanding debt has surpassed 4 million trillion VND, accounting for nearly a quarter of the total debt in the economy. This substantial capital inflow is anticipated to stimulate market recovery, yet it also raises concerns regarding capital efficiency and the potential risk of an asset bubble.

Banks Unload Real Estate: Nearly 4,000 sqm Plot in Ho Chi Minh City Draws Attention with “As-Is” Sale Approach

Major banks are accelerating debt recovery through the auction of collateral assets. A wave of properties, spanning from Hue and Tay Ninh to Ho Chi Minh City, are now up for auction.

From Capital to Digitization: Unlocking Solutions for Small Businesses in the New Era

Resolution 68 is poised to transform the landscape for millions of businesses grappling with capital pressures, tax burdens, and escalating demands for professionalism. Yet, the question remains: What solution can empower these businesses to not only maintain stability but also seize opportunities for sustainable growth?