Last week, the VN-Index surged by 50.33 points to reach 1,741.32. The average trading volume on HoSE hit 741 million shares per session, equivalent to a value of 23.758 trillion VND per session. Similarly, the HNX-Index rose by 0.74 points to 260.65.

On the HoSE, foreign investors net bought 62.86 million units, with a net value of over 4.415 trillion VND. On the HNX, foreign investors net sold 1.92 million units, with a net value of over 65 billion VND.

On the Upcom market, foreign investors net sold 1.52 million units, with a net value of nearly 21 billion VND. Overall, during the trading week from December 1-5, foreign investors net bought 59.43 million units across the market, with a total net value of over 4.329 trillion VND.

Buying Spree

Mr. Phạm Hoàng Anh, Chairman of the Board of SMC Investment and Trading Joint Stock Company (stock code: SMC), purchased 1 million SMC shares, increasing his ownership to 1.36% of the charter capital. Previously, at an extraordinary shareholders’ meeting in late October, SMC dismissed two board members, Mr. Hứa Vũ and Ms. Nguyễn Thị Ngọc Loan, the former Chairwoman.

The Chairman of SMC Investment and Trading Joint Stock Company purchased 1 million SMC shares.

SMC appointed three new board members: Mr. Phạm Hoàng Anh, the new Chairman, Mr. Hoàng Trung Dũng, and Mr. Nguyễn Ngọc Anh Duy. Additionally, two new members were added to the Supervisory Board: Mr. Nguyễn Quang Trung and Ms. Thái Thị Vân Anh.

Mr. Phạm Hoàng Anh, 34, currently serves as Deputy General Director of ConnectLog Vietnam Co., Ltd. Following his appointment as Chairman, he acquired 1 million SMC shares.

Mr. Đặng Thành Duy, General Director of Vinasun Corporation (stock code: VNS), registered to buy 1.5 million VNS shares, increasing his ownership to 7.94% of the charter capital. The transaction is expected to take place from December 10, 2025, to January 8, 2026.

In mid-August, Mr. Duy purchased 500,000 VNS shares, raising his ownership to 5.73% and becoming a major shareholder. If successful, Mr. Duy and related parties could own up to 44.77% of Vinasun’s charter capital.

Earlier, Mr. Lê Hải Đoàn, a VNS board member, registered to buy an additional 5,494,700 VNS shares, increasing his ownership to 13.6% of the charter capital. The transaction is expected to occur from December 1 to 30. If successful, Mr. Đoàn and related parties will own nearly 25% of Vinasun’s charter capital.

Vinasun leaders continuously buy VNS shares. Photo: Internet.

The Ho Chi Minh City Stock Exchange (HoSE) has received the listing application for Đông Á Steel Joint Stock Company (stock code: GDA). With over 149 million outstanding shares, Đông Á Steel’s market capitalization is estimated at 2.4 trillion VND. Additionally, Đông Á Steel recently issued shares to pay a 30% dividend for 2024.

Earning Trillions from Shares

PetroVietnam Power Corporation (PV Power – stock code: POW) announced that on December 11, it will execute shareholder rights, pay dividends in shares, and issue shares to increase charter capital from equity.

PV Power plans to issue over 281 million shares for shareholders to exercise their rights at a ratio of 100:12, meaning each shareholder holding 1 share receives 1 right, and every 100 rights allow the purchase of 12 new shares. The issuance price is 10,000 VND per share. These shares will be restricted from transfer for one year after the offering.

The total proceeds from this offering, over 2.810 trillion VND, will be used to finance the equity for the Nhơn Trạch 3 and Nhơn Trạch 4 power plant projects.

Additionally, POW will issue nearly 94 million shares as a 4% dividend to existing shareholders, meaning every 100 shares held will receive 4 new shares. PV Power will also issue over 351 million bonus shares at a 15% ratio.

PV Power earns trillions from three share offerings.

On December 17, Cà Mau Seafood Joint Stock Company (stock code: CAT) will finalize the shareholder list for the first interim dividend payment of 2025 and execute shareholder rights. Cà Mau Seafood will pay a 15% cash dividend, totaling approximately 14 billion VND.

Additionally, CAT plans to issue over 4.6 million shares to existing shareholders at a 2:1 ratio. The issuance price is 10,000 VND per share. The total proceeds, over 46 billion VND, will be used to repay loans due at BIDV’s Cà Mau branch.

Western Bus Station Joint Stock Company (stock code: WCS) announced that on December 16, it will finalize the shareholder list for the 2024 cash dividend payment at a rate of 166.66%. With 3 million outstanding shares, Western Bus Station will pay approximately 50 billion VND in dividends to existing shareholders.

Vinasun CEO Registers to Purchase 1.5 Million VNS Shares

Mr. Dang Thanh Duy, CEO of Vinasun, has recently registered to purchase 1.5 million VNS shares, boosting his ownership stake to 7.94% of the company’s capital.

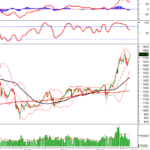

Vietstock Weekly 08-12/12/2025: Climbing Back to the Peak?

The VN-Index extended its winning streak to four consecutive weeks, despite trading volumes remaining below the 20-week average. The Stochastic Oscillator has already signaled a buy, while the MACD is narrowing its gap with the Signal line. If the MACD confirms a buy signal soon, the outlook will become even more optimistic. The index is approaching its historical peak of 1,760-1,795 points, a critical resistance level that will determine the potential for further upside in the final months of the year.

Market Paradox: Index Gains, Portfolio Pains

Despite the VN-Index extending its winning streak to the 8th consecutive session today (December 5th), many investors are experiencing a sense of “index gains, portfolio pains.” While the VN-Index climbed higher, red dominated the market landscape.