Michael Saylor, Executive Chairman of Strategy.

|

From Enterprise Software to “Bitcoin Treasury”

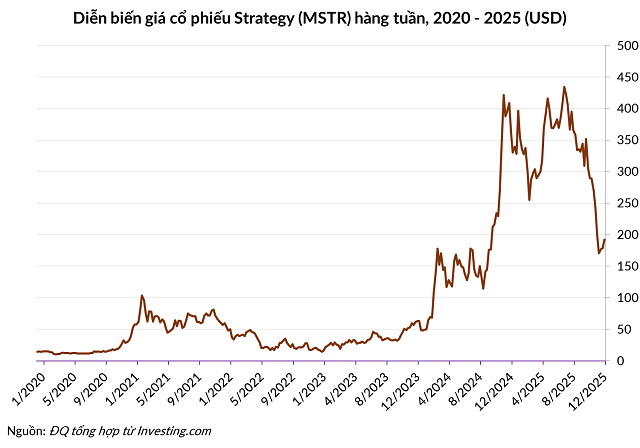

Before 2020, Strategy (formerly MicroStrategy, stock symbol MSTR) was a relatively obscure name in the tech industry. Operating in the field of enterprise analytics software, Strategy generated only about $10 million in free cash flow annually, and its core business was stagnating. Software revenue in Q3 2025 reached a modest $128.7 million.

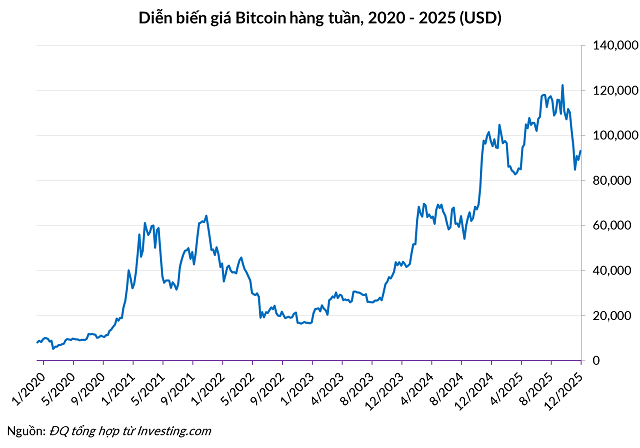

However, Michael Saylor, the company’s chairman, refused to accept this fate. Starting in August 2020, he executed a historic pivot: converting the company’s entire treasury into Bitcoin. Under Saylor’s leadership, Strategy transformed from a software company into the world’s largest “Bitcoin Treasury Company.”

As of December 9, 2025, Strategy holds 660,624 BTC, equivalent to 3.1% of the total Bitcoin supply worldwide, with a total investment cost of approximately $50 billion.

This transformation was driven by a bold financial mechanism dubbed the “Infinite Money Glitch” by analysts.

Decoding the “Infinite Money Glitch”

This “glitch” has been likened to a perpetual financial engine. Essentially, it’s a loop exploiting an irrational pricing discrepancy.

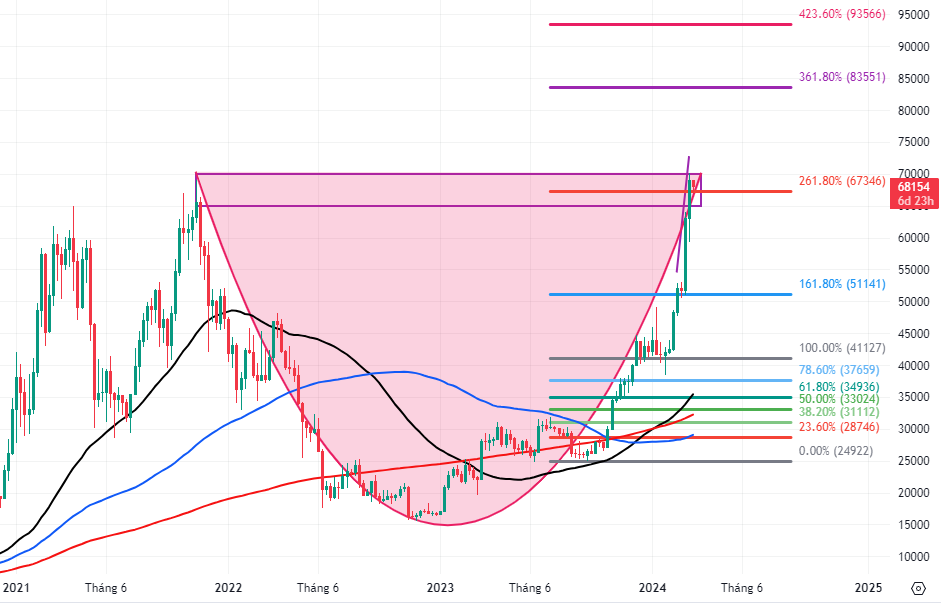

MSTR shares often trade at a significant premium compared to the value of the Bitcoin the company holds. In March 2024, this premium reached 2.6 times, meaning investors were willing to pay up to $177,000 for shares representing one Bitcoin, while Bitcoin’s market price was only around $69,000.

Why would investors pay such a high premium? They viewed MSTR as a leveraged way to own Bitcoin without the risk of margin calls on crypto exchanges. Investors bought MSTR shares with their own funds, and the company then borrowed additional capital, using both equity and debt to purchase Bitcoin. The leverage was taken by Strategy, not the investors. Even if Bitcoin’s price dropped, MSTR shareholders wouldn’t face margin calls.

Michael Saylor exploited this psychology to operate his money-printing machine in three steps.

Step One: Printing Paper for Real Money. Noticing that its shares were priced 2-3 times higher than the Bitcoin it held, Strategy continuously issued new shares. Over four years, Strategy raised nearly $10 billion from stock sales. Additionally, the company issued convertible bonds at near-zero interest rates by leveraging stock price volatility to attract risk-seeking investors.

Step Two: Buying Bitcoin. All funds raised from stock sales and debt were used to buy Bitcoin. This created a compounding growth effect: despite share dilution, the amount of Bitcoin per share also increased.

Step Three: Accelerating the Loop. Strategy’s multi-billion-dollar Bitcoin purchases drove up Bitcoin’s price. Rising Bitcoin prices further boosted MSTR’s stock price. The premium was maintained or expanded, allowing Saylor to issue more shares to buy more Bitcoin.

It was a perfect cycle where issuing more shares didn’t dilute shareholder value but instead made them richer. However, no party lasts forever.

When the Money Machine Stalled

By late 2025, this money machine had ground to a halt due to structural market changes.

The primary and most critical reason was the loss of exclusivity. Previously, MSTR was one of the most convenient and popular ways for institutional investors to access Bitcoin on the U.S. stock market. However, the launch of spot Bitcoin ETFs in January 2024 (such as BlackRock’s IBIT) with ultra-low management fees (0.25%) changed everything. Investors began asking: Why pay 2-3 times more for MSTR when you can buy Bitcoin directly via ETFs at market price?

Consequently, the premium collapsed. As of December 9, 2025, MSTR’s market cap was nearly $55 billion, while the value of its Bitcoin holdings was $60 billion, a stark contrast to the past when the premium exceeded 2 times.

With the premium gone, the money-printing loop reversed into a dangerous spiral. Every significant Bitcoin price drop inflicted pain on Strategy. New accounting standards forced the company to recognize unrealized Bitcoin losses in financial reports, resulting in a massive $6 billion loss in Q1.

More critically, the “accumulation” model was broken. With shares no longer priced at a premium, issuing new shares to buy Bitcoin would dilute existing shareholders’ value.

Raised capital was no longer used to buy Bitcoin but to build a cash reserve for debt repayment and dividends, abruptly ending the once-compelling growth story.

In early December 2025, Chairman Michael Saylor announced a $1.4 billion reserve fund, sufficient to cover preferred stock dividends for the next 21 months.

Existing Risks

Today, Strategy is no longer a money machine but a colossal ship wobbling in a storm, facing significant risks.

Pressure from Convertible Bonds: The biggest risk lies in the massive debt Strategy has accumulated. The company faces nearly $6 billion in debt obligations between 2028 and 2030. If MSTR’s stock price doesn’t reach the conversion price when bonds mature, creditors will demand cash repayment instead of shares. With limited cash on hand, Strategy’s only option will be to sell Bitcoin.

Death Spiral: This is the nightmare scenario critics of MSTR have warned about. If Strategy is forced to sell large amounts of Bitcoin to repay debt, Bitcoin’s market price will collapse. Falling Bitcoin prices will drag down MSTR’s stock price. A declining stock price will further hinder the company’s ability to raise capital, forcing more Bitcoin sales. This domino effect could not only bury Strategy but also shock the entire cryptocurrency market.

Dilution and Loss of Trust: Investors are gradually realizing the painful truth of dilution. While the company’s total Bitcoin holdings have increased, the amount of Bitcoin per share has stagnated due to excessive share issuance. The financial magic has worn off, leaving shareholders with a diluted asset and a heavy debt burden.

Risk of Being Delisted: With over 50% of its assets in cryptocurrency, Strategy faces the risk of being removed from major indices like MSCI USA in February 2026. If this happens, passive investment funds will be forced to sell MSTR, creating a billion-dollar sell-off pressure that the market may struggle to absorb.

Lessons for Investors

The story of Strategy and Chairman Michael Saylor illustrates both the power and destructiveness of financial leverage. During bull markets, leverage and financial engineering can generate extraordinary profits, leading people to believe in endless “money glitches.” But when the frenzy subsides, fundamental financial principles reassert control.

For investors, the key lesson is never to confuse a real business with a leveraged financial instrument. MSTR was a high-risk gamble with massive debt. Paying a steep premium for an asset based on faith in an individual’s “magic” or an unproven financial model always carries significant risks. The “Infinite Money Glitch” has been patched by the market, and now it’s time to face the harsh reality.

– 07:30 11/12/2025

The Soaring Price of Bitcoin Entices Companies to Join the Fray.

The number of publicly traded companies holding bitcoin globally rose from 89 at the beginning of April to 113 by the end of May. Among these companies, the largest holder boasts a staggering 580,000 bitcoins in its reserves. This emerging trend signals a growing acceptance and integration of bitcoin into the mainstream investment landscape.

A Historic Milestone: Bitcoin Surpasses $100,000

Bitcoin has officially surpassed the $100,000 mark, ushering in a new era for the world’s leading cryptocurrency. This milestone signifies a pivotal moment in the evolution of digital currencies, solidifying Bitcoin’s position as a prominent player in the global financial landscape. As Bitcoin continues to break records and captivate the world, its impact on the future of money and the potential for decentralized finance becomes increasingly evident.