As of the close of the session on December 26, the USD Index (DXY) settled at 97.7 points, marking a 0.55-point decline compared to the previous week’s end. This extends DXY’s losing streak to five consecutive weeks, pushing the greenback to its lowest level in over two months.

This trend reflects heightened investor caution amid geopolitical uncertainties, particularly the escalating tensions in Venezuela. On social media, President Donald Trump revealed that the U.S. had executed a “strong and brutal attack,” amplifying global risk concerns and diminishing the U.S. dollar’s appeal as a safe-haven asset.

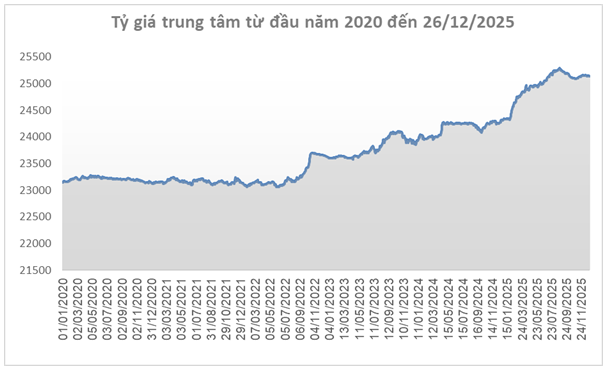

Source: SBV

|

Domestically, the USD/VND exchange rate mirrored the dollar’s weakening trend on the international market. On December 26, the State Bank of Vietnam set the central rate at 25,133 VND/USD, a 15-dong decrease from the previous week’s close.

Within the ±5% trading band, commercial banks’ USD/VND rates are permitted to fluctuate between 23,876 and 26,390 VND/USD.

At the Foreign Exchange Management Department, the reference rate remained at 23,941 – 26,355 VND/USD (buy – sell), down 19 dong and 21 dong respectively from the prior week.

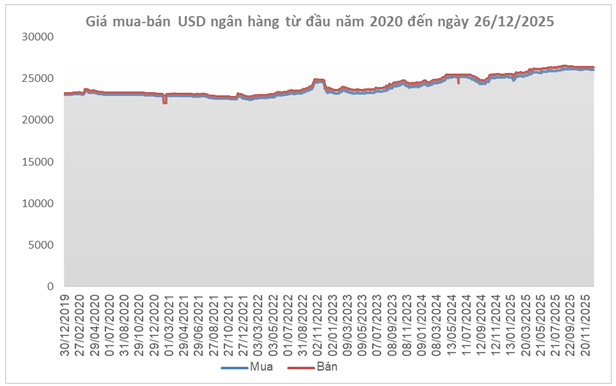

Source: VCB

|

Among banks, Vietcombank quoted the USD at 26,054 – 26,384 VND/USD (buy – sell) for the week’s end, reflecting a 41-dong drop in buying rates and a 21-dong decline in selling rates compared to the previous week.

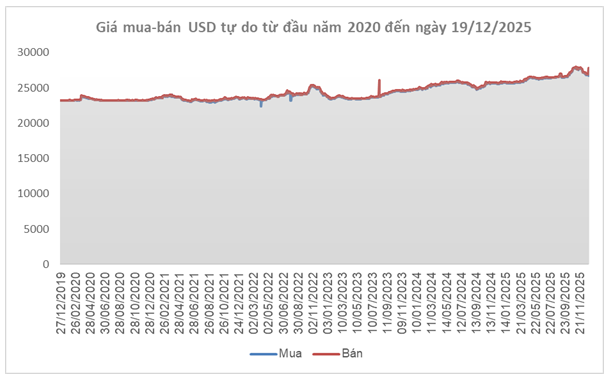

Source: VietstockFinance

|

Notably, in the free market, the USD/VND rate hovered around 26,750 – 27,820 VND/USD (buy – sell), down 150 dong on the buying side but up 820 dong on the selling side compared to the previous week.

– 18:30 28/12/2025

Gold Market and USD Exchange Rate Forecast for 2026

UOB Bank forecasts the USD/VND exchange rate at 26,300 in Q1/2026, 26,100 in Q2/2026, 26,000 in Q3/2026, and 25,900 in Q4/2026. For gold, UOB has revised its price predictions to $4,300/oz in Q1/2026, $4,400/oz in Q2/2026, $4,500/oz in Q3/2026, and $4,600/oz in Q4/2026.

USD Free Market Plunges Below 27,000 VND Mark on December 19th Afternoon

The free-market USD exchange rate has been steadily cooling in recent days, dropping below the 27,000 VND mark and narrowing the gap with bank rates.