Mr. Nguyen Thanh Tung, Chairman of Vietcombank’s Board of Directors, delivers the opening speech at the conference.

On January 9, 2026, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) successfully held the Conference to Review Party Work and Business Operations in 2025, and to Deploy Tasks for 2026.

At the conference, Mr. Nguyen Ngoc Canh, Deputy Governor of the State Bank of Vietnam, emphasized that 2025 was a year of acceleration, breakthrough, and culmination for the 2021-2025 period, while also laying a crucial foundation for the 2026-2030 development phase. Amid global uncertainties and risks, Vietcombank maintained its position as a leading state-owned commercial bank, pioneering market leadership, ensuring financial safety, achieving sustainable growth, exceeding business targets, significantly contributing to the state budget, and spearheading support for businesses, citizens, digital transformation, green finance, and social welfare.

“Vietcombank must continue its pioneering role, leading the market to become a large-scale bank with advanced technology and competitive capabilities at the regional and international levels,” stated the Deputy Governor of the State Bank of Vietnam.

Addressing the conference, Mr. Nguyen Thanh Tung, Chairman of Vietcombank’s Board of Directors, affirmed that Vietcombank would swiftly translate directives into synchronized action plans, enhance Party work quality, tighten credit control, drive substantive digital transformation, develop high-tech human resources, and strengthen risk management in line with international standards.

Vietcombank is committed to reinforcing its role as a leading state-owned commercial bank, proactively implementing monetary policies, and actively contributing to the nation’s economic development in the new phase. The bank aims to realize its strategic goal by 2030: becoming Vietnam’s largest financial group, one of the world’s top 200 financial conglomerates, and one of the globe’s top 700 listed companies, significantly contributing to Vietnam’s sustainable development.

In the conference report, Vietcombank’s leadership noted that 2025 marked the conclusion of the 2021-2025 development strategy, set against an unusually uncertain banking environment. Global trade policies, prolonged geopolitical conflicts, and inflationary pressures challenged the financial system to balance growth with safety.

Amid these challenges, Vietcombank’s business results demonstrated a consistent strategic choice: growth coupled with discipline and risk control. As of December 31, 2025, the bank’s total assets reached VND 2,480 trillion, a nearly 20% increase from the end of 2024. Credit extended to the economy totaled approximately VND 1,660 trillion, up more than 15%.

On the funding side, Market I capital reached VND 1,680 trillion, over 10% higher than the previous year-end, ensuring a safe capital balance. On this foundation, pre-tax profit met targets, with ROA and ROE profitability ratios among the industry leaders, while the non-performing loan ratio remained below 1%.

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

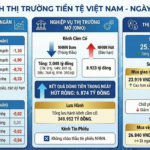

Overnight VND Interest Rates Dip Below USD as SBV Reduces Liquidity Support

The trading session on January 8th witnessed a significant decline in Vietnamese Dong (VND) interbank interest rates across the board. Notably, the overnight rate, which accounts for the majority of trading volume, plummeted by over 1 percentage point, falling below the equivalent USD rate for the same period.

Ho Chi Minh City’s Banking Sector: Prioritizing Credit for Emerging Growth Drivers and Realizing the Vision of an International Financial Hub

On the morning of January 9, 2026, during the Banking Sector Task Deployment Conference for Zone 2, leaders from the State Bank of Vietnam (SBV) and the People’s Committee of Ho Chi Minh City outlined the strategic vision for the year. The focus will be on channeling credit capital into emerging growth drivers and key infrastructure projects, while accelerating the transition from proposal to execution in establishing the International Financial Center.