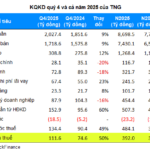

According to the Q4/2025 financial report, Foodcosa recorded a net profit of VND 6.5 billion, the highest in the company’s history. Although the absolute profit margin is not substantial, this result marks a significant improvement compared to the VND 728 million loss in the same period last year.

Compared to Q3/2025, when the company’s profit was less than VND 70 million and had just ended a five-quarter loss streak, the Q4 result is considered Foodcosa’s most notable turnaround in recent years.

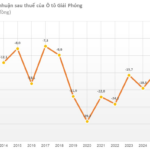

| Foodcosa’s Quarterly Net Profit from 2020 to Present |

Notably, the surge in profit did not stem from revenue growth. In Q4/2025, Foodcosa’s revenue decreased by 9% year-over-year to VND 92 billion. The profit improvement was primarily due to cost control. The cost of goods sold dropped by 12%, while administrative expenses plummeted by 45%. These cost-cutting measures enabled the company to return to net profit, reversing the previous year’s loss.

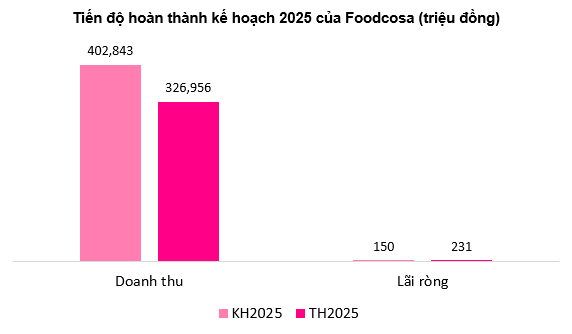

Thanks to the exceptional profit in the final quarter, Foodcosa concluded 2025 with a net profit of VND 231 million, narrowly avoiding a loss after the VND 1.5 billion loss in 2024. The modest 2025 profit is insufficient to offset the prolonged loss period from 2016 to 2021. As of year-end 2025, the company still reported an accumulated loss of over VND 194 billion.

The company’s equity stands at VND 61 billion. Foodcosa’s management has repeatedly emphasized the severe working capital shortage, forcing the company to maximize existing resources to sustain operations.

For 2025, Foodcosa set a modest profit target of VND 150 million, significantly lower than previous years, given the company’s consistent failure to meet business plans. With a profit of VND 231 million, the company exceeded its annual target by approximately 1.5 times.

Meanwhile, 2025 net revenue reached VND 327 billion, a 19% decline from the previous year and only 81% of the planned target.

Source: VietstockFinance, compiled by the author

|

On the UPCoM market, FCS shares experienced a short-term recovery, rising over 6% in the past week. On the morning of January 16th, the stock traded around the reference price of VND 6,800 per share. However, over the past year, FCS’s market price has slightly decreased by approximately 3%, with average liquidity of over 18,500 shares per session.

| FCS Stock Price Movement Since the Beginning of 2025 |

In terms of personnel, in late November 2025, Mr. Nguyễn Văn Hiển was elected as Foodcosa’s Chairman of the Board for the 2021-2026 term, following the approval of the extraordinary shareholders’ meeting on November 18th.

Previously, Mr. Võ Hùng Dũng stepped down as Chairman to take on a new role at Southern Food Corporation (Vinafood 2, UPCoM: VSF), the parent company currently holding 59.78% of Foodcosa’s charter capital.

– 10:58 16/01/2026

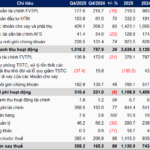

TNG Records 392 Billion VND Profit in 2025, Stock Rebounds Strongly

Despite a slowdown in Q4/2025 profits compared to the previous two quarters, TNG Investment and Trading JSC (HNX: TNG) concluded 2025 with its highest-ever net profit.

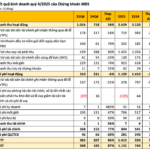

MBS Reports 86% Surge in Q4 Profits, Exceeding 2025 Annual Targets

MBS Securities Corporation (HNX: MBS) has released its standalone financial report for Q4/2025, reporting a net profit of over 308 billion VND, an 86% increase driven by strong performance in lending, investment, and brokerage activities. This growth offset the decline in proprietary trading profits and rising interest expenses. The results also enabled MBS to surpass its full-year pre-tax profit target.