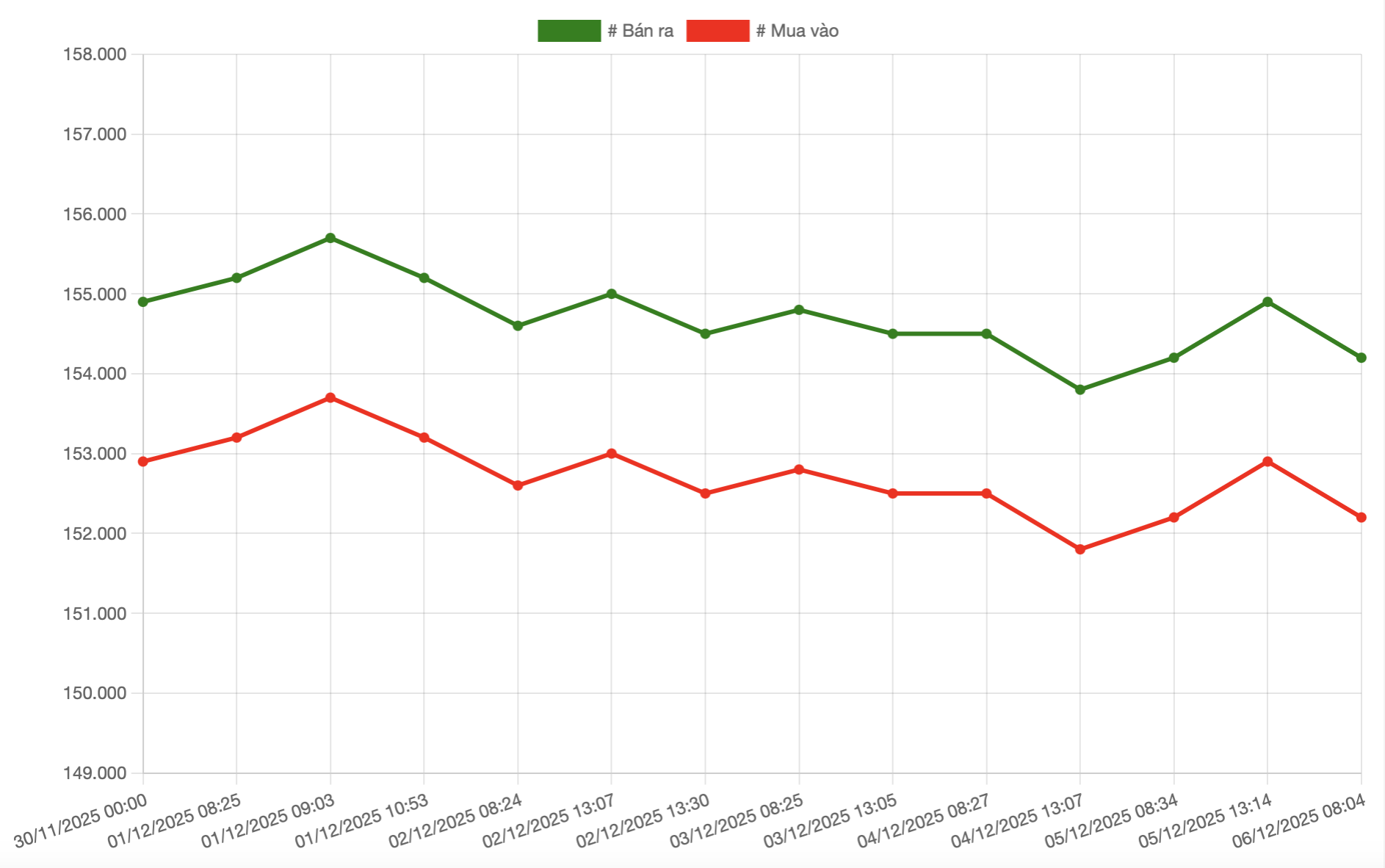

As of early morning on December 7th, the price of SJC, DOJI, and PNJ gold bars is listed at 152.2 – 154.2 million VND per tael, a decrease of 700 thousand VND per tael compared to the previous week’s closing price. During the week, the price of SJC gold at these brands peaked at 153.7 – 155.7 million VND per tael, then dropped to 151.8 – 153.8 million VND per tael at one point.

The price of gold bars at Bao Tin Manh Hai and Bao Tin Minh Chau also decreased by 600 – 700 thousand VND per tael over the past week, currently selling at 154.2 million VND per tael, while the buying prices are 152.8 and 152.7 million VND per tael, respectively. Mi Hong and Phu Quy are trading at 153 – 154.2 million VND per tael and 151.2 – 154.2 million VND per tael, respectively.

The buying-selling price difference for gold bars at various gold shops ranges from 1.2 to 3 million VND per tael, meaning investors could lose up to 3.7 million VND per tael if they bought at the end of last week and sold this week.

SJC gold bar price movements over the past week

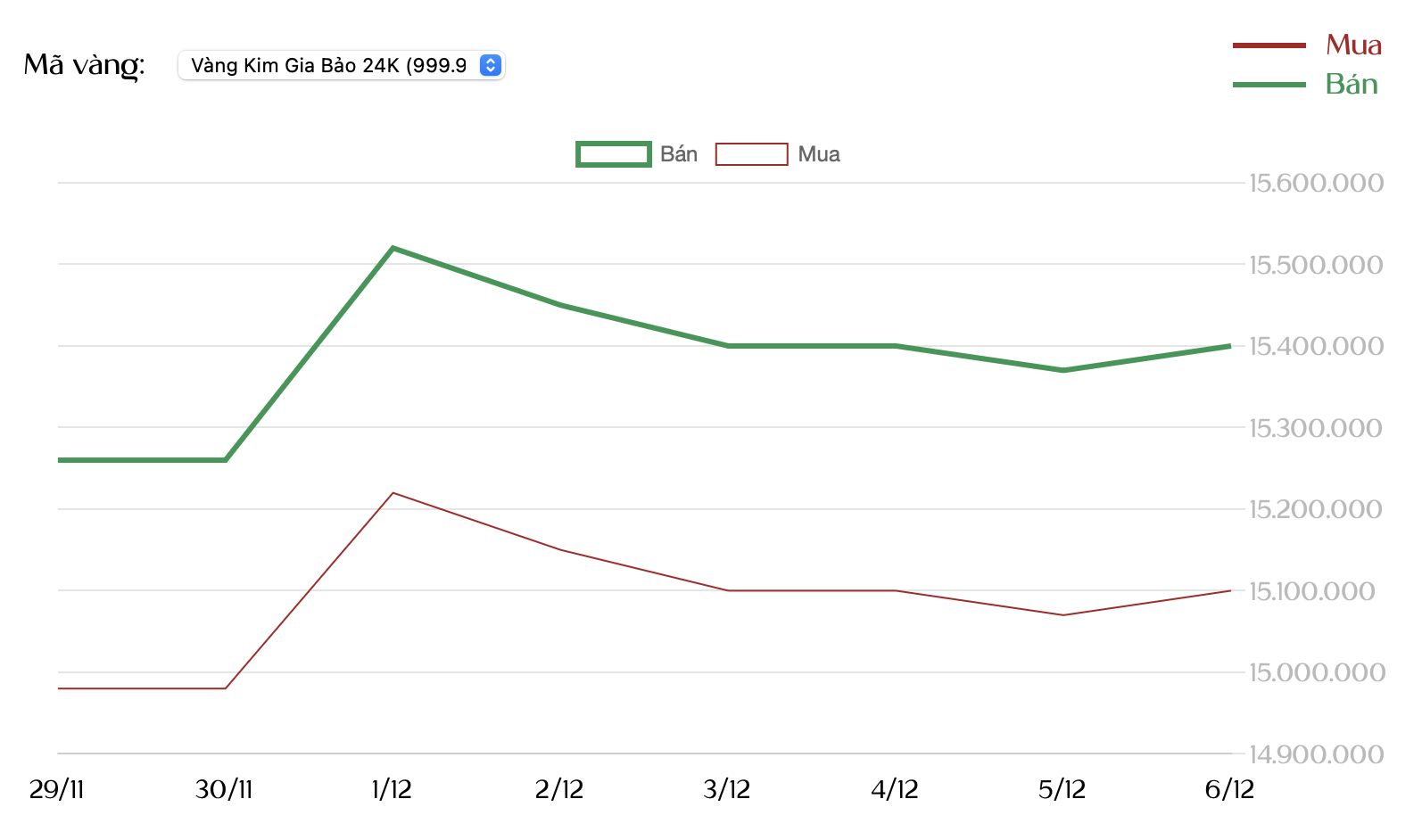

Over the past week, the price of gold rings at various gold shops decreased by 700 thousand to 1.1 million VND per tael. Kim Gia Bao gold rings at Bao Tin Manh Hai and Bao Tin Minh Chau gold rings are currently listed at 150.5 – 153.5 million VND per tael. SJC gold rings fell below the 150 million VND per tael mark, dropping to 149.5 – 152 million VND per tael. Meanwhile, the price of gold rings at PNJ, DOJI, and Phu Quy has been stable, trading at 150 – 153 million VND per tael.

If investors bought gold rings at the end of last week and sold them today, they could lose up to 4 million VND per tael.

Gold ring price movements at Bao Tin Manh Hai over the past week

International gold prices this week remained around $4,200 per ounce, as inflation is no longer a significant obstacle to the Federal Reserve’s interest rate adjustment plans.

According to Kitco News, the gold market is awaiting the Federal Reserve’s policy meeting next week, hoping it will end the prolonged uncertainty and provide clear direction for gold prices in the near future.

Over the past six weeks, market expectations regarding U.S. interest rates have changed rapidly. At the most recent meeting, Fed Chair Jerome Powell stated that a rate cut in December was “not a certainty.” This firm stance led the market to almost rule out the possibility of a rate cut.

However, relatively stable inflation and a noticeable slowdown in the U.S. labor market have brought the possibility of a rate cut back into play just days before the meeting. According to CME’s FedWatch tool, by late October, the market was betting on a 90% chance of a Fed rate cut, but after the November meeting, this probability dropped to just 30%. Currently, that forecast has returned to nearly 90% for the final meeting of 2025.

Fluctuations in policy expectations have significantly impacted gold prices. Prices hit a low of nearly $3,900 per ounce in November, then rebounded and are currently trading around $4,200 per ounce, but have not surpassed the previous week’s peak.

Despite the positive price movements, some experts believe the market needs new momentum to return to the record highs of October. As 2025 draws to a close, this is seen as a significant challenge.

Aaron Hill, Director of Analysis at FP Markets, notes that future gold price movements depend on whether the Fed continues to ease policy, along with macroeconomic factors such as slowing growth or increased geopolitical risks. According to Hill, to set an all-time high, gold needs a “trifecta” of support: significant rate cuts, a weaker U.S. dollar, and increased safe-haven demand. A single rate cut is not enough; the market needs a macroeconomic shock or strong dovish signals from the Fed.

Barbara Lambrecht, an analyst at Commerzbank, noted in a September report that the Fed is expected to make two rate cuts next year; however, concerns about slowing growth and political pressure could lead the Fed to ease more aggressively.

“If FOMC members want to cut rates more times than expected in September, that could push gold prices higher, especially since this scenario is not yet reflected in the market for early-year meetings,” Lambrecht said.

Lukman Otunuga, an analyst at FXTM, believes gold will continue to experience strong volatility amid uncertainty about the Fed’s policy trajectory. According to Otunuga, U.S. interest rates could be cut for the third time this year, but the outlook for 2026 is “unpredictable” as the Fed lacks October NFP and the latest CPI data. “Any surprises could cause gold to fluctuate significantly. If it surpasses $4,240 per ounce, the price could rise to $4,300. If it falls below $4,200, the price could retreat to the $4,180–$4,160 range,” he said.

In an interview with Kitco News, Eric Strand, founder of the precious metals investment firm AuAg Funds, stated that even if gold continues to accumulate above $4,000, the market still holds significant value. He believes market sentiment for gold is much more sustainable than just a single interest rate decision. Regardless of what the Fed does or signals next week, Strand says the only direction for interest rates is down.

He added that not only must interest rates decrease, but to significantly reduce borrowing costs, the Fed will also need to implement a robust quantitative easing program. “Huge deficits and debt mean a large amount of additional money will need to be printed,” he said. “For this reason, gold will rise in price, regardless of its current level. Now is the time to invest in gold, or you’ll miss the opportunity again.”

David Morrison, an expert at Trade Nation, believes that despite the slowdown around $4,200 per ounce, any decline next week could be seen as a buying opportunity. According to Morrison, if there is a sharp drop, gold could retreat to the $3,800–$3,600 range, and that would be “the time to prepare for a strong rally to new record highs.”

In addition to the Fed meeting, three other central banks—the Reserve Bank of Australia, the Bank of Canada, and the Swiss National Bank—will also announce their policies next week. The market expects all three banks to keep interest rates unchanged.

Gold Prices Plummet: SJC and Ring Gold Investors Face Potential $170 Loss per Tael in One Week

If you had purchased gold rings last weekend and sold them today, you could have incurred a loss of up to 4 million VND per tael.

USD Hits One-Month Low

The US dollar’s decline in international markets persisted from late November into the first week of December 2025 (01–05/12/2025), fueled by growing expectations that the Federal Reserve will cut interest rates during its upcoming meeting next week.

Double Profits, Double Impact: The Financial Trend Revolutionizing Personal Money Management in Vietnam

Have you ever wondered, “Can idle or spent money generate returns?” The answer is a resounding yes, and this philosophy is driving a revolution in how modern individuals manage their personal finances. A prime example of this trend is VIB’s Profit Duo—a financial solution that forward-thinking users are leveraging to achieve dual profitability.