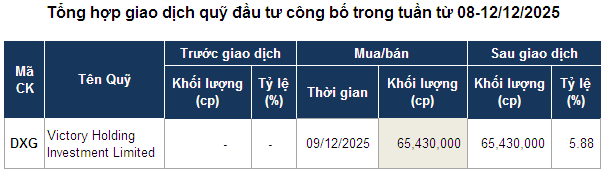

Specifically, during the session on December 9th, Victory Holding Investment Limited—a member of VinaCapital—acquired over 65 million shares of DXG, equivalent to 5.88% of the charter capital. This move officially established them as a major shareholder of Dat Xanh Group.

The transaction was executed as part of DXG’s private placement offering, totaling 93.5 million shares at a price of 18,600 VND per share. The total capital raised, exceeding 1.7 trillion VND, is earmarked for investment in the DatXanhHomes Parkview project.

Victory Holding Investment Limited is estimated to have invested approximately 1.217 trillion VND to finalize this deal. The remaining portion of the offering, comprising 28.7 million shares, was purchased by Dragon Capital for around 522 billion VND.

Prior to participating in DXG’s private issuance, Dragon Capital had maintained a net selling position since mid-July 2025, when the stock price approached its three-year peak. Over the subsequent five months, the foreign fund group net-sold over 62 million shares, reducing their ownership stake in DXG from over 15% to 8.96% as of December 4th.

| DXG Stock Performance from Early 2021 to December 12, 2025 |

At the close of trading on December 12th, DXG shares settled at 16,750 VND per share, hitting the lower limit compared to the previous session and marking an 11% decline since early December.

Source: VietstockFinance

|

– 07:28 14/12/2025

KraneShares Dragon Capital Vietnam Growth Index ETF Officially Lists on NYSE

KraneShares, a global leader in innovative ETF solutions, proudly announces the launch of the KraneShares Dragon Capital Vietnam Growth Index ETF (Ticker: KPHO).

VinaCapital Chief Economist: Vietnam’s Economic Growth Peak Expected by Mid-2026

Vietnam harnesses the synergy of intrinsic economic drivers and institutional reform efforts, creating robust opportunities for breakthrough growth. However, to materialize foreign capital inflows and reduce capital costs, elevating corporate governance standards to international best practices is imperative.