VIMC Ship

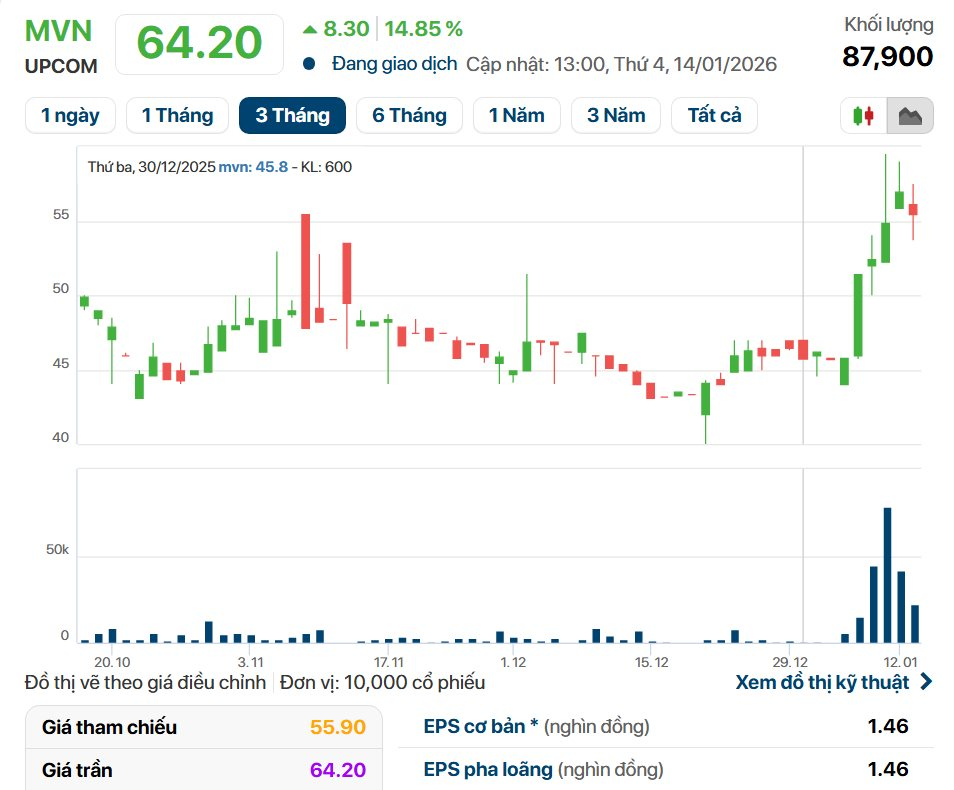

On January 14th, Vietnam Maritime Corporation (VIMC)’s stock (MVN) surged to its ceiling price of VND 64,200 per share, boosting its market capitalization to over VND 66.7 trillion.

This rally followed VIMC’s announcement (Document No. 20/TM-HHVN) seeking consultants to concurrently execute: capital increase, public offering, strategic investor search, and Ho Chi Minh City Stock Exchange (HoSE) listing.

The restructuring aims to reduce state ownership from 99.47% to 65%, meeting large-scale public company shareholder structure requirements.

36-Week Timeline for Listing and Divestment

VIMC’s detailed timeline includes: 10-15 weeks for share issuance advisory, 16-22 weeks for public offering and strategic investor placement post-contract, culminating in HoSE listing within 30-36 weeks.

Financially, VIMC’s 9M2025 report showed VND 13.653 trillion revenue (+10% YoY) and VND 1.912 trillion net profit (-15% YoY). Notably, cash and equivalents exceeded VND 9 trillion, comprising over 25% of VND 35 trillion total assets.

Financial Strength and Supply Chain Evolution

VIMC is transitioning from port operations to integrated logistics, anchored by ports, shipping, and maritime services.

Key assets include Cai Mep – Thi Vai deep-water ports via CMIT (with APM Terminals) and SSIT (with SSA Marine), enabling direct Europe/US routes for mega-ships, optimizing supply chain costs and time.

State-Owned Shipping Giant with $2.7B Market Cap Seeks Share Offering to Reduce Government Ownership to 65%

On January 8th, Vietnam Maritime Corporation (VIMC, UPCoM: MVN) issued an invitation to interested parties to participate in consulting services for increasing its chartered capital. This includes advising on a public offering of shares and a strategic investor placement.

Saigon Port to Fully Divest from Member Logistics Company

The Board of Directors of Saigon Port (UPCoM: SGP) has approved the divestment of its entire stake in Saigon Port Logistics JSC (SPL). This strategic move aims to restructure the investment portfolio and focus resources on key projects, including the Hiep Phuoc Port and Can Gio Port.

“FPT and VIMC Collaboration Elevates Financial Management in Vietnam’s Maritime Industry”

The Vietnam Maritime Corporation (VIMC) and FPT proudly announce the launch of their unified financial reporting solution, FPT CFS. This marks a significant step forward in VIMC’s financial management digitization journey and brings us closer to realizing Resolution 57 on sustainable marine economic development, underscoring the importance of innovation and digital transformation.