On December 25th, the Hanoi Stock Exchange (HNX) approved the registration of Au Lac Joint Stock Company’s shares under the stock code ALC. The total number of registered shares is nearly 56.5 million.

Previously, in August 2024, Au Lac was fined VND 350 million by the State Securities Commission (SSC) for becoming a public company in 2007 without registering for trading or listing its shares on a stock exchange.

Au Lac is a leading private company in the maritime transport sector, specializing in oil tankers. The company is chaired by Mrs. Ngo Thu Thuy.

The company’s fleet consists of 8 oil tankers with a total deadweight tonnage of 119,574 DWT. Au Lac focuses on transporting oil products for Vietnamese importers from neighboring countries to Vietnam, within Vietnam, and between Asian countries.

As of September 26, 2025, Au Lac’s chartered capital is approximately VND 565 billion. Shareholders include Mr. Nguyen Duc Hieu Johnny (9.82%), Mrs. Nguyen Thien Huong Jenny (12.81%), CONEY PEARL PTE.LTD (17.13%), and POLYSCIAS PTE.LTD (17.70%).

Notably, CONEY PEARL PTE.LTD and POLYSCIAS PTE.LTD became Au Lac’s shareholders on September 18, 2025. Both entities are registered at Keppel Bay Tower, 1 HarbourFront Avenue, Singapore.

Mr. Nguyen Duc Hieu Johnny and Mrs. Nguyen Thien Huong Jenny are children of the Chairwoman, Mrs. Ngo Thu Thuy.

Mrs. Ngo Thu Thuy is a prominent figure in Vietnam’s financial market, particularly known for her involvement in the power struggle at Eximbank (EIB).

Au Lac was a long-term shareholder of Vietnam Export-Import Commercial Bank (Eximbank – EIB). The company later sold all its EIB shares and invested in ACB.

Since early 2023, Au Lac has gradually sold its ACB shares, completely divesting by Q1 2024.

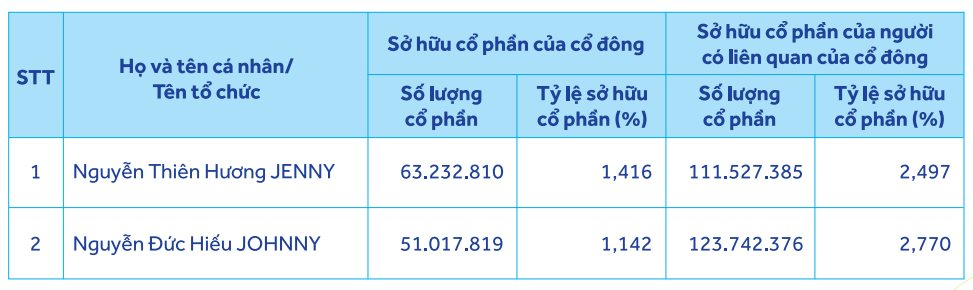

According to ACB’s shareholder list as of April 29, 2025, Mrs. Nguyen Thien Huong Jenny and Mr. Nguyen Duc Hieu Johnny hold 63.2 million and 51 million ACB shares, respectively.

The total ACB shares held by these individuals and related parties exceed 174.76 million.

Compared to the September 2024 announcement, both individuals increased their ACB holdings, with the related group’s total shares rising from 173.83 million to 174.76 million.

Previously, a related shareholder was International Education Village Thien Huong JSC.

Based on ACB’s closing price of VND 24,050 on April 29, 2025, the value of these shares exceeds VND 4.2 trillion.

May 23, 2025, was the ex-dividend date for ACB’s 2024 dividend, offering a 10% cash and 15% stock dividend. Cash payment was made on June 5, 2025, and stock transfer by June 30. ACB has not yet updated the group’s ownership ratio.

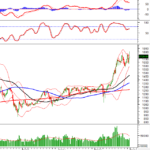

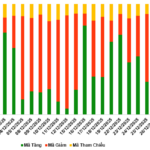

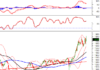

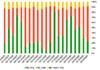

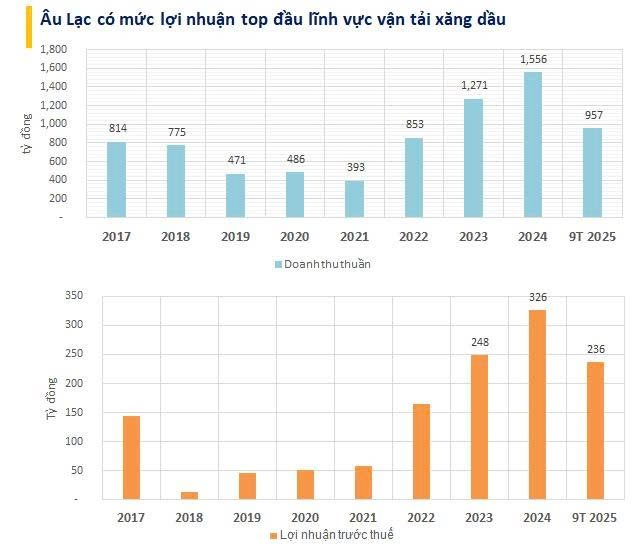

In Q3 2025, Au Lac reported VND 342 billion in revenue, an 8% decrease from Q3 2024. However, a 38% reduction in cost of goods sold boosted gross profit by nearly 11 times, from VND 11 billion to VND 117 billion. Gross margin improved from 2.92% to 34.2%.

This resulted in a turnaround from a VND 15 billion net loss in Q3 2024 to a VND 70 billion net profit in Q3 2025.

For the first nine months of 2025, despite an 18% revenue decline to VND 957 billion, net profit rose 22% to VND 191 billion year-over-year.

The company attributed the revenue decline to reduced fuel transport demand due to slower global trade growth, policy changes, and weaker demand in China and India, impacting the maritime transport sector.

As of Q3 2025, Au Lac’s total assets were VND 2,241 billion, a 1.3% decrease from the beginning of the year. Total liabilities fell 20% to VND 691 billion, with loans totaling VND 517 billion.

Why Do Many Auctions of State-Owned Enterprise Shares Fail?

Numerous auctions for state-owned share lots in several companies have been canceled due to a lack of participant interest.

Japan Quang Real Estate Completes Settlement of VND 2.150 Billion Bond Issuance

Japan Quang Real Estate has successfully settled the principal amount of 2.150 trillion VND and nearly 118 billion VND in interest for the bond issuance NQRCB2124001.