During the sharing session, the group’s leadership emphasized that to prepare for upcoming projects, Trungnam Group has recently intensified investment promotion activities for new projects to optimize its advantages and experience.

The company will continue to seek new opportunities to expand its core business segments, including wind power, solar power, and LNG projects, while also maintaining its focus on infrastructure with highway and bridge projects across the country.

Positive Financial Signals

According to information shared at the event, as of December 2025, the group’s revenue reached 13.686 trillion VND. Total revenue from power plants increased by over 10% compared to 2024, reaching 6.000 trillion VND in 2025. The 2026 plan is expected to maintain a growth rate of around 10%, driven by favorable weather conditions, increased demand for green energy from the government, and improved operational stability after the initial phase, reducing technical incidents and optimizing useful power generation time thanks to a more experienced operational team.

Liquidity in 2025 has also significantly improved, with bond packages for power plants paying principal and interest on time, maintaining commitments to bondholders regarding effective cash flow use in 2026.

Notably, Trung Nam has achieved certain results in bond usage negotiations, gaining consensus and support from bondholders. Bondholder meetings have recorded many positive signals, laying a solid foundation for the group’s financial stability.

Specifically, for the bond package of Thuan Nam Power Plant, the main bondholder, MB Bank (82% of the value), agreed and completed restructuring in June 2025. The payment schedule for bond batches has been adjusted to match the project’s actual cash flow, reducing financial pressure in the early operating years and aligning with EVN’s payment schedule.

Similarly, for the bond package of Dak Lak Power Plant, the main bondholder, Vietcombank (VCB – holding 75% of the value), approved the restructuring plan in December 2025. Periodic payment obligations have been flexibly adjusted to suit the cyclical and seasonal revenue nature of the wind power project.

Strengthening Restructuring and Financial Asset Management

Trung Nam also announced that the company has seized opportunities to restructure and overcome challenges. Financial restructuring measures are being implemented on schedule, with active support and cooperation from credit institutions. Many banks have proposed restructuring plans.

Most banks have evaluated and supported the financial restructuring plan with a total restructuring value of over 10.000 trillion VND at power plants. Implementation is progressing across projects, with restructuring completed at several key projects.

Currently, Trung Nam has classified and reorganized existing debts while allocating appropriate capital for new projects.

For capital deployment in the 2026–2030 phase:

Renewable energy under the adjusted QH8 plan, with a total investment of 165.000 trillion VND (over 6 billion USD).

Ca Na LNG Power Plant, with a total investment of 57.000 trillion VND (over 2 billion USD).

In addition to its own capital, Trung Nam has worked with domestic and international credit institutions to mobilize capital and collaborated with leading global strategic partners: consultants (UL, Tractebel, DNV), general contractors (PowerChina, China Energy), and suppliers and operators (Enercon, Siemens Gamesa, Mingyang, Sungrow, Envision).

Payments to EVN have also improved, while issues related to the CCA mechanism are being urgently addressed by the government in 2025.

Restarting Energy Projects and Boosting Infrastructure Investment

With its existing business foundation and consistent development goals, Trung Nam plans to increase its 2026 investment by around 10%, focusing on its strengths. The company will vigorously restart energy projects in 2026, with wind power, solar power, and LNG projects under study and proposal to local authorities.

The company continues to invest in key infrastructure while participating in large tenders, aligning with the national development strategy to increase public investment to around 10% of GDP.

Ongoing infrastructure projects include: the Ho Chi Minh City Tidal Flood Control Project (Phase 1), Chau Doc – Can Tho – Soc Trang Expressway, Khanh Hoa – Buon Ma Thuot Expressway, Bien Hoa – Vung Tau Expressway, and Rach Xuyen Tam Package XL01 Km0+000 to Km2+512 from Nhieu Loc Thi Nghe Canal to Bui Dinh Tuy Bridge, including Rach Cau Son (Ho Chi Minh City).

In 2026, planned infrastructure projects include the Hai Phong Ring Road 2 and the Gia Nghia – Bao Loc – Phan Thiet Highway (under study and proposal to authorities) in Lam Dong Province.

Exciting News from Trung Nam

At a recent business update and 2026 strategy session, the conglomerate’s leadership announced a robust relaunch of energy projects in the coming year. Alongside this, they emphasized continued investment in critical infrastructure and active participation in major tenders.

Exclusive Investment Opportunity: December 27, 2025 – January 2, 2026 – Three Mega Urban Projects, Nearly $850 Million in Capital

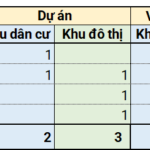

During the week of December 27, 2025, to January 2, 2026, four provinces attracted investment in five projects, totaling nearly VND 21.9 trillion. Among these, three urban development projects accounted for approximately VND 20 trillion. The most notable was a project in Hưng Yên province, with an investment of over VND 15.6 trillion.

Deputy CEO of Trungnam Group: Outstanding Financial Issues to Be Resolved by First Half of 2026

On January 6, 2026, Trungnam Group (Trung Nam Corporation) hosted a meeting to share insights into their business operations and unveil their strategic plans for the year. During the event, Mr. Lê Như Phước An, Standing Deputy General Director of Trungnam Group, highlighted the company’s promising financial indicators and provided updates on the ongoing tidal prevention project in Ho Chi Minh City.