Despite the VN-Index’s sharp correction, shares of TTF, owned by Truong Thanh Wood Processing Joint Stock Company, demonstrated remarkable resilience. Closing the session on December 10th, TTF hit its third consecutive ceiling, surging to 3,960 VND per share. Buying momentum surged, with trading volume on December 10th skyrocketing to nearly 14 million shares, the highest in over two years.

In just one month, TTF shares have rebounded by over 40%, reaching a 1.5-year high.

This unexpected rally comes amidst a relatively sluggish business environment for Truong Thanh Wood. While Q3/2025 revenue grew positively by 32% year-over-year to 312 billion VND, the company still reported a loss of over 12 billion VND for the quarter. Despite returning to profitability in earlier quarters, the heavy Q3/2025 loss resulted in an accumulated loss of 3,263 billion VND as of September 30th, 2025.

As of Q3/2025, TTF recorded long-term advance payments totaling 1,501 billion VND, with 1,032 billion VND coming from Vinhomes JSC, a subsidiary of Vingroup. This advance payment stems from a 2017 framework agreement designating Truong Thanh Wood as a strategic supplier of wood products for Vingroup and its subsidiaries, with a projected total value of 16,000 billion VND. The agreement was extended for five years in May 2022, until May 2027, allowing the company to reclassify this item as long-term, easing cash flow pressure.

Established in 1993 with its first factory in Dak Lak, Truong Thanh Wood Processing Joint Stock Company transitioned from a limited liability company to a joint-stock company in 2003, operating three factories at the time.

During its peak business years from 2009 to 2015, Truong Thanh Wood boasted annual revenues in the trillions of VND, earning the title of “Vietnam’s Wood King.”

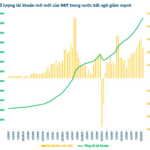

In 2016, a major scandal erupted in Vietnam’s financial sector when auditor E&Y uncovered a 980 billion VND discrepancy in Truong Thanh Wood’s inventory compared to its books.

A review of TTF’s consolidated financial statements from 2010 to 2015 revealed consistently high inventory levels, even as revenue declined, indicating unusual trends. Raw materials, work-in-progress, and finished goods constituted a significant portion of the inventory until the paper shortage was exposed.

Unable to determine the exact timing of the shortfall, the company recorded a 1,052 billion VND inventory impairment loss in cost of goods sold for 2016. This was the primary cause of the record-breaking 1,296 billion VND loss that year.

On the stock market, investors fled TTF shares, with selling pressure reaching nearly 9 million shares at the floor price on August 4th, 2016, while only 10 shares were bought.

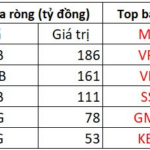

Foreign Investors Net Sell Nearly VND 400 Billion in Vietnamese Stocks on December 10th: Which Stocks Were Targeted?

In the afternoon trading session, MBB stocks led the net buying list, with foreign investors pouring approximately 241 billion VND into this ticker.