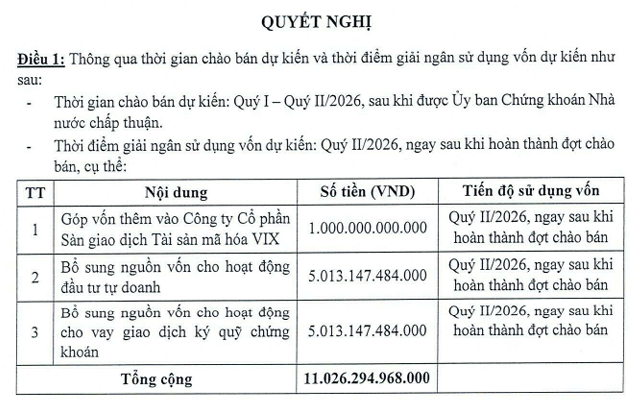

VIX is set to offer nearly 919 million shares to existing shareholders, a plan long in the making. This move aims to increase the company’s chartered capital from over 15,314 billion VND to nearly 24,503 billion VND.

According to a recent resolution, the offering is scheduled for Q1-Q2/2026, pending approval from the State Securities Commission. Once completed, VIX plans to allocate the entire proceeds in Q2/2026.

At an offering price of 12,000 VND per share, VIX expects to raise over 11,026 billion VND. The funds will be allocated as follows: over 5,013 billion VND for proprietary trading, over 5,013 billion VND for margin lending, and notably, 1,000 billion VND to increase capital in VIXEX (VIX Crypto Asset Exchange). VIXEX is positioned to compete for a pilot spot in Vietnam’s emerging crypto asset market.

Source: VIX

|

Established on August 26, 2025, VIXEX shares its headquarters with VIX at 22nd Floor, 52 Le Dai Hanh Street, Hai Ba Trung District, Hanoi. Mr. Nguyen Van Hieu serves as both CEO and Legal Representative.

VIXEX began with a chartered capital of 1,000 billion VND, founded by three shareholders: FTG Vietnam JSC (64.5%), 3C Computer-Communication-Control JSC (20.5%), and VIX Securities (15%). Since its inception, no changes in business registration have been reported.

During an extraordinary shareholders’ meeting on November 28, 2025, VIX addressed shareholder concerns about its preparedness for the crypto asset market. The company confirmed its investment in VIXEX and the selection of a technology partner.

VIX emphasized the significant potential of this nascent market, particularly following the government’s resolution allowing pilot crypto asset trading.

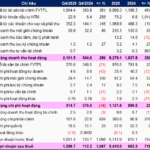

In other developments, VIX recently reported a surge in Q4/2025 profits, closing 2025 with record earnings. The lending and proprietary trading segments, heavily invested in the GELEX group, were key drivers of this success.

Specifically, VIX’s pre-tax and post-tax profits for 2025 reached over 6,717 billion VND and 5,410 billion VND, respectively—an 8.2-fold increase from 2024 and slightly exceeding annual targets.

By year-end 2025, VIX’s total assets hit a record high of 34,167 billion VND, a 74% increase from the beginning of the year. This growth was primarily driven by expanded lending and financial assets measured at fair value through profit or loss (FVTPL).

VIX’s Record 2025 Profits: Proprietary Trading Triumphs with GELEX Group

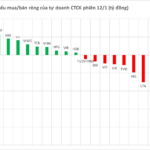

VIX shares have recently rebounded from a low of 20,000 VND per share, with improved liquidity. However, the current price of 24,700 VND per share (as of January 16, 2026) remains significantly below the peak of 40,000 VND per share reached in mid-October 2025.

| VIX Shares Recover Slightly After Sharp Decline |

– 17:18 16/01/2026

VIX Records Historic Profits in 2025, Proprietary Trading Thrives on GELEX Group’s Success

VIX Securities Corporation (HOSE: VIX) has announced its Q4/2025 financial report, revealing a remarkable surge in profits compared to the same period last year, capping off 2025 with record-breaking earnings. The primary drivers of this outstanding performance were the lending and proprietary trading segments, with a significant portion of the portfolio attributed to GELEX group stocks.

VIX Stock Surges, Achieving 2025 Profit Targets Ahead of Schedule

VIX Securities Corporation is rapidly emerging as a standout player in the brokerage industry, showcasing exceptional profit growth that outpaces its peers.