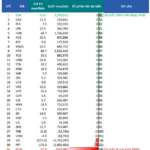

The upcoming restructuring of the VN30 index will significantly impact four ETFs with a combined net asset value of 10.3 trillion VND. Leading the pack is DCVFMVN30 ETF with 6.6 trillion VND, followed by KIM Growth VN30 ETF (2.5 trillion VND), MAFM VN30 ETF (902 billion VND), and SSIAM VN30 ETF (230 billion VND).

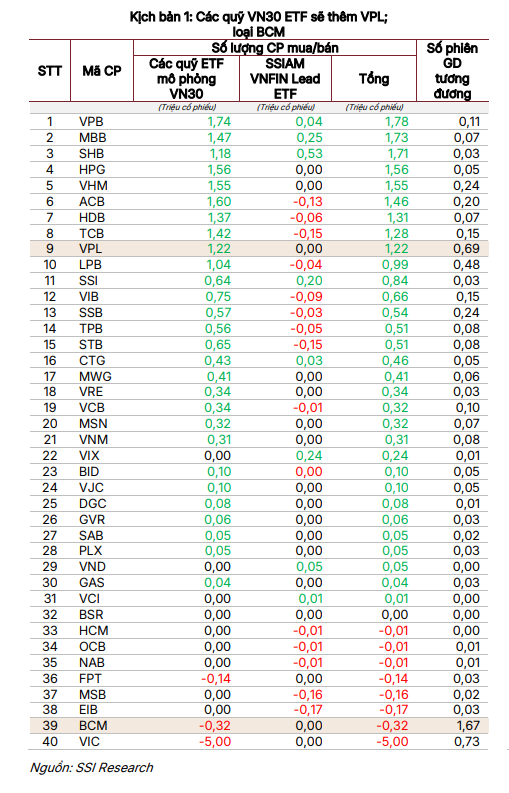

Scenario: Adding VPL, Removing BCM

According to the latest forecast by SSI Research, VPL is expected to join the VN30 blue-chip index, while BCM faces potential removal. VPL has met all criteria for inclusion, boasting a 12-month average market capitalization of 154.6 trillion VND, ranking 11th and qualifying for the Top 20 priority group.

If added, SSI Research predicts the four VN30-tracking ETFs will purchase 1.22 million VPL shares.

Conversely, BCM risks removal due to insufficient liquidity. Its 12-month average order-matching trading value of 26.3 billion VND per session falls short of the 30 billion VND threshold.

If removed, BCM would face selling pressure from ETFs, totaling 315,000 shares.

In this scenario, the four ETFs could buy VPB (+1.7 million shares), ACB (+1.5 million shares), and VPL (+1.2 million shares), while selling 5 million VIC shares and 315,000 BCM shares.

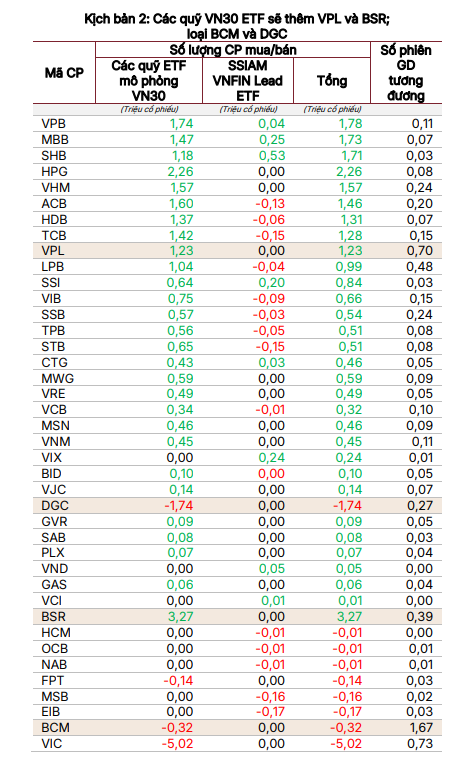

Scenario: Adding VPL and BSR, Removing BCM and DGC

SSI Research presents a second scenario where BSR could join VN30 alongside VPL. Currently, BSR is close to the Top 20 in market capitalization.

If this scenario materializes, BSR would see strong buying interest with 3.27 million shares, becoming the most purchased stock in the restructuring. Meanwhile, DGC, the smallest stock by market cap, would be removed with 1.74 million shares sold.

In this case, ETFs would heavily buy BSR, HPG, and VPL (3.2 million, 2.2 million, and 1.2 million shares, respectively), while selling VIC, DGC, and BCM (5 million, 1.7 million, and 315,000 shares, respectively).

Source: SSI Research

|

Why is VIC facing heavy selling pressure?

In this restructuring, VIC is the most heavily sold stock. After a 94% surge since the September 2025 review, VIC now accounts for 15.16% of the VN30 index, exceeding the 10% single-stock limit. ETFs must sell VIC to rebalance their portfolios, with an estimated 5 million shares to be sold.

Additionally, the combined weight of Vingroup-related stocks (VIC, VHM, VPL) is capped at 15% under HOSE-Index Rule 7.2, applicable to related stocks including parent and subsidiary companies.

The restructured portfolio will be officially announced on January 21, 2026, and completed by February 2, 2026. With the ETFs’ total assets tracking the VN30 index reaching 10.3 trillion VND, this restructuring is expected to significantly impact the market.

– 16:28 09/01/2026

“Oil and Gas Tycoon Poised to Enter VN30 Index in January Review”

BSC Research forecasts that this stock could see additional purchases of approximately 3.3 million units by VN30 index-tracking ETFs.

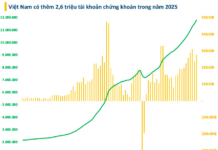

Stock Market Nears All-Time High

The trading session on December 22nd was notably vibrant, with the VN-Index surging by 46 points, nearing its historic peak of 1,760. Investor sentiment rebounded as capital flowed back into the market, primarily targeting large-cap stocks. Among these, banking and real estate sectors emerged as the key drivers of the rally.