The PVI Infrastructure Investment Fund (PIF) has recently reported a significant change in its shareholding status at Saigon Technology and Telecommunication Joint Stock Company (Saigontel, Stock Code: SGT, HoSE). PIF ceased to be a major shareholder after selling 6.2 million SGT shares on December 18, 2025. This transaction reduced its ownership from 6.76% (10 million shares) to 2.57% (3.8 million shares), effectively removing it from the list of major shareholders.

Additionally, PVI Asset Management (PVI AM), the fund manager of PIF, holds 250,000 SGT shares, equivalent to 0.17% of Saigontel’s charter capital.

Illustrative image

Following the sale, PIF and its related parties now hold a combined total of 4.05 million SGT shares, representing 2.74% of the company’s charter capital.

In other developments, Saigontel’s Board of Directors recently approved a plan to issue shares to existing shareholders in 2025. The company plans to offer over 148 million shares at a ratio of 1:1, allowing each shareholder to purchase one additional share for every share held. These shares will be freely transferable.

Priced at 10,000 VND per share, the offering is expected to raise over 1.48 trillion VND. The funds will be allocated as follows: [insert allocation details if available]. The share issuance is scheduled for Q4/2025 to Q2/2026, pending approval from the State Securities Commission (SSC). Once approved, Saigontel will announce the details and distribute the shares in compliance with legal requirements.

If successful, Saigontel’s total shares will double from over 148 million to more than 296 million, increasing its charter capital from over 1.48 trillion VND to more than 2.96 trillion VND.

Financially, Saigontel reported robust performance in the first nine months of 2025, with net revenue surpassing 1.285 trillion VND, a 51.6% increase compared to the same period in 2024. After-tax profit reached nearly 356.6 billion VND, a 12.8-fold increase year-on-year.

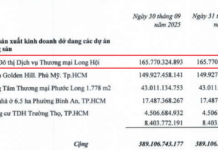

As of September 30, 2025, Saigontel’s total assets decreased by 6.6% from the beginning of the year to over 7.697 trillion VND. Inventory accounted for 48.1% of total assets, amounting to more than 3.701 trillion VND.

On the liabilities side, total debt stood at over 5.249 trillion VND, a 14.7% decrease from the start of the year. Loans and financial leases constituted 70.7% of total debt, totaling more than 3.709 trillion VND.

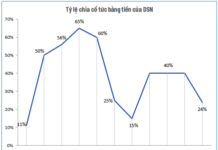

Dam Sen Water Park Declares 24% Cash Dividend Payout

Dam Sen Water Park Joint Stock Company (HOSE: DSN) has announced the closure of its shareholder list for the first cash dividend payment of 2025, offering a 24% dividend rate, equivalent to VND 2,400 per share. The ex-dividend date is set for January 13, 2026.

Pioneer Plastics to Distribute Nearly VND 257 Billion in Interim Dividends for Q1/2025

Pioneering Plastics plans to distribute an interim dividend of approximately VND 256.6 billion for the first phase of 2025, offering shareholders a 15% payout ratio. The final registration date for eligibility is set for January 13, 2026.