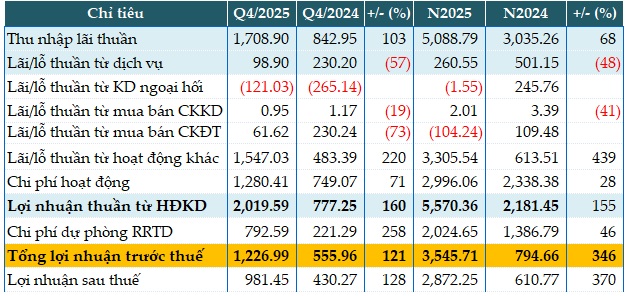

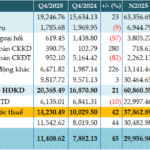

ABBank experienced a robust year of growth in 2025, with net interest income surging by 68% to reach VND 5,089 billion.

While some non-interest income streams, such as service fees, foreign exchange, and securities trading, saw declines, a significant surge in other operating income, amounting to VND 3,305 billion (5.4 times higher than the previous year), offset these reductions.

Operating expenses rose by 28% to VND 2,996 billion. Consequently, net profit from operations more than doubled (2.5 times) compared to the previous year, reaching VND 5,570 billion.

Despite allocating VND 2,025 billion for credit risk provisions (a 46% increase), ABBank still achieved a pre-tax profit of VND 3,546 billion, 4.5 times higher than the previous year. This figure also surpassed the annual pre-tax profit target of VND 1,800 billion by 97%.

|

ABBank’s Q4 and 2025 Business Results. Unit: Billion VND

Source: VietstockFinance

|

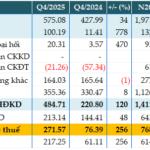

Total assets as of year-end 2025 increased by 25% compared to the beginning of the year, reaching VND 220,462 billion. Customer loans grew by 15% to VND 113,891 billion, while customer deposits surged by 47% to VND 133,411 billion.

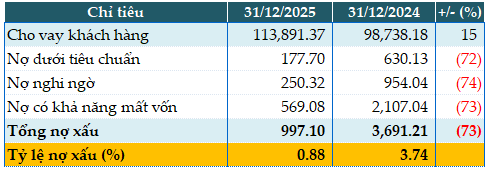

Asset quality further enhanced ABBank’s stellar year, with total non-performing loans as of December 31, 2025, decreasing by 73% to VND 997 billion. All loan categories witnessed significant reductions in bad debt. Consequently, the NPL ratio dropped from 3.74% at the beginning of the year to 0.88%.

|

ABBank’s Asset Quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

In other news, ABBank will unveil its new brand identity on January 31, 2026.

– 7:00 PM, January 30, 2026

2025 Pre-Tax Profit Stagnates, Vietcombank’s NPL Ratio Improves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 44,020 billion in its latest consolidated financial statement, marking a 4% increase compared to the previous year. This growth is primarily driven by a significant rise in non-interest income. Notably, the bank’s non-performing loans (NPLs) decreased by 31% at year-end compared to the beginning of the year.

VietinBank Projects 37% Pre-Tax Profit Surge by 2025, Credit Growth Nears VND 2 Trillion Milestone

VietinBank (HOSE: CTG) has reported a pre-tax profit of nearly VND 43,446 billion for 2025, marking a 37% increase year-on-year. This impressive growth is primarily attributed to a significant reduction in credit risk provisions. Notably, the bank’s customer loans outstanding at the end of the year surpassed VND 1,990 trillion.

PGBank Reports Pre-Tax Profit of Over 768 Billion VND in 2025, Marking an 81% Surge

Prosperity and Development Commercial Joint Stock Bank (PGBank, UPCoM: PGB) has released its Q4 2025 financial report, revealing a pre-tax profit of over 768 billion VND for the year. This impressive figure marks an 81% increase compared to the previous year and surpasses the annual plan by 7%.