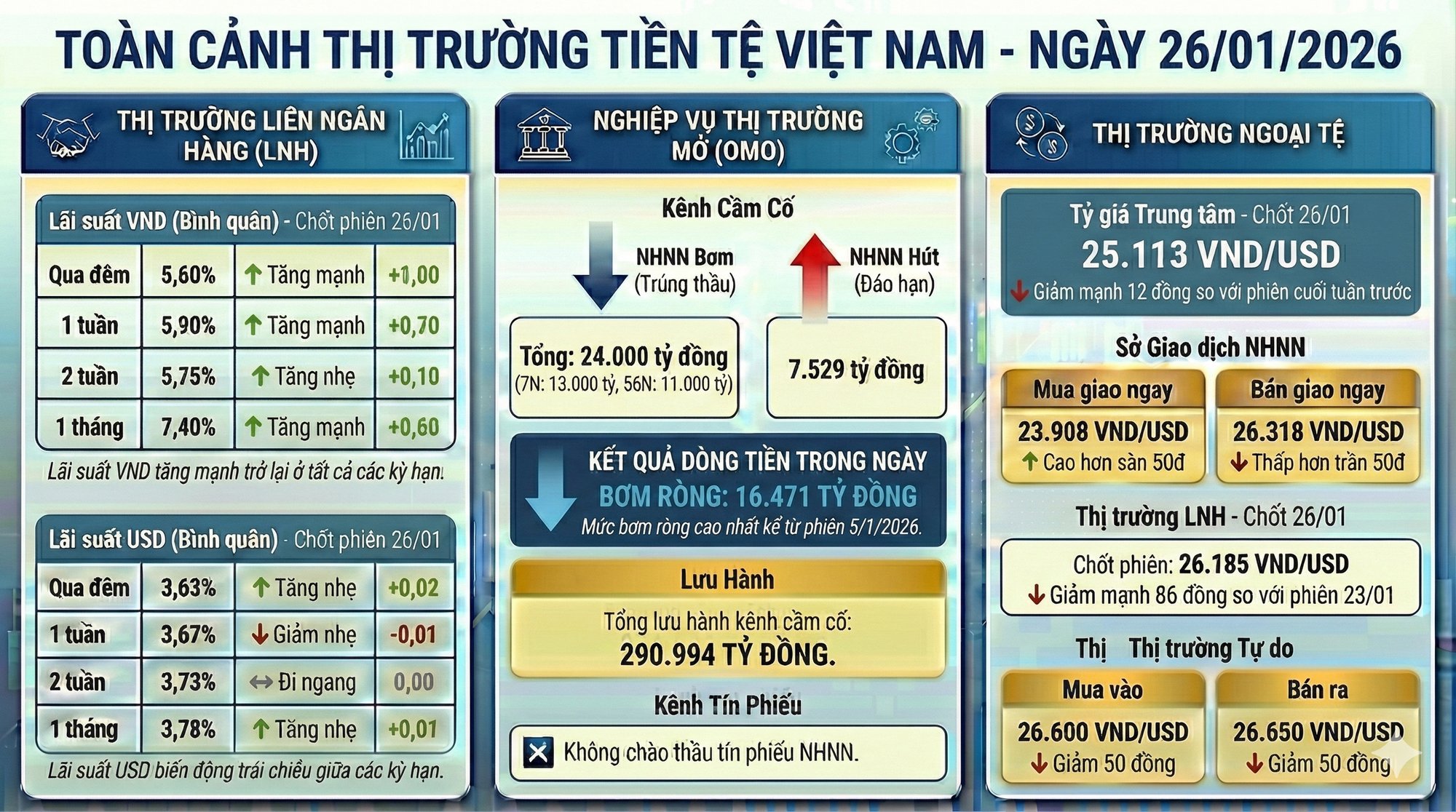

Foreign Exchange Market: On January 26th, the State Bank of Vietnam significantly reduced the central exchange rate. The central rate was set at 25,113 VND/USD, marking a 12-dong decrease compared to the previous week’s closing session.

At the Trading Center, the spot buying rate was listed at 23,908 VND/USD, 50 dong higher than the floor rate, while the spot selling rate was set at 26,318 VND/USD, 50 dong below the ceiling rate.

In the interbank market, the USD/VND rate closed at 26,185 VND/USD, a sharp decline of 86 dong from the January 23rd session. In the unofficial market, the USD rate dropped by 50 dong on both buying and selling sides, trading around 26,600 VND/USD and 26,650 VND/USD, respectively.

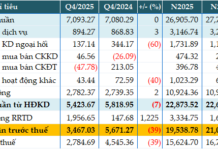

Interbank Money Market: On January 26th, the average interbank lending rates for VND surged across all tenors up to one month compared to the previous week’s closing session. Notably, the overnight rate—the primary tenor accounting for 80–90% of transaction value—rose sharply by 1.00 percentage points to 5.60% per annum.

Similarly, the one-week rate increased by 0.70 percentage points to 5.90% per annum; the two-week rate edged up by 0.10 percentage points to 5.75% per annum; and the one-month rate climbed by 0.60 percentage points to 7.40% per annum.

For USD, interbank rates exhibited mixed movements across tenors. The overnight rate rose by 0.02 percentage points to 3.63% per annum. The one-week rate dipped slightly by 0.01 percentage points to 3.67% per annum. The two-week rate remained unchanged at 3.73% per annum, while the one-month rate increased by 0.01 percentage points to 3.78% per annum.

Open Market Operations: On the collateralized lending channel (OMO), during the January 26th session, the State Bank of Vietnam offered 13,000 billion VND for a 7-day tenor and 11,000 billion VND for a 56-day tenor, with a uniform interest rate of 4.5% per annum.

The results showed that the entire offered amount was successfully bid. Meanwhile, 7,529 billion VND matured. The State Bank did not offer treasury bills. Consequently, in this session, the State Bank netted an injection of approximately 16,471 billion VND into the market—the highest level since the January 5, 2026 session. The total outstanding volume on the collateralized channel rose to 290,994 billion VND.

Revoking 18 Decisions and Circulars Issued by the Governor

Circular No. 67/2025/TT-NHNN repeals several legal normative documents issued by the Governor of the State Bank of Vietnam (SBV). This circular shall take effect from February 16, 2026.

Latest Currency Market Update (Jan 15): State Bank of Vietnam Resumes Net Injection of VND

The January 14th trading session witnessed a slight uptick in short-term VND interbank interest rates, coinciding with the State Bank of Vietnam resuming net VND liquidity injections through open market operations. In the foreign exchange market, the central exchange rate inched up, while USD rates across markets remained largely stable.