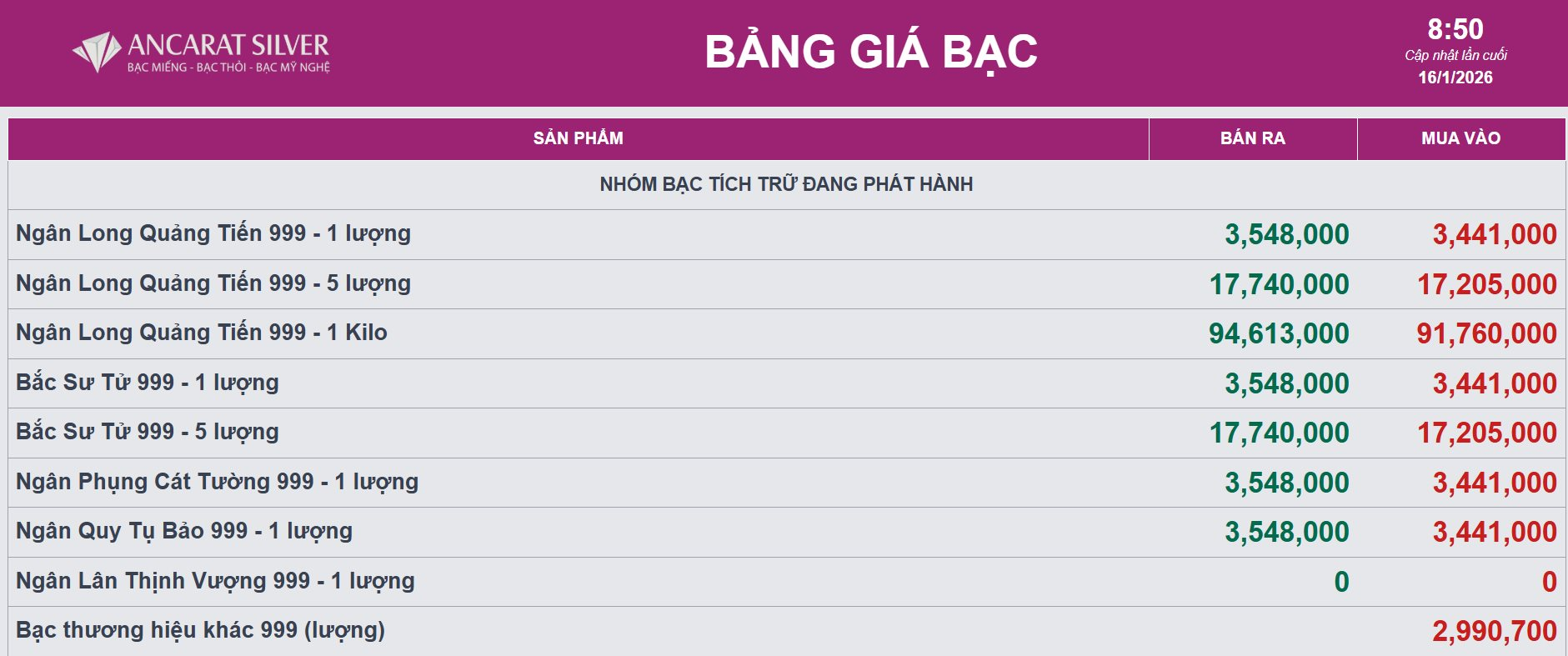

At Ancarat Vietnam Precious Metals Joint Stock Company, today’s silver price is listed at VND 3,441,000 per tael (buy) and VND 3,548,000 per tael (sell) in Hanoi, an increase of VND 120,000 per tael on the buying side and VND 127,000 per tael on the selling side compared to yesterday morning’s session.

Meanwhile, 1kg 999 silver bars are priced at VND 91,760,000 per bar (buy) and VND 94,613,000 per bar (sell), updated at 8:50 AM on January 16th.

On the global market, silver is trading at $91.3 per ounce.

Silver prices experienced significant volatility during Thursday’s session (January 15th) following the U.S. decision not to impose tariffs on critical minerals. The threat of import tariffs on key minerals had previously triggered a broad-based rally in commodities, pushing silver, copper, and other metals to record highs as traders rushed to ship goods into the U.S. to avoid potential tariffs.

According to precious metals analyst Christopher Lewis (FX Empire), recent developments indicate that the silver market is entering a sensitive phase where trends can reverse rapidly based on news and investor sentiment. In this context, short-term adjustments are not viewed negatively but rather as opportunities to enter the market.

Notably, the silver supply deficit has persisted for at least five consecutive years, providing sustained support for prices. On the demand side, medium- and long-term prospects continue to improve due to the boom in data centers and China’s increasing stockpiling of precious metals. Additionally, silver was added to the U.S. list of critical minerals last year due to its essential role in advanced technologies and clean energy infrastructure, particularly in solar panels, electric vehicles, and electronics.

With these drivers, Christopher Lewis believes that silver approaching $100 per ounce in the near future is well-founded, rather than merely speculative.

“World’s Second-Largest Asset Plunges in Dramatic Downturn”

Today’s silver prices have plummeted both domestically and globally, marking a significant decline across the board.

Silver Surges Past $90/Ounce: Will ‘Rich Dad, Poor Dad’ Author’s Warning Come True?

Renowned author Robert Kiyosaki has boldly forecasted that silver prices will surge past $70 per ounce, with the potential to reach an astonishing $200 per ounce.