Vietjet Aviation Joint Stock Company (stock code: VJC) has released its consolidated financial report for Q4/2025, highlighting a remarkable surge in profitability as the standout feature of its financial performance for the quarter.

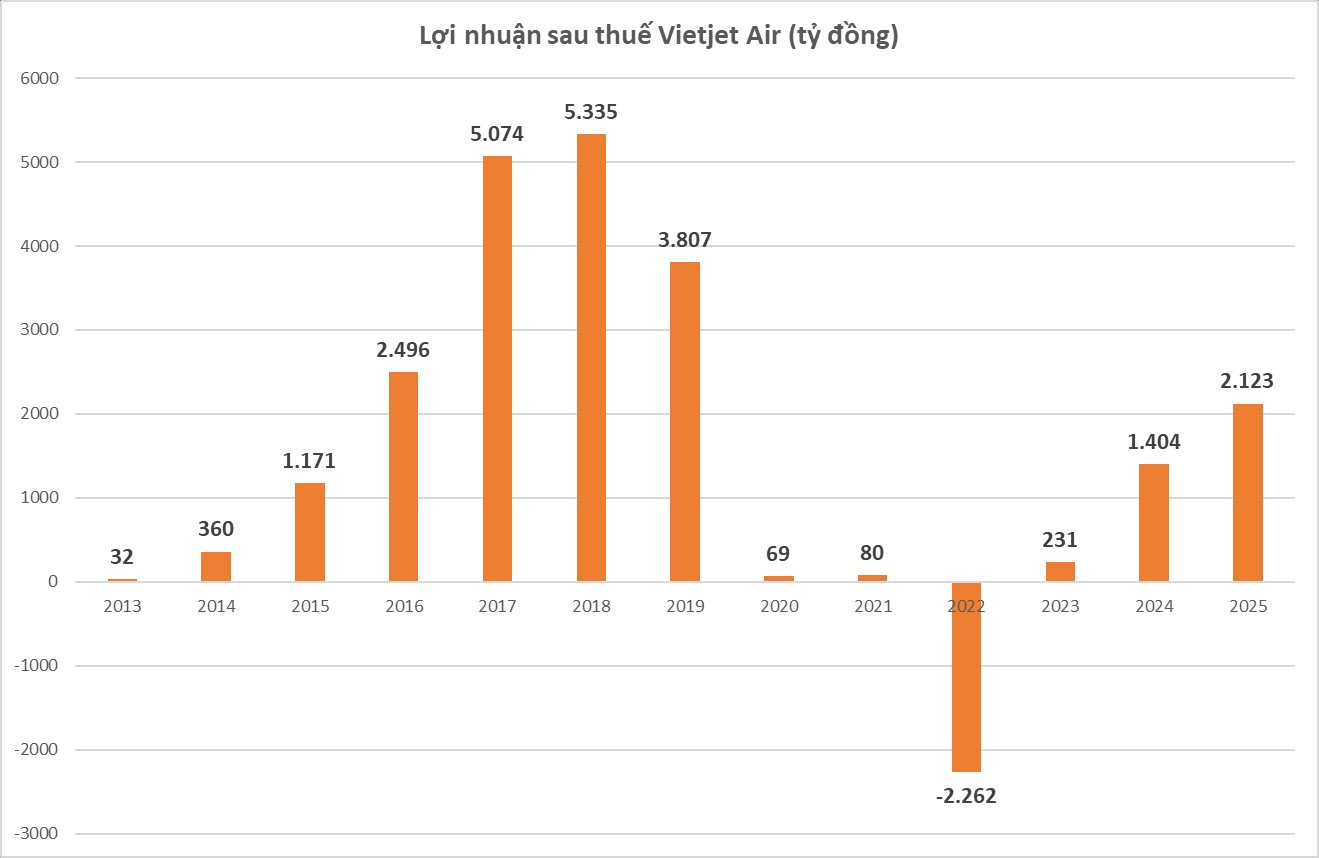

In Q4/2024, Vietjet’s consolidated after-tax profit stood at VND 21 billion. Fast forward to Q4/2025, this figure skyrocketed to VND 509 billion, marking an astonishing 24-fold increase year-over-year.

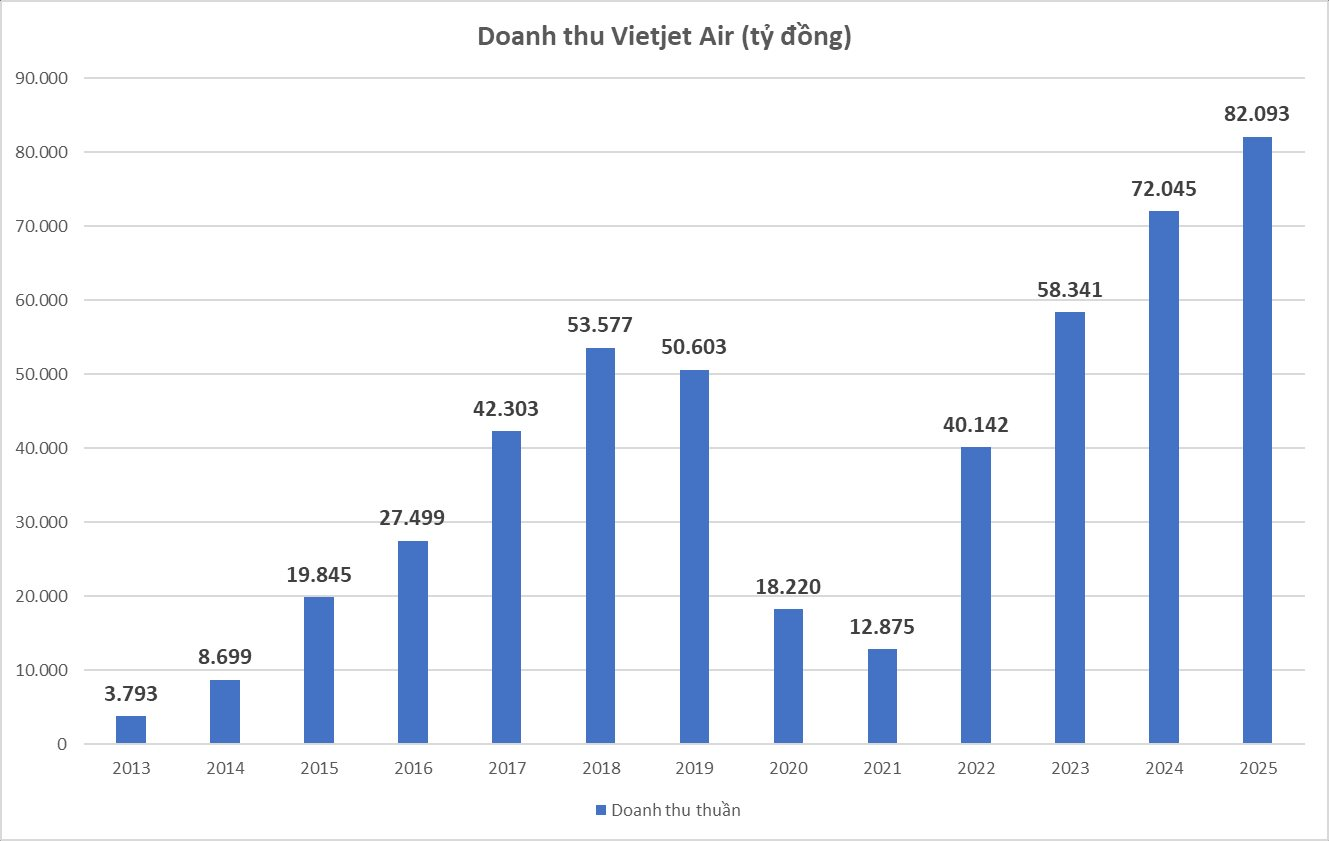

For the full year 2025, Vietjet reported consolidated revenue of VND 82,093 billion, the highest in its operational history and a 14% increase compared to 2024.

Full-year after-tax profit reached VND 2,123 billion, up 51% year-over-year. On average, the airline generated approximately VND 5.8 billion in net profit daily throughout 2025.

Alongside the profit growth, Vietjet’s debt levels also saw a significant increase to meet capital demands for fleet expansion. As of December 31, 2025, the company’s total financial debt (short-term and long-term) reached approximately VND 69,000 billion, a 62.3% rise from VND 42,512 billion at the beginning of the year.

Notably, the debt structure reveals a strong focus on long-term liabilities. Long-term loan and finance lease debt stood at VND 42,943 billion by year-end 2025, up nearly 43% from the start of the year. This primarily stems from bond issuances and bank loans for fixed asset financing. Meanwhile, short-term debt doubled to VND 26,056 billion.

Despite the substantial debt increase, Vietjet’s financial health remains robust, supported by ample cash reserves. As of December 31, 2025, the company held VND 10,986 billion in cash and cash equivalents, a 2.4-fold increase from the beginning of the year, with a net debt-to-equity ratio of 2.25.

In response to the positive financial results, VJC shares saw a vibrant trading session on the stock market. Closing the session on January 30, VJC rose 3.96% to VND 170,500 per share, with robust liquidity of nearly 1.7 million units.

Industrial Real Estate Firm KCN Reports 44% Profit Surge in Q4 2025, Stock Skyrockets Unexpectedly

By 2025, the company’s cumulative net revenue reached 1.08 trillion VND, marking a 24% increase compared to the previous year. Meanwhile, its after-tax profit soared to 345 billion VND, reflecting a robust 15.6% growth.

Power Generation Company Reports 2025 Profit of $1 Trillion, a 12-Fold Increase from Previous Year

In 2025, NT2 achieved a remarkable year-end performance with net revenue reaching 7.804 trillion VND, marking a 31% increase compared to the previous year. The company’s after-tax profit for the same period soared to nearly 1.000 trillion VND, a 12-fold surge from the 82.9 billion VND recorded in 2024.

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.