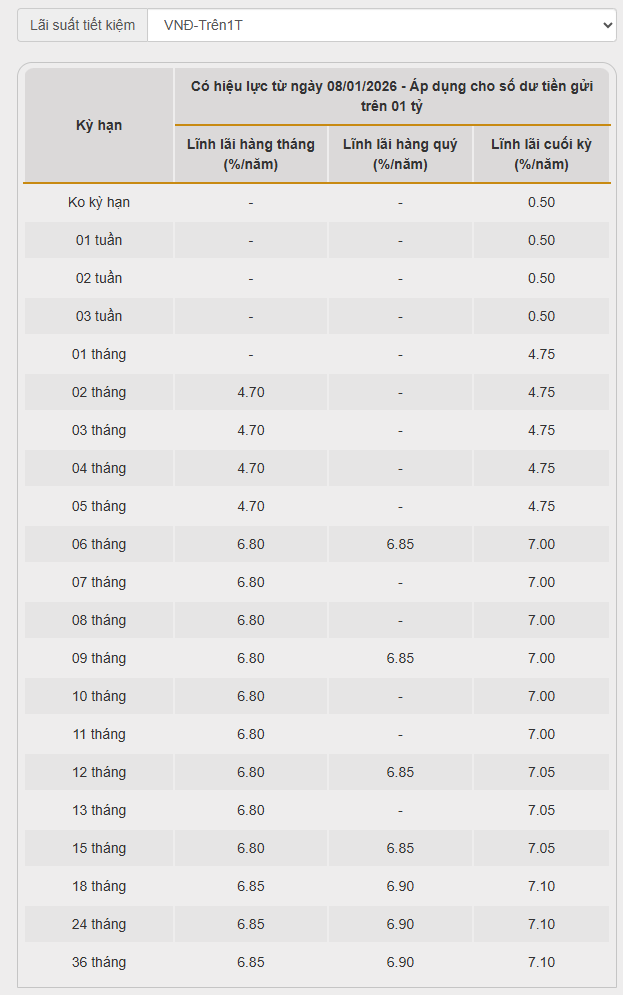

Bac A Commercial Joint Stock Bank (Bac A Bank) has recently updated its deposit interest rates, effective from January 8, 2026, with the highest rate reaching 7.1% per annum for deposits of 1 billion VND or more.

According to the published rates, Bac A Bank continues to apply a tiered interest rate mechanism based on deposit size, distinguishing between deposits below 1 billion VND and those from 1 billion VND and above. Notably, interest rates for medium to long-term deposits ranging from 6 to 36 months have been uniformly increased by 0.3% per annum compared to previous rates.

Specifically, for deposits below 1 billion VND, the interest rate for terms of 6–11 months with interest paid at maturity has been raised to 6.8% per annum; terms of 12–15 months are listed at 6.85% per annum. The highest interest rate for this group reaches 6.9% per annum, applicable to deposits with terms of 18–36 months, with interest paid at maturity. Meanwhile, interest rates for shorter terms of 1–5 months remain unchanged at 4.55% per annum.

For deposits from 1 billion VND and above, interest rates for terms of 1–5 months also remain unchanged, continuing at 4.75% per annum. However, for longer terms, the bank has further increased the interest rate floor: terms of 6–11 months with interest paid at maturity have been raised to 7% per annum; terms of 12–15 months reach 7.05% per annum. Notably, Bac A Bank offers the highest mobilization interest rate of 7.1% per annum for deposits with terms of 18–36 months.

With these adjustments, Bac A Bank is now one of the few banks offering mobilization interest rates above 7% per annum for deposits of 1 billion VND. Apart from Bac A Bank, only three other banks currently offer mobilization interest rates above 7% per annum: OCB, PGBank, and Cake by VPBank.

Specifically, PGBank offers interest rates ranging from 7.1% to 7.3% per annum for deposits with terms of 6–36 months. OCB applies interest rates from 7% to 7.3% per annum for deposit terms of 21 months or more. The digital-only bank Cake by VPBank offers interest rates of up to 8.1% per annum for terms of 6 months or more.

Bank Raises Savings Interest Rates: Up to 9.65% Annually

To enjoy the attractive 9.65% annual interest rate, this bank sets specific requirements regarding deposit terms and amounts.