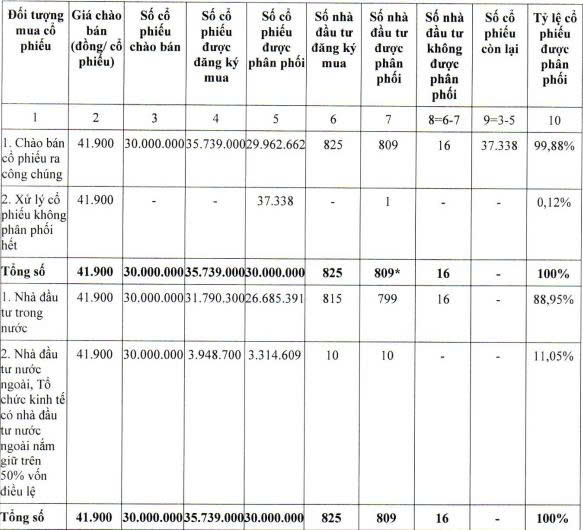

Hoa Phat Agricultural Development Joint Stock Company (HPA) has submitted a report to the State Securities Commission (SSC) detailing the results of its public share offering.

By the end of the offering period on January 6, 2026, Hoa Phat Agriculture successfully allocated 30 million shares to 809 investors at a price of VND 41,900 per share. The shares are expected to be transferred in January and February 2026.

Previously, by the registration deadline on December 15, 2025, Hoa Phat Agriculture recorded a total subscription volume of 35.7 million shares, exceeding the offered amount by 19%.

Due to oversubscription, HPA implemented a pro-rata allocation ratio of 83.941912% to ensure fairness among all investors.

Source: Hoa Phat Agriculture

By the payment deadline on January 5, 2026, 36,665 shares registered by investors remained unpaid, and 673 odd shares arose due to rounding.

According to Resolution No. 01/2026/QD-HDQT of the Board of Directors, the entire surplus of 37,338 shares was reallocated to Vietcap Securities JSC (Stock Code: VCI) at the same price of VND 41,900 per share.

Upon completing the IPO, Hoa Phat Agriculture raised VND 1,257 billion, with a net income of nearly VND 1,207 billion after deducting expenses. The company also increased its charter capital from VND 2,550 billion to VND 2,850 billion.

Following this issuance, Hoa Phat Group JSC (Stock Code: HPG, HoSE) remains the controlling shareholder of Hoa Phat Agriculture, holding over 242.2 million shares, equivalent to an 84.999% ownership stake.

Recently, the SSC announced the receipt of Hoa Phat Agriculture’s report on its initial public offering results.

The SSC instructed the company to coordinate with the Vietnam Securities Depository and the Ho Chi Minh City Stock Exchange (HoSE) to complete registration, depository, and listing procedures as required.

Established in 2016, Hoa Phat Agriculture specializes in animal feed production, pig, cattle, and poultry farming.

Its flagship products include HP Feed and BigBoss animal feed, breeding and commercial pigs, Australian beef cattle, and clean eggs. The company operates a closed-loop value chain model from feed production to farm, headquartered in Pho Noi A Industrial Park, Nguyen Van Linh Commune, Hung Yen Province.

In terms of market share, Hoa Phat Agriculture ranks among Vietnam’s top 10 pig farming enterprises, top 13 animal feed producers, and leads in clean egg production in the North, as well as whole Australian beef cattle.

International Dairy Lof Sets Date for 25% Cash Dividend Payout

International Dairy Lof is set to distribute over 154.5 billion VND in dividends for the second tranche of 2024 to its shareholders via cash payment, at a rate of 25%. The final registration date for eligibility is January 16, 2026.

MCH Stock Hits All-Time High on First Day of HOSE Listing: Opportunities for Late Investors and MSN’s Valuation Recalibration

Masan Group’s current market capitalization stands at a modest $4.2 billion, yet its holdings in Masan Consumer, Masan Meatlife, Masan Hightech Materials, and Techcombank are valued at nearly $9 billion. This figure excludes the additional value of Wincommerce, further underscoring the group’s significant untapped potential.

Vietcap Announces Cash Dividend Payout Ahead of Lunar New Year, Approved by Chairman Nguyen Thanh Phuong

The Board of Directors of Vietcap Securities Joint Stock Company (stock code: VCI) has approved the first dividend payment plan for 2025 in the form of cash.