The Board of Directors of PTM recently approved a plan to offer 3.2 million shares to existing shareholders at a price of 10,000 VND per share, aiming to raise 32 billion VND in capital.

This funding will be utilized to purchase approximately 70-80 MG vehicles from SAIC Motor Vietnam, bolstering inventory during a period of fluctuating demand. The capital raise is scheduled for the first quarter of 2026.

The rights issue ratio is set at 10:1, allowing shareholders holding 10 shares to purchase 1 additional new share. The rights are transferable but limited to a single transfer.

|

PTM is raising capital amidst its aggressive expansion of the MG network. Previously, the company received shareholder approval to invest 69 billion VND in acquiring a leasing company operating a showroom in Hai Duong City. This acquisition enables PTM to immediately utilize the existing facility without new construction, ensuring stable premises until 2061 at a significantly lower land lease cost compared to the surrounding area.

Projections indicate that the acquisition will yield substantially higher profits, estimated at over 64 billion VND within 5 years, compared to approximately 40 billion VND if the company continued leasing due to eroding profit margins from rental expenses.

The company views the old Hai Duong area as a strategic location for developing an MG Premium showroom, completing its Northern network, and expanding into Hung Yen.

MG Distributor Seeks to Acquire Showroom Leasing Company

PTM is a subsidiary of Hang Xanh Automobile Services JSC (Haxaco, HOSE: HAX), holding a 51.6% stake. The company pioneered the first MG dealership in Vietnam and has since expanded to 15 dealerships, 9 of which meet Premium standards. The 2025 target is to increase this number to 20 dealerships and capture 40% of the MG market share.

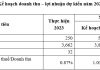

Over the past few years, PTM has experienced rapid growth through scale expansion. Sales surged from 563 vehicles in 2023 to over 3,300 vehicles in 2024, with the first half of 2025 already reaching nearly half of the previous year’s total. Gross profit in 2024 soared to 254 billion VND from 36 billion VND in 2023; the first half of 2025 generated over 107 billion VND, accounting for 15.61% of revenue.

However, Q3 2025 results showed a slowdown. After-tax profit plummeted to just over 362 million VND compared to nearly 51 billion VND in the same period last year. Revenue declined to 300 billion VND, while gross margin fell from 20.6% to 11.6%. Intensifying competition and weak demand caused operating costs to rise faster than sales. In the first 9 months, PTM reported a net profit of less than 34 billion VND, a 63% decrease.

– 18:30 05/12/2025

Brokerage Firm’s Stock Surges to Upper Limit Ahead of Extraordinary Shareholder Meeting

Previously, VIX experienced a steep decline, with its price plummeting from nearly 40,000 VND per share (on October 16th) to below 23,000 VND per share (by November 25th). This represents a staggering loss of almost 74% in value within just over a month.