Issue – Analysis: With the US dollar under significant pressure from the Federal Reserve’s easing policy, what will the exchange rate trend look like in 2026?

After a challenging 2024-2025 period, the USD/VND exchange rate enters 2026 with a more favorable international backdrop as the greenback weakens and the Fed begins its rate-cutting cycle.

The Greenback’s Downward Trajectory

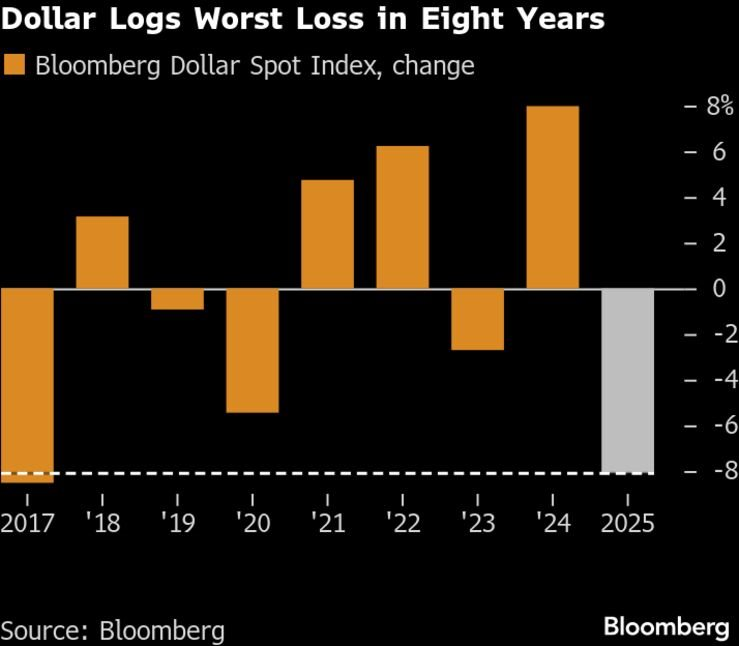

The global exchange rate landscape has shifted significantly from the previous tense period. According to Bloomberg, in 2025, the US dollar recorded its most substantial annual decline since 2017, with the Bloomberg Dollar Spot Index falling by approximately 8%. This movement reflects the market’s growing expectation of the Federal Reserve’s monetary easing cycle.

The US dollar saw its largest decline in 8 years.

Meanwhile, the US Dollar Index (DXY), which measures the greenback’s strength against six major currencies, dropped by 9.4% in 2025, its steepest fall in eight years. Reuters reports that despite occasional short-term recoveries, the overall trend for the USD remains under pressure as the market is increasingly confident that the Fed will implement at least two rate cuts in 2026. Data from the Commodity Futures Trading Commission (CFTC) also indicates a growing number of short positions on the USD, while options markets lean towards a weaker dollar in the short term.

The DXY index fell over 9% in 2025. Source: TradingEconomics

Another notable factor is the risk associated with the Fed’s independence. US President Donald Trump is expected to announce his choice for the next Fed Chair soon, with expectations leaning towards a more dovish successor. Goldman Sachs suggests that concerns surrounding the Fed’s leadership changes may persist into 2026, tilting the interest rate outlook towards further easing. This continues to exert downward pressure on the US dollar in the medium term.

However, not all institutions predict a prolonged weakening of the USD. Morgan Stanley forecasts a tug-of-war for the dollar over the next 12 months, with continued weakness in the first half of 2026, followed by a recovery and an end to the depreciation cycle in the second half. Under this scenario, the DXY index could drop to around 94 points in Q2 2026 before returning to 100 points by year-end, tied to a slowdown and subsequent improvement in US economic growth, with the policy rate falling to 3.0–3.25%.

Despite differing trajectories, the common thread in forecasts is that the US dollar is unlikely to maintain the strength seen in 2022–2024. Rồng Việt Securities (VDSC) also predicts that the Fed will implement two rate cuts in 2026, lowering the federal funds rate to 3.0–3.25% by year-end, which would push the DXY index down to the 92–95 range. In this context, external pressure on the USD/VND exchange rate is expected to ease compared to 2024–2025.

A More Stable Exchange Rate in 2026

Despite a more favorable international environment, the USD/VND exchange rate in 2026 will still be influenced by domestic factors. According to Shinhan Vietnam Securities, recent exchange rate pressures have primarily stemmed from increased USD demand for imports, coupled with net outflows of foreign currency. The State Bank of Vietnam (SBV) has repeatedly intervened in the market by selling forward foreign exchange, narrowing its intervention capacity due to declining foreign exchange reserves.

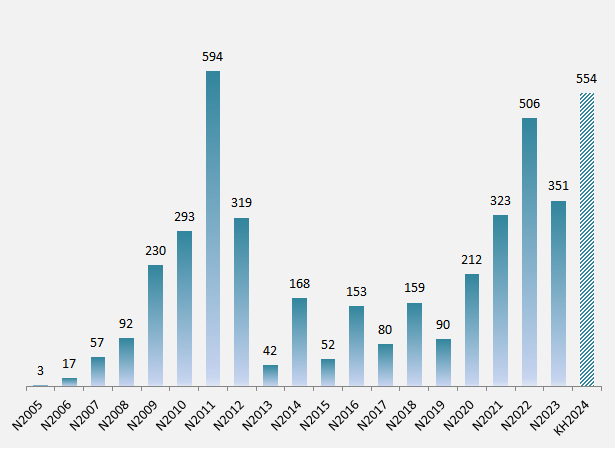

Shinhan Vietnam Securities notes that after peaking in early 2022, Vietnam’s foreign exchange reserves have gradually declined over the past three years.

Source: VDSC

VDSC also notes that foreign exchange reserves continued to decline slightly in 2025 to meet foreign currency demands during periods of tension, with no significant improvement expected in 2026 as solutions to attract foreign currency take time to become effective.

However, VDSC emphasizes that exchange rate pressures in 2026 will ease due to three factors: the normalization of global interest rates, a narrowing USD/VND interest rate differential, and stable FDI inflows. Under the baseline scenario, the USD/VND exchange rate is forecast to fluctuate within a ±4% range, ending 2026 between 26,890 and 27,150 VND/USD.

Taking a more cautious view, Mr. Nguyễn Minh Tuấn, CEO of AFA Capital, believes that despite a more favorable international environment with the Fed’s rate cuts and a cooling DXY index, the USD/VND exchange rate is more likely to stabilize rather than decline sharply. The baseline scenario is that the exchange rate will remain at a high level with limited volatility, reflecting the dominance of internal factors such as the trade balance, foreign currency demand, and the SBV’s policy direction. External factors will primarily reduce pressure, while the degree of stability and the exchange rate level will largely depend on the flexibility and scope of domestic policies.

“In my opinion, the State Bank of Vietnam will likely continue to manage flexibly, prioritizing exchange rate stability while selectively easing monetary policy to support growth,” Mr. Nguyễn Minh Tuấn commented.

Meanwhile, MBS Securities (MBS Research) offers a more optimistic forecast, suggesting that a weaker US dollar, coupled with improved foreign currency supply from exports and remittances, will limit the USD/VND exchange rate increase to around 2.2–2.5% in 2026.

It appears that 2026 is likely to be a more “breathable” year for the USD/VND exchange rate compared to 2024–2025, thanks to reduced external pressures from a weaker US dollar and the Fed’s policy easing. However, certain factors will make it difficult for the exchange rate to return to lower levels. Instead, the consensus among experts is that the exchange rate will stabilize and fluctuate within a narrower range.

USD Price Rebounds

In the final week of 2025 (December 29-31), the USD rebounded in international markets following the release of the Federal Reserve’s December meeting minutes.

Key Highlights in the Regulation of Banking System Liquidity for 2025

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s outright purchase channel to stabilize exchange rates while balancing systemic liquidity. By 2025, however, the operational strategy underwent a notable shift.

What Factors Will Drive USD/VND Exchange Rate Pressure in 2026?

Despite the significant decline in the DXY index in 2025, the USD/VND exchange rate remains under pressure, indicating that domestic factors are playing a dominant role. As we move into 2026, the question arises: will this trend persist, or will new dynamics emerge to ease the exchange rate tensions?