Dr. Tran Quy emphasized this perspective at the Vietnam Enterprise Management Forum 2025, as digital assets and cryptocurrencies are gradually moving out of the “gray area” into a formal legal framework in Vietnam. According to him, many current debates stem from conflating blockchain technology with the nature of digital assets, leading to the perception of these assets as “virtual,” existing more through speculation than intrinsic value.

He argued that the core issue is not the complexity of the technology or the number of trading platforms, but a more fundamental question: whether it qualifies as an asset, and if so, how it should be identified, evaluated, registered, and managed.

From this perspective, Dr. Tran Quy distinguishes between two layers of concepts. The first is the digital environment, or on-chain, where assets are mapped and operated. The second, more critical layer, is the asset itself, with all the legal attributes of a traditional asset. “Once it’s an asset, it must possess all the characteristics of an asset. The ‘digital’ aspect is merely the environment in which the asset operates,” the expert explained.

This approach also explains why Dr. Quy believes that not every asset with a market price can be considered a digital asset. According to him, for an asset to be recognized, it must be tied to specific property rights, exist within a complete ecosystem, and have mechanisms for evaluation, registration, and oversight. If an asset can be created with just a few technical steps and assigned value based on subjective will, it cannot be considered a legitimate asset.

In this context, Dr. Quy observes that Vietnam’s digital asset market currently exists in two parallel parts. The “invisible” part consists of spontaneous activities lacking a legal framework, where assets are created and traded primarily based on speculation and expectations. The “visible” part is the emerging legal framework, policies, and management systems. The regulator’s task, according to him, is not to completely reject the invisible part but to create a bridge to bring these activities into the visible part, where trust is built through laws and oversight.

At this point, Dr. Quy highlights the sandbox concept as a key tool. According to him, a sandbox is not just a space for testing new technology but a policy and management experimentation space under controlled conditions. “The issue isn’t how many cryptocurrency exchanges exist, but how they are managed,” he said, adding that the five pilot units under Resolution 05 are not insignificant when compared to the traditional stock market.

Dr. Tran Quy – Director of the Vietnam Institute of Digital Economy Development

|

This viewpoint gained consensus from other speakers at the forum. Mr. Nguyen Phu Dung, co-founder of PILA Group, stated that digital assets are fundamentally expressions of trust in a digital proof. This trust cannot be based on personal relationships, as in the traditional economy, but on transparent, independently verifiable data. “Trust in the digital age comes from data, not promises,” he emphasized.

According to Mr. Dung, when data is cleaned, standardized, and linked to clear identification, capital will naturally flow to assets with real value. He believes this is key to solving a major economic bottleneck, where capital is overly concentrated in physical assets like real estate, while innovative projects struggle to access financial resources.

From a technology company perspective, Mr. Le Thanh, co-founder of Ninety Eight, views blockchain as just one layer of infrastructure. If the focus remains solely on exchanges or trading activities, the digital asset market will struggle to achieve sustainable growth. “Blockchain is a large ecosystem, with digital assets being just one part,” the expert noted, adding that applications related to asset issuance, management, and operation are key to long-term value.

Drawing from international practices, Mr. Thanh believes Vietnam has a distinct advantage in this trend, particularly in tokenizing real-world assets. Tangible assets like real estate, energy, logistics, or tourism rights, when standardized and digitized, can open new capital channels beyond national borders.

Speakers agreed that the digital asset trend extends beyond financial investment into various economic sectors. Blockchain can be applied to trace product origins, verify ownership, or optimize cross-border payments. These applications, they argue, address transparency and trust issues, which are inherent weaknesses in many emerging markets.

In this context, Government Resolution 05 is seen as a pivotal milestone. It not only allows for the pilot testing of the cryptocurrency market but also lays the foundation for a formal legal framework, moving digital assets out of the prolonged gray area. Experts believe that controlled pilot testing enables regulators to observe risks and learn lessons for policy refinement before scaling up.

Dr. Tran Quy sees Resolution 05 as a transitional mechanism. Its goal is not to legalize all existing activities but to filter, standardize, and reshape the market toward transparency. In this process, the sandbox serves as a “testing ground” for new models, where the state, businesses, and investors collaborate and share risks.

Digital assets must possess all legal characteristics of an asset – Illustration

|

From the sandbox, the discussion expands to the International Financial Center model. According to Dr. Quy, this center cannot be separated from the digital asset ecosystem, as it provides a space to experiment with financial models that traditional legal frameworks cannot yet accommodate. The sandbox mechanism within the International Financial Center allows for more flexible standards in payments, transactions, and governance, giving Vietnam an edge in attracting global capital.

Experts believe Vietnam’s greatest advantage lies in its position as a “latecomer.” Instead of replicating the path of traditional financial centers, Vietnam can leverage the on-chain trend to close the gap and build a new model suited to its domestic conditions. However, the prerequisite remains establishing trust through data, identification, and a clear legal framework.

According to Dr. Tran Quy, emphasizing the term “asset” is not just a conceptual issue but a policy direction. When digital assets are recognized as real assets, all related activities—from issuance and trading to registration—must adhere to corresponding standards. Only then can digital assets become an effective capital channel, rather than a short-term speculative playground.

Experts agree that the path ahead for Vietnam’s digital asset market will not be without challenges. However, with a cautious approach starting from the sandbox, gradually expanding to the International Financial Center, and focusing on the nature of assets, the market has the potential to develop more sustainably. In this landscape, technology is merely a tool, while trust and governance form the foundation.

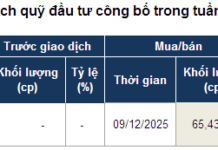

Pilot Implementation of the Cryptocurrency Market in Vietnam Starting September 9, 2025

– 07:00 14/12/2025

Blockchain Accelerates Real Estate Firms’ Path to IPO, Experts Say

By tokenizing real-world assets on the blockchain, real estate businesses can access capital far earlier than traditional IPO timelines.

Unlocking Vietnam’s Vast Capital Market Potential in the New Era

With new equity capital reaching 10% of GDP and KRX infrastructure significantly boosting liquidity, experts believe the capital market is poised for a breakthrough, supported by an increasingly robust policy framework.

Unlocking Digital Assets: A New Growth Catalyst

In the wake of the government’s issuance of Resolution 05, which pilots the cryptocurrency market, a pivotal moment has emerged for the digital economy and corporate governance reform. Representatives from businesses, experts, and policymakers engaged in discussions on the digital economy, exploring how these components can collectively forge a new foundation for growth.