PGBank aims for 58% profit increase, reaching 554 billion VND

PGBank forecasts that 2024 will continue to pose challenges and difficulties. However, Vietnam’s economy is expected to break out and become a regional bright spot with a GDP growth target of 6%-6.5%, and CPI controlled at 4%-4.5%.

For the banking industry, credit growth for the entire economy in 2024 is targeted at around 15%. The State Bank is determined to actively, flexibly, and synchronously manage key monetary policy tools. Direct credit to production and business sectors and growth drivers such as investment, consumption, and exports, while strictly controlling credit in areas with potential risks.

In the context of the macroeconomy expected to have brighter colors and the foundation of additional charter capital, the ecosystem and customer base have been cultivated and strengthened during 2023. PGBank aims to become one of the multi-functional, modern, and efficiently operating commercial joint-stock banks, providing high-quality banking financial services.

To achieve this goal, PGBank identified a plan to focus on key industries and fields such as industrial manufacturing, trade, construction, and real estate. Simultaneously, the goal is to increase non-interest income to 30% of revenue, increase the proportion of CASA to reduce capital costs, and, based on that, offer competitive lending interest rates, launch a preferential package of 1,000 billion VND for small and medium-sized enterprises serving production and business and a package of 4,000 billion VND for large enterprises.

Total assets are expected to reach VND 63,503 billion by December 31, 2024, an increase of 14%, equivalent to VND 8,012 billion, compared to the end of 2023. Total mobilization will reach VND 56,530 billion, an increase of nearly 14%, in which market 1 capital mobilization will reach VND 41,230 billion, an increase of over 15%. Outstanding loans will reach VND 40,476 billion, an increase of nearly 13% compared to the end of 2023 (PGBank’s credit growth rate is assigned by the SBV).

|

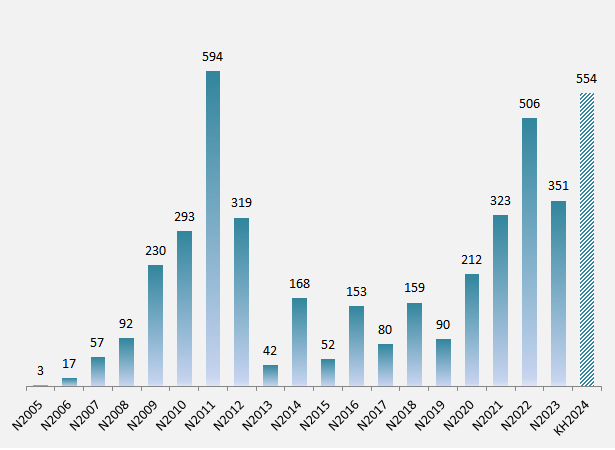

PGBank’s 2024 pre-tax profit plan. Unit: Billion VND

Source: VietstockFinance

|

Based on credit growth and capital mobilization targets, PGBank aims for a pre-tax profit of VND 554 billion, an increase of 58% compared to 2023.

At the end of 2023, PGBank’s total assets reached VND 55,491 billion, exceeding the plan by 5% and increasing by more than 13% compared to the beginning of the year. Total mobilized capital reached VND 49,798 billion, exceeding the plan by 6% and increasing by nearly 17%.

Outstanding loans as of December 31, 2023, reached VND 35,881 billion, fulfilling the plan and increasing by more than 11% compared to the beginning of the year. However, pre-tax profit reached VND 351 billion, more than 66% of the plan and decreased by 31% compared to the previous year.

The bank stated that the reasons for pre-tax profit not reaching the plan were: The scale of average outstanding loans did not meet expectations, the business was challenging, and it was challenging to find high-quality credit customers due to the high competition among banks. Interest rates on loans decreased under the guidance of the SBV, but mobilization interest rates did not decrease accordingly. Non-interest income decreased due to a decline in service fees and insurance revenue because of general market difficulties. In addition, PGBank changed its shareholder structure and business orientation, requiring time to review and rearrange operations to align with the new strategy.

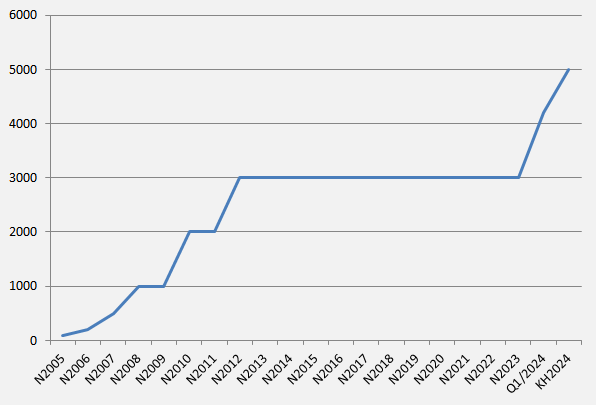

Increased capital to VND 5,000 billion

Currently, PGBank has completed the capital increase by issuing 120 million bonus shares in the first quarter of 2024, to VND 4,200 billion.

Regarding the charter capital increase plan through a share offering to existing shareholders, PGBank’s BOD said it is still carrying out related work and procedures to ensure completion in accordance with the plan adopted by the 2023 Extraordinary General Meeting of Shareholders.

PGBank said that after the completion of the capital increase from the issuance of bonus shares, the bank’s current charter capital has changed compared to the 2023 capital increase plan, leading to a change in the issuance/distribution ratio compared to the initial issuance plan.

Therefore, at the 2024 Annual General Meeting of Shareholders, PGBank’s BOD will propose adjusting the distribution ratio for the offering of shares to existing shareholders from 27% to over 19%.

Specifically, PGBank’s BOD plans to offer shareholders up to 80 million shares at a price of VND 10,000 per share. The exercise ratio is 4:21 (shareholders owning 21 shares will be able to buy 4 new shares).

PGBank plans to allocate the VND 800 billion raised from the share issuance to the following activities: Loans to meet short-term (VND 200 billion) and medium- and long-term capital needs of customers (VND 305 billion); Investment in information technology infrastructure, bank conversion (VND 230 billion), and Provision of capital for fixed asset purchases (VND 65 billion).

|

PGBank’s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

The charter capital is expected to reach VND 5,000 billion in 2024.