Pre-General Meeting

BEFORE THE GENERAL MEETING

General Meeting’s Eve

|

Shareholders Register for the General Meeting

|

The End Point of the Restructuring Journey

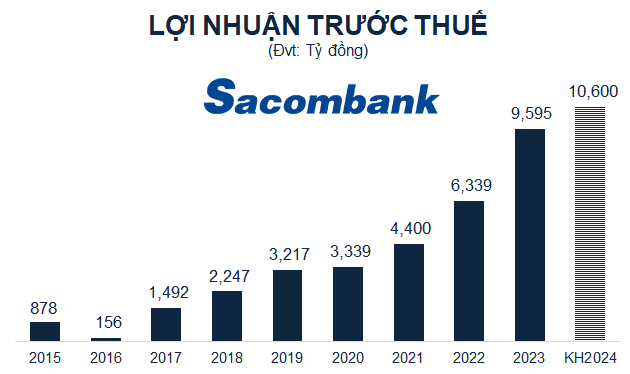

In 2023, Sacombank has achieved 9,595 billion VND in pre-tax profit, an increase of more than 51% compared to the previous year, and fulfilled its set plan. The on-balance sheet NPL ratio was at 2.1%, an increase of 1.18% compared to the beginning of the year, in the context of increasing credit risks and declining customers’ repayment ability. However, the overall credit quality is still under control, with the total NPL ratio decreasing by 0.16%.

Regarding the bad debt handling, in 2023, Sacombank recovered and handled 7,941 billion VND of bad debts and backlog assets, of which 4,487 billion VND were classified as Project debts, reducing its proportion in total assets down to 3%. Adequate risk provisions are set aside in accordance with regulations, with the total provision balance reaching 25,099 billion VND, an increase of more than 10%, including a 34% increase in provisions for loans.

2024 Pre-tax Profit Plan Reaches 10,600 Billion VND, an Increase of 10%

In 2024, it is forecasted that potential risks from macro factors will still exist. However, with the accumulated strength, at the end of the restructuring journey at Sacombank is very near, Sacombank will continue to increase its strength to fully conclude the restructuring process successfully and enter a new development stage with many higher goals. Sacombank sets the following key targets for the new year:

(1) Increase the scale and efficiency of all units in the system, ensuring the system operates safely and effectively.

(2) Achieve breakthroughs in business, build and complete digital transaction points.

(3) Continue digital transformation, increase utility services and products to bring about customer experience and security.

(4) Reduce the overall NPL ratio to below 3%, complete and terminate the restructuring project after the merger.

(5) Implement dividend distribution procedures for shareholders from retained earnings in order to increase the financial capacity to bring Sacombank as one of the leading retail banks.

Sacombank is confident in handling outstanding issues thoroughly to complete the restructuring ahead of schedule, thereby setting growth targets compared to 2023. The total assets set to reach 724,100 billion VND by the end of 2024, an increase of 10% compared to the beginning of the year. The total capital mobilized reaches 636,600 billion VND, an increase of 10%.

Total outstanding loans reach 535,800 billion VND, an increase of 11%, and will be adjusted according to the mobilization and lending growth targets in accordance with the quota allocated by the State Bank. The NPL ratio is controlled below 2%.

The pre-tax profit set for 2024 is 10,600 billion VND, an increase of 10% compared to the results in 2023.

Source: VietstockFinance

|

Accumulated Retained Earnings of 18,387 Billion VND

Regarding the profit distribution plan, Sacombank has 7,469 billion VND of profit available for distribution. After allocating to funds, the Bank has 5,716 billion VND of consolidated after-tax profit. Together with nearly 12,671 billion VND of retained earnings from the previous year, Sacombank has 18,387 billion VND of accumulated consolidated retained earnings.

At this year’s General Meeting of Shareholders, Sacombank also plans to elect an additional member to the Board of Directors (BOD), increasing the total number of BOD members for the 2022-2026 term to 5.

…To be continued