Winter months are typically the peak time for heating demand, but the United States is on track to complete a winter with the lowest temperatures since 1950. The warmer-than-usual winter temperatures have resulted in lower natural gas heating use than initially expected. Meanwhile, U.S. natural gas production has surged, reaching a record 105 billion cubic feet per day in December 2023.

The supply-demand imbalance has led to a “free fall” in natural gas prices in the United States, dropping more than 50% since mid-January.

Last Friday, the price of the March delivery natural gas contract at the Henry Hub – the U.S. natural gas market benchmark – settled at $1.61 per million British thermal units (MMBTU), slightly higher than the $1.58 per MMBTU on Thursday. Except for a few days in mid-2020, during the COVID-19 pandemic-induced demand slump, this is the lowest closing price for the next-month natural gas contract since 1995.

“What’s happening is really unusual. I don’t want to say ‘devastation,’ but expectations for natural gas demand are really crumbling,” said Matt Rogers, a meteorologist at consulting firm Commodity Weather Group (CWG), to the Financial Times.

Climate change has led to increasingly warmer winters around the world. Data released this month showed the global average temperature over a 12-month period exceeded the pre-industrial benchmark level by more than 1.5 degrees Celsius. The temperature increase is reducing the need for fuel for heating, even as the shift away from coal increases the demand for gas in power generation.

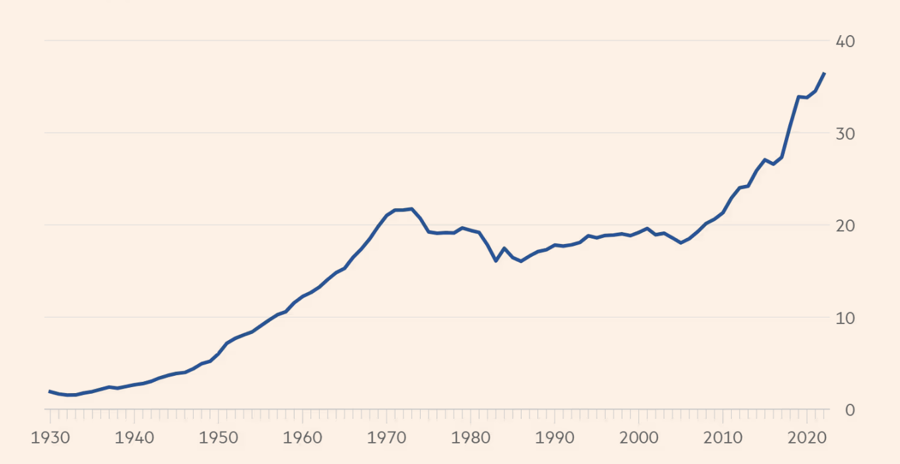

The number of heating degree days – a measure of how cold the weather is based on the number of days the temperature falls below a certain reference threshold – has decreased by 7% in the past two decades, according to the U.S. Energy Information Administration (EIA) data.

The U.S. National Oceanic and Atmospheric Administration, the government agency responsible for determining weather trends, recently warned that ice cover in the Great Lakes has fallen to record lows for this time of year. Based on the available data, analysts forecast that this winter – running from December to March – will be the warmest since reliable weather monitoring equipment was installed at the country’s airports in the 1950s. CWG experts estimate this year’s winter to be 3% warmer than the previous record set in 2016, based on the number of heating degree days.

Contrary to the declining heating demand, U.S. natural gas production, which has been steadily increasing for the past 15 years since the shale revolution, continues to hit new highs. S&P Global Commodity Insights estimated U.S. natural gas production peaked at over 105 billion cubic feet per day in December 2023. Thereafter, production declined in January before rebounding to around 105 billion cubic feet per day in early February.

“The reason is weather and record production levels,” said Luke Larsen, Director of Research at S&P, regarding the declining gas prices, and argued that gas producers will soon have to cut production.

“I think there will be supply-related issues if production levels stay this way. There’s a high likelihood that production will have to be reduced,” said Larsen.

Some natural gas producers have recently signaled cutbacks in drilling plans due to the falling gas prices, which put pressure on profit margins. Comstock Resources said it will reduce its rig count from 7 to 5 and suspend dividends until prices recover. Antero Resources has cut its rig count from 3 to 2 and reduced its budget for drilling new wells. EQT, the largest U.S. natural gas producer, said it is prepared to lower production this year if necessary, depending on price developments.

The gas surplus has pushed U.S. natural gas inventories to over 2.54 trillion cubic feet a little over a week ago, according to the EIA. This level is 11% higher than a year ago and 16% above the five-year average.

The subdued demand has also caused natural gas prices to plummet and inventories to rise in many other regions around the world. In Europe, the Dutch Title Transfer Facility (TTF) gas price – the regional gas market standard – has fallen 22% this year to about €25 per megawatt-hour, equivalent to $7.9 per MMBTU, or less than one-tenth of the peak during last summer’s energy crisis.

Liquefied natural gas (LNG) prices delivered to Northeast Asia, according to data from Argus, have fallen 23% this year and are at their lowest level since 2021.

Traders predict that it will take time to rebalance the natural gas supply-demand dynamics, so the options market reflects a low possibility of a short-term price rally in natural gas prices in the United States.

“I think the market has given up hope on any sustainable recovery in natural gas prices this year. The market is pricing in the potential for further declines in natural gas prices until the supply-demand situation is resolved,” said Charlie Mcnamara, head of commodities research at US Bank.