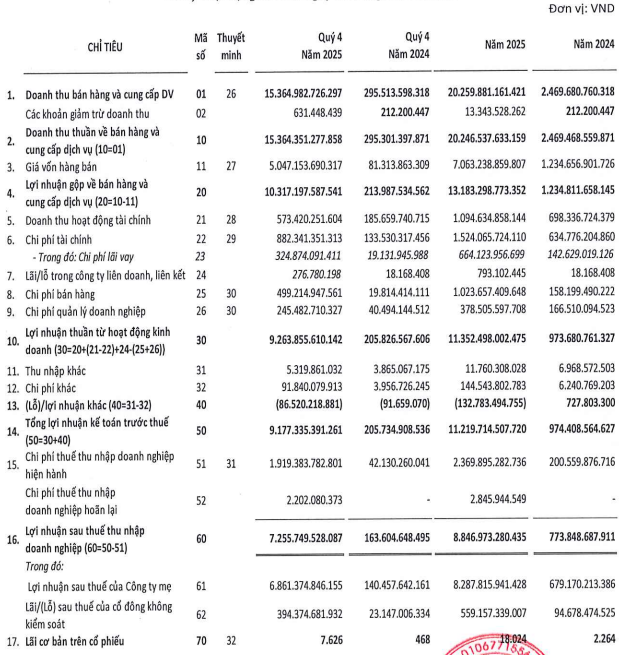

According to the consolidated financial report, KSF’s net revenue in 2025 reached over VND 20.2 trillion, an 8.2-fold increase compared to the previous year. Financial revenue also surged to approximately VND 1.1 trillion, marking a nearly 57% growth.

Despite increased expenses due to the consolidation of SSH’s business results, KSF still recorded a net profit of nearly VND 8.3 trillion, more than 12 times higher than in 2024.

Compared to the annual pre-tax profit plan, KSF’s result of over VND 11.2 trillion successfully met the target of achieving a profit between VND 8-12 trillion, as approved by the shareholders’ meeting.

In Q4 2025 alone, KSF’s business performance saw remarkable growth, with net revenue and net profit reaching over VND 15.3 trillion and nearly VND 6.9 trillion, respectively—52 times and 49 times higher than the same period last year.

|

Consolidated Business Results of KSF in Q4 and Full Year 2025

Source: Q4 2025 Consolidated Financial Report

|

Regarding the merger between KSF and SSH, in October 2025, KSF issued nearly 600 million shares for the swap at a ratio of 1.6:1 (1 SSH share for 1.6 newly issued KSF shares). Post-issuance, KSF’s charter capital increased to over VND 8,997 billion, and the company held 374 million SSH shares, equivalent to 99.96% of Sunshine Homes’ voting shares.

During this share swap, Mr. Đỗ Anh Tuấn, Chairman of KSF’s Board of Directors, received 390 million KSF shares, increasing his ownership from 54.2% to 61.4%.

Simultaneously, Mr. Tuấn’s family members also participated in similar transactions. Mr. Đỗ Văn Trường (Mr. Tuấn’s brother) acquired 36 million KSF shares, raising his ownership to 4.03%. Mrs. Đỗ Thị Hồng Nhung (Mr. Tuấn’s sister) held over 6.2 million shares, equivalent to 0.69%. Collectively, the group related to Mr. Đỗ Anh Tuấn owns over 595.4 million shares, representing 66.2% of KSF’s charter capital.

Returning to KSF’s 2025 performance, the company’s total assets as of December 31, 2025, reached approximately VND 119.6 trillion, nearly six times higher than the beginning of the year. Short-term cash holdings and inventory stood at over VND 7 trillion and VND 14.7 trillion, respectively—more than eight times and 17 times higher.

Total liabilities reached nearly VND 99.8 trillion, over seven times higher. Outstanding loans also surged to more than VND 23.6 trillion, 25 times higher than the previous year-end, primarily from bank loans.

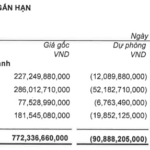

Additionally, KSF incurred a bond debt of over VND 4 trillion, issued by its subsidiary Xuan Dinh Construction Investment JSC. The bond debt stems from three bond packages with varying terms and issuance values, ranging from 48 to 60 months. The interest rate for the first payment period is 11% per annum, followed by a floating rate calculated as the reference rate plus 4.5% per annum. The proceeds from this issuance were used by Xuan Dinh to invest in shares of DAT Construction Investment JSC or DAT’s capital contribution in Big Gain Investment LLC, a key co-managed entity with KSF.

– 16:19 30/01/2026

The $5 Billion Handshake: Sunshine Group and Kita Invest Forge Landmark Partnership

In 2025, Sunshine Group Joint Stock Company (HNX: KSF) embarked on a transformative year marked by strategic M&A deals and aggressive project expansions across Vietnam, from the North to the South. This ambitious growth propelled their investment portfolio into the trillions of VND, partnering with leading real estate giants and amassing a project inventory surpassing 20 trillion VND.

“Seaport Company Records $6 Trillion Profit, Achieves Historic EPS of 7,350 VND, with Cash Comprising 50% of Assets”

By the end of fiscal year 2025, Dong Nai Port Joint Stock Company (PDN) achieved its highest-ever profit in its operational history, with earnings per share (EPS) reaching 7,350 VND. Simultaneously, the company maintained a robust level of cash and bank deposits.