According to the latest data released by the State Bank of Vietnam (SBV), by the end of September, customer deposits across credit institutions (CIs) reached nearly VND 16,180 trillion, encompassing both individual and corporate clients.

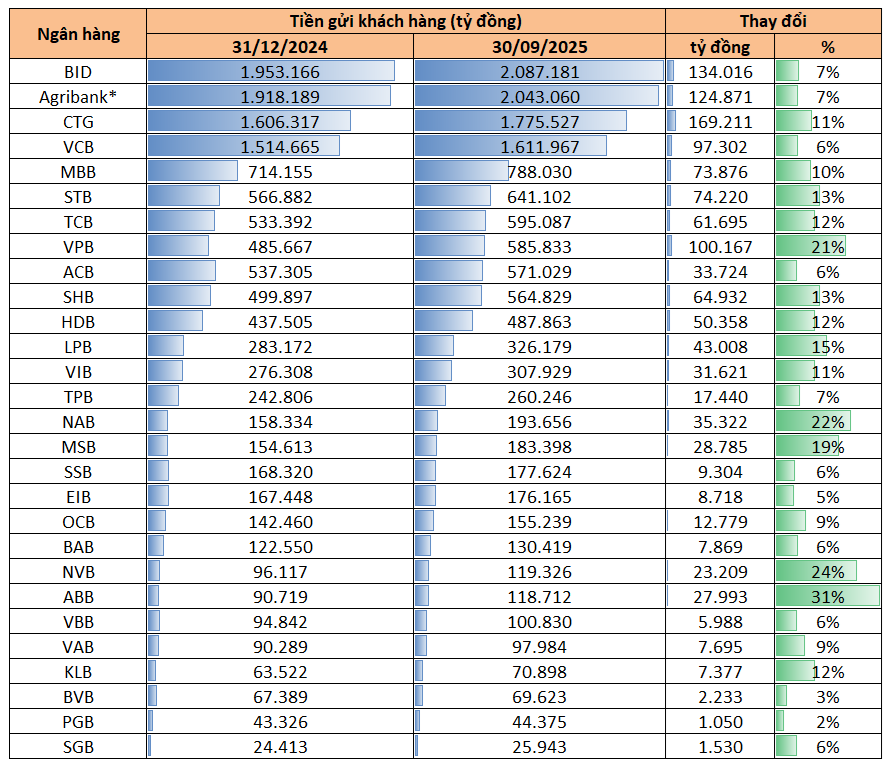

Financial reports from Q3/2025 reveal that the total customer deposits of 27 listed banks and Agribank surpassed VND 14,300 trillion by the end of September, marking a 9.6% increase compared to the end of 2025.

The top 10 banks with the highest deposit volumes are: BIDV, Agribank, VietinBank, Vietcombank, MB, Sacombank, Techcombank, VPBank, ACB, and SHB. Collectively, these banks hold approximately VND 11,300 trillion in deposits, accounting for 70% of the total banking system deposits.

Source: Compiled from Q3/2025 financial reports. (Agribank data as of 30/6/2025)

VietinBank outpaced BIDV in absolute growth, attracting an additional VND 169.211 trillion, bringing its total deposits to VND 1,776 trillion—an 11% growth in the first nine months of the year.

BIDV, a leading player, added VND 134 trillion, raising its total customer deposits to VND 2,087 trillion, maintaining its position as the bank with the largest deposit mobilization in the system.

Agribank reported an additional VND 125 trillion in deposits during the first half of the year, reaching VND 2,043 trillion by 30/6/2025. This growth is attributed to its extensive customer base and strong presence in rural areas, where resident deposits have shown consistent growth. While Agribank has not released Q3/2025 data, estimates suggest its deposit growth may surpass that of BIDV and VietinBank.

VPBank stood out with a remarkable VND 100 trillion increase in customer deposits in the first nine months, the highest among private banks and surpassing Vietcombank. VPBank’s deposits reached VND 585.833 trillion by the end of September, reflecting a 21% growth—the highest among major banks.

Vietcombank added over VND 97 trillion, increasing its deposit base to VND 1,612 trillion. Despite a modest 6% growth rate, its deposit volume remains in the top four, underscoring the strong position of state-owned banks.

Sacombank and MB, both private banks, saw deposit increases of over VND 70 trillion in the first nine months. Sacombank attracted VND 74 trillion (+13%), reaching VND 641.102 trillion, while MB secured nearly VND 74 trillion (+10%), totaling VND 788.030 trillion by the end of Q3.

SHB also demonstrated significant deposit growth, adding nearly VND 65 trillion (+13%), resulting in a total deposit base of VND 564.829 trillion.

Techcombank recorded a VND 62 trillion increase, bringing its total customer deposits to VND 595.087 trillion. ACB, known for its stable savings customer base, added nearly VND 34 trillion (+6%).

Analyzing the top 10 banks with the highest deposit growth, state-owned banks continue to dominate in absolute terms, while private banks—notably VPBank, MB, Sacombank, and SHB—lead in growth rates. The Big4 banks maintain nearly half of the system’s total deposits, despite offering lower interest rates, highlighting their strong reputation and market position.

Record-Breaking Deposits: Vietnamese Citizens Flood Banks with Unprecedented Cash Inflows

Record-breaking deposits flood banks as interest rates soar, igniting a fierce battle for savings at year-end.