Specifically, on December 9th, the Board of Directors of CKG passed a resolution to relieve Mr. Trần Thọ Thắng (born in 1965) from his position as Chairman of the Board, in accordance with his personal wishes. Concurrently, Mr. Nguyễn Xuân Dũng was appointed as the new Chairman for the 2021-2026 term, effective from December 10, 2025.

New Chairman of CKG Board, Nguyễn Xuân Dũng

|

According to CKG, after over 30 years of leadership, Mr. Thắng expressed his desire to step down as Chairman as part of a pre-planned succession strategy. This move aims to empower the next generation of leaders to build upon existing achievements and strategic directions. Despite leaving the chairmanship, Mr. Thắng will remain affiliated with CKG as a Board Member.

Regarding the new Chairman, Mr. Nguyễn Xuân Dũng joined the CKG Board in June 2024 and is currently the company’s largest shareholder, holding a 9.62% stake.

In its announcement, CKG stated that under the new Chairman’s leadership, the company will continue to execute existing projects, expand its operational footprint, enhance corporate governance in line with public company standards, ensure transparency with shareholders, accelerate digital transformation, and forge strategic partnerships to boost competitiveness.

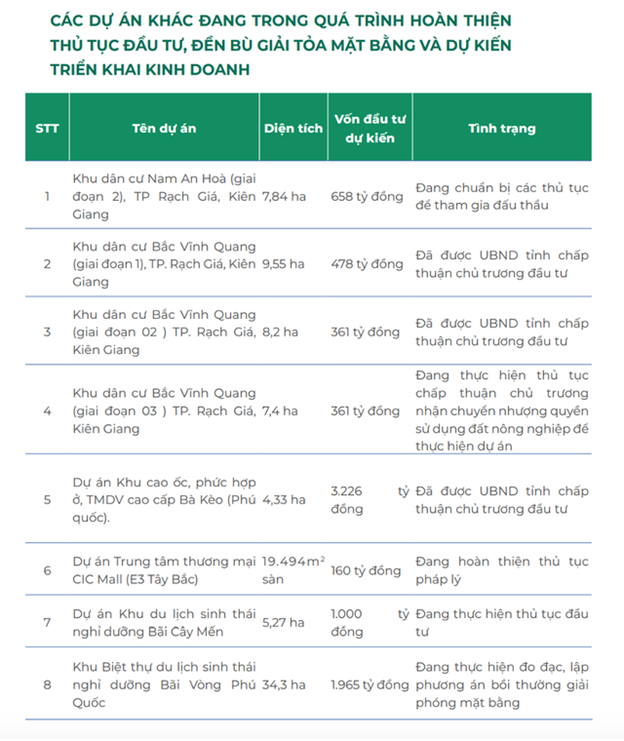

Sharing his development vision, Mr. Dũng highlighted that CIC Group will focus on three strategic regions: Rạch Giá, as the traditional market and revenue cornerstone; Phú Quốc Special Economic Zone, for developing high-value commercial and tourism products; and Ho Chi Minh City along with southern provinces, targeting urban development, social housing, and commercial services expansion.

Source: CKG 2024 Annual Report

|

To fund these initiatives, in June 2025, CKG completed a capital increase from 952.6 billion VND to 1.6 trillion VND. This was achieved through the issuance of 19 million shares as dividends and the sale of over 47 million shares to existing shareholders, aimed at strengthening financial capacity. Additionally, the State Securities Commission approved raising the foreign ownership limit to 49%.

– 11:05 10/12/2025

Đèo Cả Transportation Infrastructure Seeks to Inject Additional VND 790 Billion into Affiliated Enterprise

The Deo Ca Transport Infrastructure is set to inject an additional VND 790 billion into Deo Ca Urban Infrastructure Co., Ltd., increasing its ownership stake from 8% to 17.8%.

Becamex Group Plans to Inject Additional Capital into Two Affiliated Companies

Becamex Group plans to inject additional capital into two of its affiliates, Becamex Bình Phước and Becamex Bình Định, utilizing proceeds from a bond issuance.