Technical Signals of VN-Index

During the morning trading session on December 18, 2025, the VN-Index continued to hover around the critical technical threshold of the 50-day SMA (Simple Moving Average).

The MACD indicator persisted in its downward trajectory, nearing the zero line, raising concerns about a potential short-term drop below this level.

Trading volume remained relatively low, indicating investor caution in the near term.

Technical Signals of HNX-Index

During the morning trading session on December 18, 2025, the HNX-Index experienced alternating sessions of gains and losses, reflecting investor indecision.

However, a buy signal from the Stochastic Oscillator has emerged. If the MACD follows suit with a similar signal in upcoming sessions, the outlook may improve.

HDB – Ho Chi Minh City Development Commercial Joint Stock Bank

During the morning trading session on December 18, 2025, HDB shares rose alongside increased trading volume, surpassing the 20-session average, signaling optimistic investor sentiment.

Currently, HDB prices are retesting the October 2025 peak (around 25,700-26,500), while the MACD has issued a buy signal and remains above zero, further supporting short-term upward momentum.

YEG – Yeah1 Group Corporation

YEG shares extended their rally for the third consecutive session during the morning trading on December 18, 2025, accompanied by a Dragonfly Doji pattern and surging trading volume, exceeding the 20-session average, indicating heightened investor activity.

Presently, prices have breached the upper band of the Bollinger Bands, while the Stochastic Oscillator has generated a buy signal.

Additionally, YEG shares continued their recovery after successfully breaking out of the upper edge of the bearish price channel, with indicators forming higher highs and higher lows. This suggests a strengthening recovery outlook.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change upon the conclusion of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:07 December 18, 2025

Technical Analysis Afternoon Session 17/12: Tug-of-War Testing the 50-Day SMA

The VN-Index is currently grappling with a critical technical threshold, testing the 50-day Simple Moving Average (SMA) as it oscillates between gains and losses. Meanwhile, the HNX-Index continues its recovery trajectory, bolstered by a buy signal from the Stochastic Oscillator indicator.

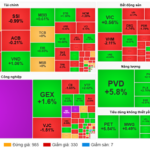

Market Pulse December 17: Selling Pressure Persists, VN-Index Remains in the Red

At the close of trading, the VN-Index fell by 5.52 points (-0.33%), settling at 1,673.66 points, while the HNX-Index dropped by 1.96 points (-0.77%), closing at 253.12 points. Market breadth tilted toward the red, with 400 decliners outpacing 284 advancers. Similarly, the VN30 basket saw red dominate, with 21 losers, 6 gainers, and 3 unchanged stocks.