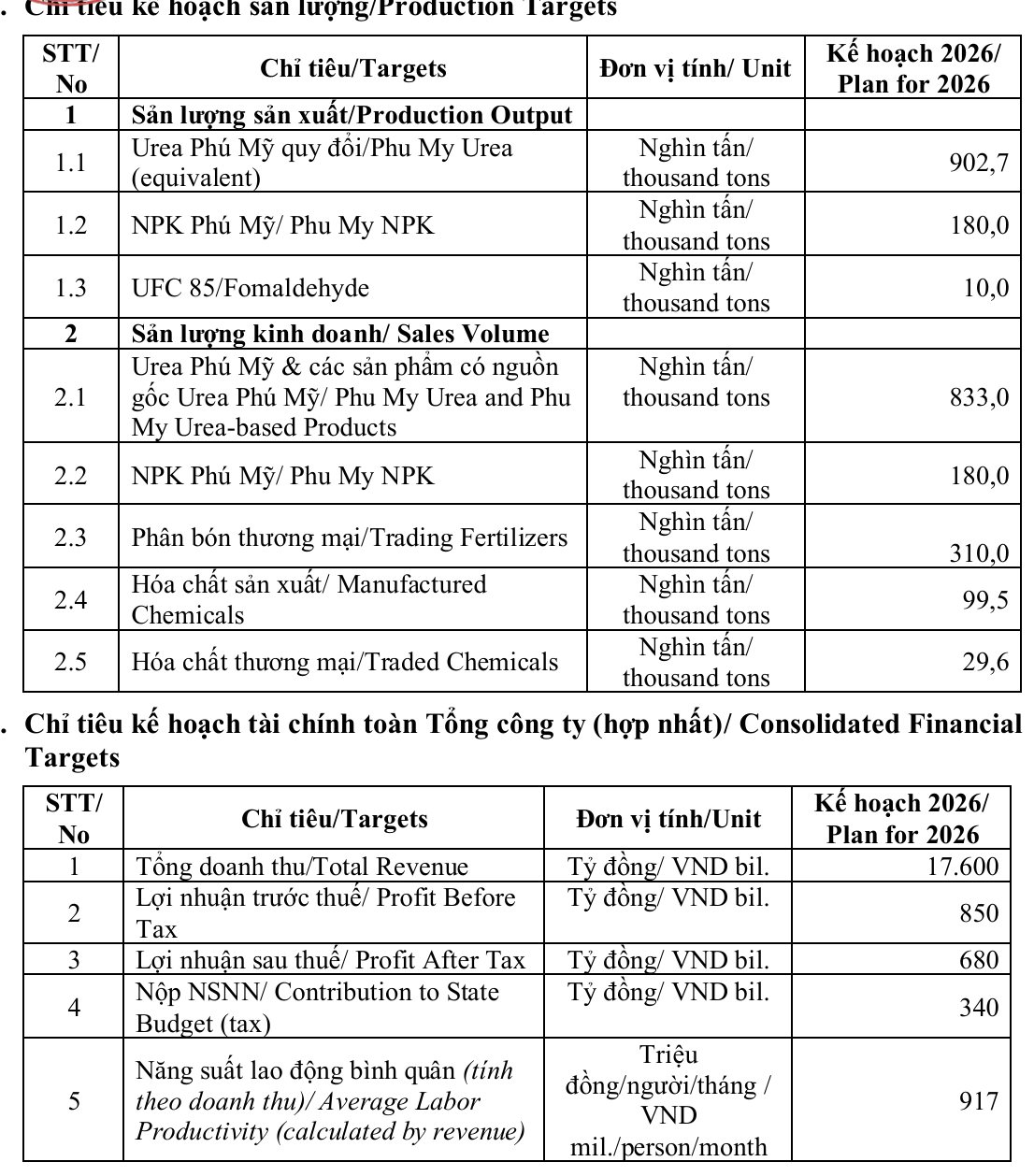

The Board of Directors of PetroVietnam Fertilizer and Chemicals Corporation (DPM) has approved the production and business plan targets for the 2026 fiscal year. A notable highlight in this resolution is the focus on labor productivity.

Specifically, the parent company’s total revenue target is set at VND 15,295 billion. Corresponding to this scale, DPM aims for an average labor productivity of VND 917 million per person per month, based on revenue. This metric will serve as a benchmark to evaluate the efficiency of workforce utilization in the upcoming business period.

Regarding consolidated financial targets, the company plans to achieve pre-tax profit of VND 850 billion and post-tax profit of VND 680 billion. These figures represent double-digit growth compared to the estimated performance of the previous year.

Other operational efficiency metrics, such as return on average equity (ROAE) and return on assets (ROA), are projected to reach 6.1% and 3.9%, respectively.

In terms of production structure, Phu My Urea plans to produce 902,700 tons of urea equivalent. The output for Phu My NPK and UFC 85 is expected to be 180,000 tons and 10,000 tons, respectively. For sales, the total volume of urea and urea-based products is set at 833,000 tons, commercial fertilizers at 310,000 tons, and commercial chemicals at 29,600 tons. Additionally, the company’s product portfolio will include Phu My DAP.

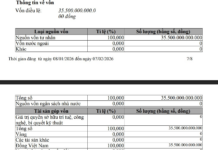

For investment activities, the total capital requirement for 2026 is VND 1,163.3 billion. This includes VND 582.6 billion for basic construction investment, VND 371.7 billion for asset and equipment procurement, and VND 210 billion for financial investments. According to the resolution, 100% of this investment capital will be sourced from equity, with no plans to utilize borrowed funds.

Regarding financial structure, the debt-to-equity ratio will be maintained at 0.55. The dividend payout ratio for 2026 is projected at 12% of the charter capital, equivalent to VND 1,200 per share. For 2025, due to actual post-tax profits exceeding the plan, the dividend payout may be adjusted upward from the proposed 12%.

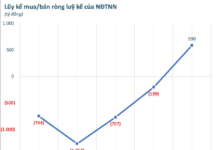

In the market, DPM shares are trading around VND 23,500 per share. Based on this price and the planned dividend of VND 1,200, the dividend yield is expected to be approximately 5.1%.

Technical Analysis for the Afternoon Session of January 7th: Soaring to New Heights

The VN-Index has continued its robust growth trajectory, decisively breaking through the previous peak established in October 2025 (equivalent to the 1,740-1,795 point range). Meanwhile, the HNX-Index has halted its decline and rebounded, signaling a recovery in momentum.

Rivals of Nguyen Phuong Hang’s Dai Nam Tourism Complex Prepare to Pay High Cash Dividends

This company boasts a longstanding tradition of delivering substantial cash dividends, consistently distributing double-digit percentage returns to shareholders on an annual basis.