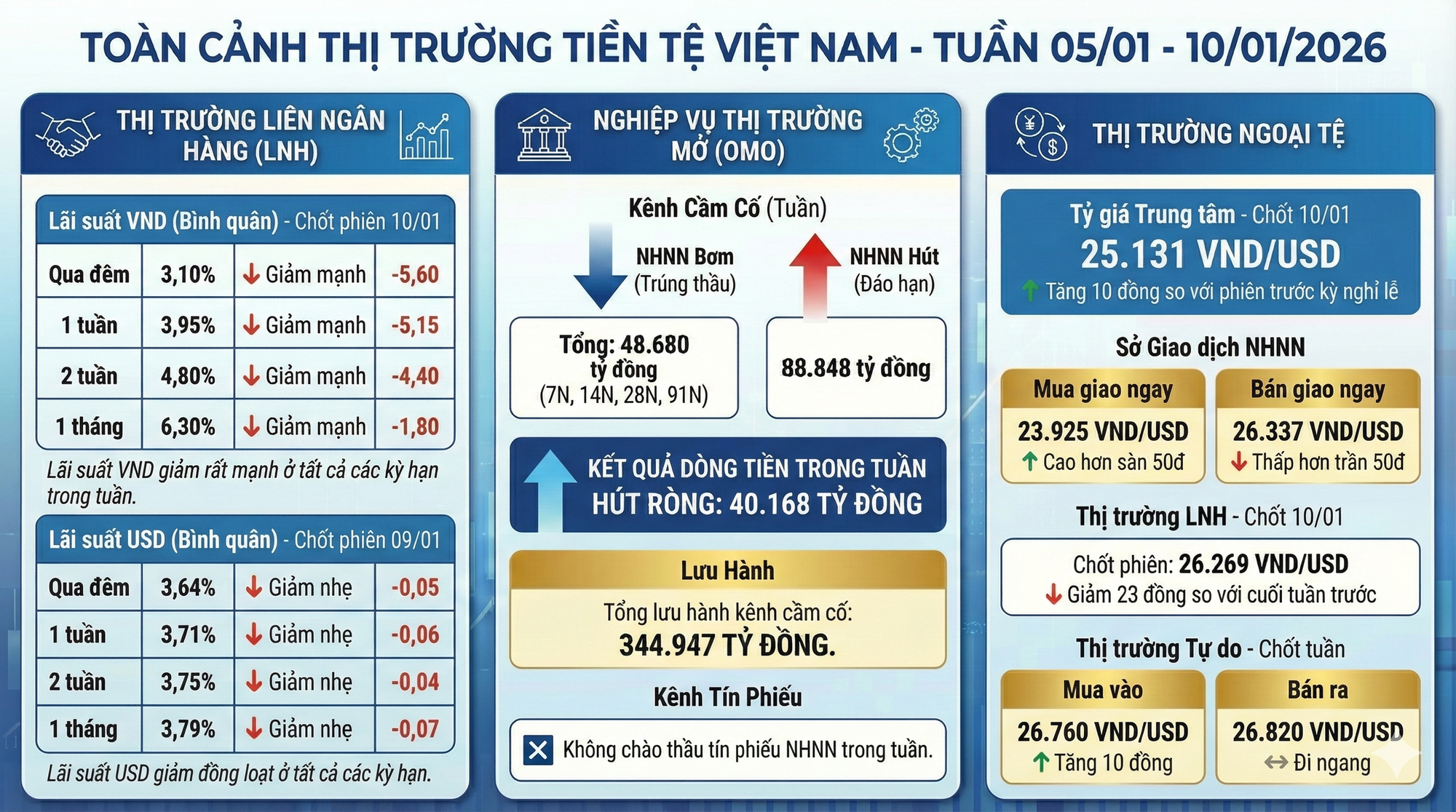

During the trading week of January 5th to January 10th, Vietnam’s interbank VND interest rates saw a sharp decline across all tenors, particularly in the overnight segment, which accounts for approximately 80–90% of transaction value.

By the end of the week on January 10th, the overnight rate plummeted by 5.60 percentage points to 3.10% per annum. The one-week rate dropped by 5.15 percentage points to 3.95% per annum; the two-week rate fell by 4.40 percentage points to 4.80% per annum; and the one-month rate decreased by 1.80 percentage points to 6.30% per annum.

For USD, interbank interest rates also declined uniformly across all tenors. As of the session closing on January 9th, the overnight rate stood at 3.64% per annum, down by 0.05 percentage points; the one-week rate decreased by 0.06 percentage points to 3.71% per annum; the two-week rate fell by 0.04 percentage points to 3.75% per annum; and the one-month rate dropped by 0.07 percentage points to 3.79% per annum.

In the repo market for government bonds, the State Bank of Vietnam (SBV) offered a total of VND 61 trillion across tenors of 7 days, 14 days, 28 days, and 91 days, maintaining the interest rate at 4.5% per annum.

The auction results showed a winning volume of VND 48.68 trillion, while maturities reached VND 88.848 trillion. The SBV did not issue treasury bills during the week.

Thus, the SBV net absorbed VND 40.168 trillion from the market via open market operations. The total outstanding volume in the repo market decreased to VND 344.947 trillion.

In the foreign exchange market from January 5th to January 10th, the SBV adjusted the central exchange rate with slight increases and decreases across sessions. By January 10th, the central rate was set at VND 25,131 per USD, up by 10 VND compared to the pre-holiday session.

At the Trading Desk, the spot buying rate was listed at VND 23,925 per USD, 50 VND higher than the floor rate; while the spot selling rate was listed at VND 26,337 per USD, 50 VND lower than the ceiling rate.

In the interbank market, the USD/VND exchange rate continued its downward trend in most sessions. By the end of the week, the rate closed at VND 26,269 per USD on January 10th, down by 23 VND from the previous week’s close.

In the unofficial market, the USD rate fluctuated unevenly across sessions. By week’s end, the buying rate increased by 10 VND, while the selling rate remained unchanged from the previous week, trading around VND 26,760 per USD and VND 26,820 per USD, respectively.

Vietcombank and BIDV Raise Lending Interest Rates

Average lending rates at Vietcombank climbed to 5.8% per annum in December 2025, marking the second consecutive month of upward adjustments. Meanwhile, BIDV also raised its lending rates after a prolonged period of stability.

Steering and Managing Credit Growth: SBV’s Flexible Approach to Achieving 2026 Monetary Policy Objectives

Empowering credit institutions to proactively manage lending activities, this initiative fosters expansion and credit growth. It allows for flexible adjustments in credit growth targets, ensuring alignment with capital efficiency and economic growth objectives. By linking credit growth to effective capital utilization, it supports sustainable economic development.

Key Highlights in the Regulation of Banking System Liquidity for 2025

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s outright purchase channel to stabilize exchange rates while balancing systemic liquidity. By 2025, however, the operational strategy underwent a notable shift.

Currency Market Update: SBV Nets VND Injection, Overnight Rates Dip to 4%, USD Black Market Plunges

The week of December 22–26 witnessed a cooling trend in the foreign exchange market, as central rates, interbank rates, and free market rates all declined compared to the previous week. Interbank interest rates fluctuated unevenly across different tenors, while the State Bank of Vietnam injected a net liquidity of over 6.1 trillion VND through the OMO channel to support system liquidity.