Services

Source: BaF

|

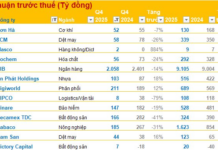

In 2025, the livestock industry faced continued challenges due to disease outbreaks and flooding. Foot-and-mouth disease affected 19 farms across 11 provinces, while African swine fever hit 2,782 farms in 34 provinces and cities, resulting in the death and culling of 1,273,082 pigs—a 13-fold increase from 2024. This significantly impacted pork supply throughout the year. Despite these difficulties, BaF Vietnam Agriculture Joint Stock Company (BAF) expanded its operations, achieving growth in both output and pork sales revenue.

According to the consolidated Q4/2025 financial report, the company launched two additional farms, bringing the total number of active farms to 40. As part of its 2026 herd expansion strategy, BAF is developing 13 new farms in the Central Highlands and Central regions, expected to increase the sow herd by 70,000. Currently, BAF’s total herd exceeds 850,000 pigs, including nearly 75,000 sows.

In Q4/2025, pork sales reached over 234,000 pigs, with fattening pigs accounting for the majority, marking a 73% increase year-over-year. Pork sales revenue totaled nearly VND 1,399 billion, up 45% year-over-year. For the full year 2025, total pork sales reached approximately 782,000 pigs, generating VND 5,045 billion in revenue—a 140% and 155% increase, respectively, compared to 2024.

Source: BaF

|

In Q4/2025, net revenue reached VND 1,399 billion, entirely from livestock operations. Pig prices bottomed out at VND 45,000–46,000/kg, impacting the company’s revenue. Production costs rose due to increased disease prevention, post-flood environmental management, and adverse weather conditions. Additionally, new farm operations increased labor, utility, depreciation, and initial operating costs. To prepare for the 2026–2030 strategy, BAF invested in feed formula upgrades, high-yield pig breeding research, and Muyuan’s advanced biosecurity systems, raising production costs. As a result, the company reported a net loss of VND 264 billion in Q4/2025.

For the full year 2025, consolidated net revenue reached VND 5,045 billion. Gross profit totaled nearly VND 822 billion, up 61% year-over-year. Pre-tax and post-tax profits were VND 102 billion and VND 100 billion, respectively.

By year-end, total assets reached nearly VND 10,676 billion, up 43%. Inventory increased 21% to VND 2,692 billion, including pigs slated for market release during the next price upcycle.

Fixed assets rose 44% to VND 3,447 billion with the launch of 13 farms in 2025. Work-in-progress long-term assets increased 63% to VND 1,331 billion, including new farms and breeding stock.

Expanding Modern Livestock Operations

In February 2026, BAF will launch two farm clusters with a capacity of 5,000 sows, 60,000 fattening pigs, and 60,000 replacement pigs. Aiming to become Vietnam’s leading livestock company, BAF plans to open 16 new farms and a 300,000-ton/year feed mill in Binh Dinh in 2026. Additionally, a high-rise pig farming project (64,000 sows and 1.6 million fattening pigs) is set to begin construction in April 2026 and start operations in Q3/2027.

With support from Muyuan, BAF is implementing cutting-edge technologies to enhance productivity and biosecurity: a 5-layer smart biosecurity system; AI-powered 24/7 health monitoring; precision feeding systems; smart odor and disinfection systems (eliminating 95% of odors); and a circular economy model. Waste treatment systems convert waste into resources: treated wastewater is reused, and solid waste is transformed into organic fertilizer, creating a sustainable agricultural cycle.

Over the past two months, pig prices rose from VND 48,000/kg to VND 81,000/kg, expected to remain high in H1/2026. This benefits companies like BAF with large herds and inventory. BAF plans to release 220,000 pigs during this high-price period, anticipating strong Q1/2026 results.

– 17:19 30/01/2026

U.S. Firm Uncovers Major Offshore Oil Reserves in Vietnam: Plans $200 Million Investment in Two Oil Fields This Year

American energy giant Murphy Oil has announced a significant investment in Vietnam, with a planned $110 million allocation for operations in 2025, primarily focused on field development. This commitment is set to nearly double in 2026, reaching $195 million.

Techcombank Sets 2025 Profit Record Fueled by Ecosystem Strength and Digital Platform

On January 20, 2026, Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) officially announced its 2025 business results, showcasing remarkable growth figures. Capping off a highly successful financial year, Techcombank achieved record-breaking profits, driven by its superior ecosystem strategy and digital transformation platform.