Q&Me has released a groundbreaking report titled “Fast Food Trends in Vietnam: Insights from Receipt Analysis.” This comprehensive report is based on a dataset of 400 real receipts, offering a detailed look into consumer behavior at major fast-food chains in Ho Chi Minh City and Hanoi.

The findings reveal significant shifts in taste preferences, spending habits, and customer demographics. Fast food in Vietnam is no longer just a quick Western-style meal option; it has been deeply localized to align with Vietnamese lifestyles and family structures.

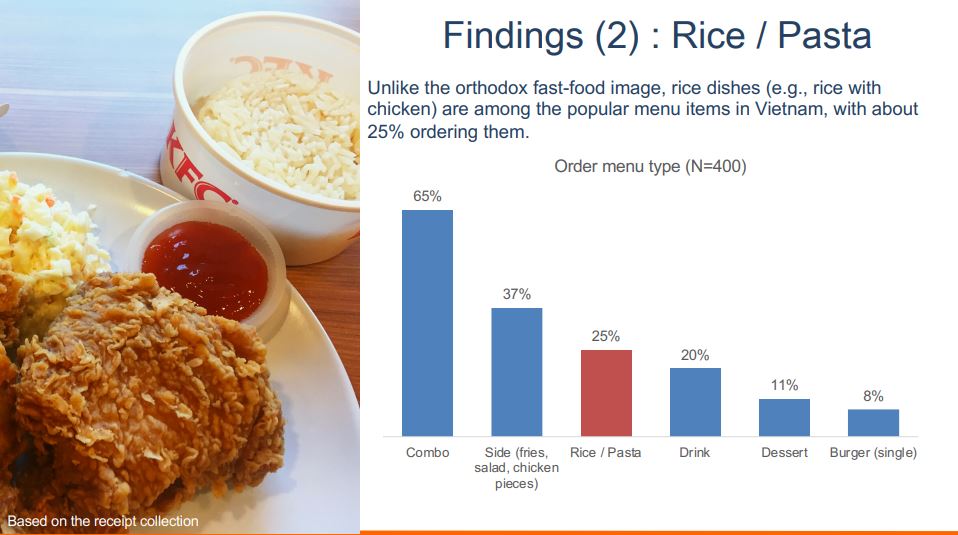

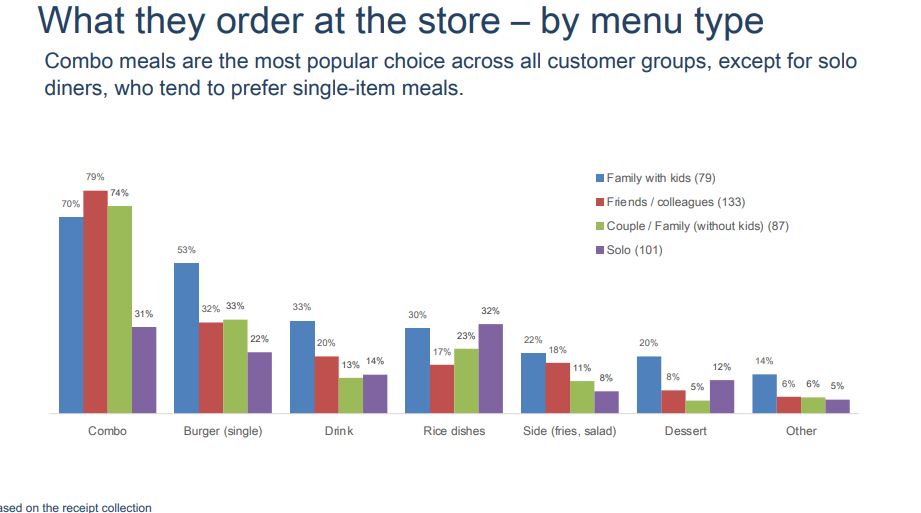

According to Q&Me’s analysis, combos have become the backbone of fast-food menus. A staggering 65% of customers opt for combos over à la carte items. This trend underscores the importance of value-for-money, as pre-packaged combos at reasonable prices simplify decision-making and boost average order value for businesses.

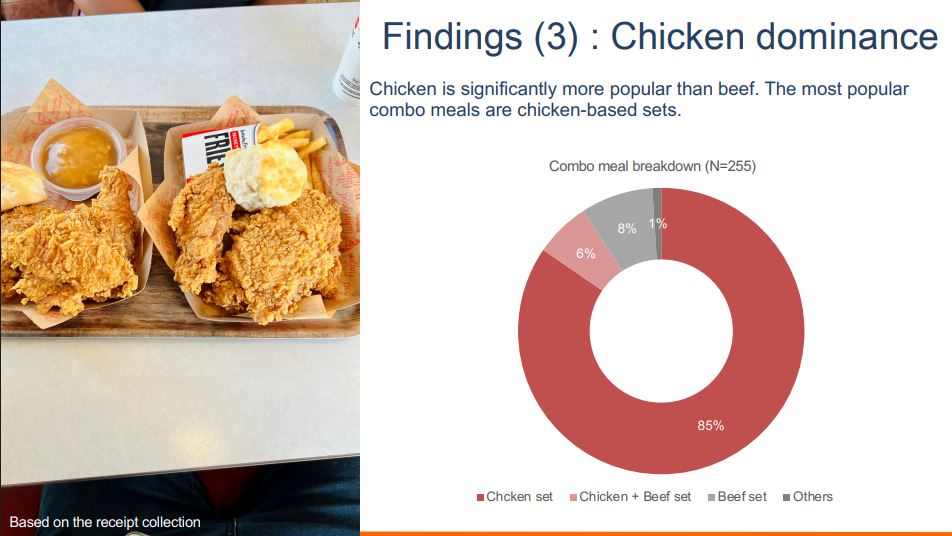

Within these combos, chicken dishes dominate, with 85% of combo orders featuring chicken. In contrast, beef combos, traditionally associated with American-style burgers, account for only 8%. This highlights Vietnamese consumers’ preference for white meat and fried chicken over classic beef burgers. Consequently, many chains, especially fried chicken brands, are expanding their chicken-based product lines.

Notably, rice and pasta dishes have transcended their side dish status. Approximately 25% of orders include rice or pasta, three times more than the 8% of customers who order a single burger. This indicates a strong demand for filling, traditional meal options, even within the fast-food context.

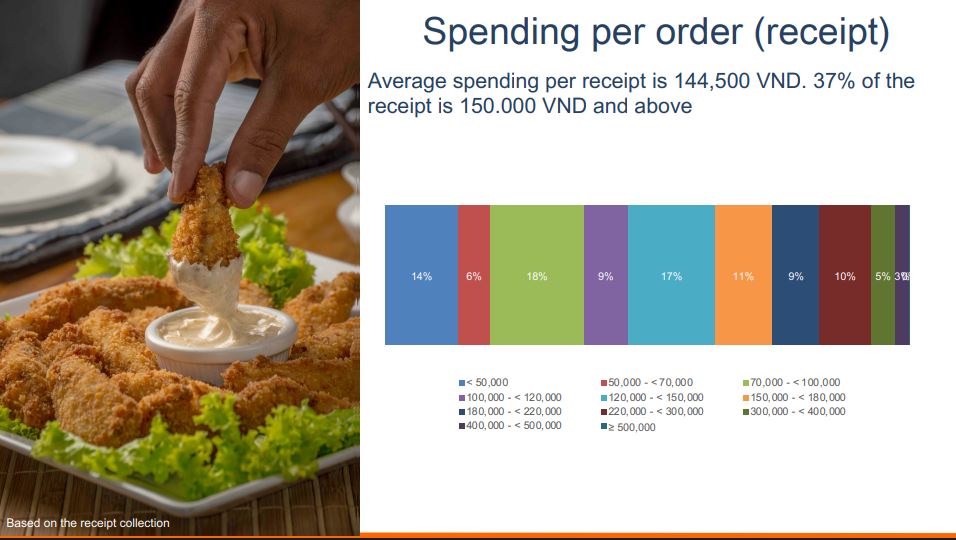

Operationally, the 400 receipts analyzed show an average order value (AOV) of 144,500 VND. Each receipt serves an average of 2.3 people, with 2.6 items ordered per group. This translates to an average spend of 62,800 VND per person, a competitive price point for daily urban meals.

In terms of consumption patterns, fast-food visits are evenly split between weekdays and weekends, indicating that fast food has become a regular dining choice rather than a special occasion treat. Dinner accounts for 52% of visits, slightly edging out lunch at 48%. Geographically, the survey focuses on Vietnam’s two largest markets, with 60% of samples from Ho Chi Minh City and 40% from Hanoi.

The popularity ranking of menu categories further reinforces these trends. Combos lead with 65%, followed by sides like fries, salads, and single chicken pieces (37%), rice/pasta (25%), beverages (20%), desserts (11%), and single burgers (8%).

Another key insight is the role of families with children. On average, each group consists of 2.3 people, and 33% of all groups include children. This positions fast-food outlets as popular destinations for families with young kids.

The presence of children significantly boosts spending. Groups with children spend an average of 189,000 VND per receipt, compared to the overall average of 144,500 VND. These groups also order 3.4 items per receipt, versus 2.2 items for groups without children.

When it comes to menu choices, families with children prioritize combos for cost efficiency and variety. They also frequently order sides and desserts to cater to children’s preferences. With 25% of orders including rice or pasta, these options are seen as safe and filling choices for kids, compared to single burgers at just 8%.

EVN Sustains Profitability in 2025

At the 2025 Year-End Review and 2026 Task Deployment Conference, Vietnam Electricity (EVN) announced that it had surpassed the profit target set by the Ministry of Finance.