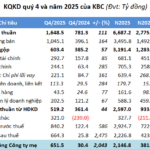

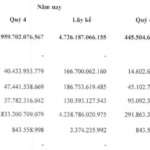

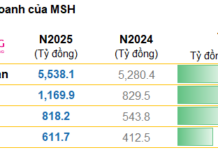

According to the consolidated financial report, Novaland recorded a cumulative revenue of nearly VND 7 trillion in 2025, a 23% decrease compared to the previous year. Real estate transfers contributed approximately VND 6.4 trillion to this figure. Despite the decline, the company’s gross profit surged nearly 54 times to VND 4.5 trillion, driven by improved profit margins.

Financial revenue, however, dropped by over 46% to nearly VND 3.2 trillion, primarily due to the absence of trading securities gains seen in the previous year.

In terms of expenses, both financial and management costs were reduced by NVL, with financial costs down 20% to VND 3.8 trillion and management costs down 12% to VND 1.3 trillion. Conversely, selling expenses rose by 14% to VND 611 billion.

A highlight for NVL in 2025 was the extraordinary other income of nearly VND 2.2 trillion, a 5.4-fold increase from the previous year. This was largely due to the reversal of approximately VND 1.3 trillion in penalties for late land rental and land use fee payments related to the Lakeview City project.

Thanks to this extraordinary income, NVL reported a net profit of over VND 1.7 trillion in 2025, a significant turnaround from the previous year’s loss of VND 6.4 trillion. Notably, the company had initially projected another loss for 2025.

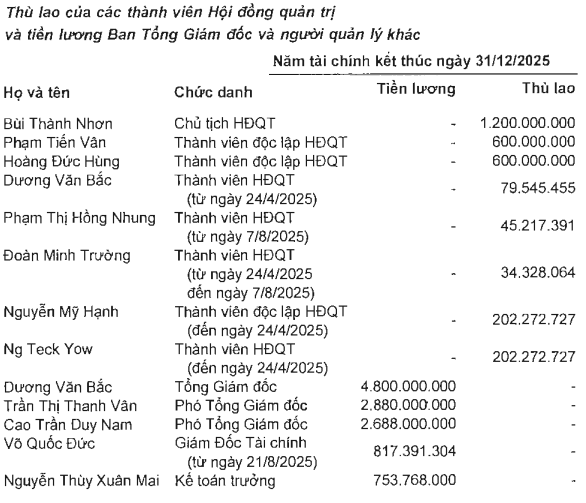

Among NVL’s leadership, CEO Duong Van Bac received the highest salary in 2025, totaling VND 4.8 billion.

Source: NVL

|

| Novaland’s Business Performance Over the Past 5 Years |

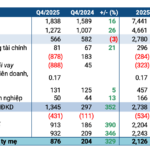

In Q4/2025, a similar trend emerged: despite a 67% decline in net revenue, NVL achieved a net profit of nearly VND 3.2 trillion, compared to a loss of VND 2.4 trillion in the same period the previous year. This was driven by a sharp increase in financial revenue and other income.

Notably, during Q4, NVL divested entirely from several subsidiaries, including Green Highland Real Estate Investment LLC (VND 10 billion), Nova Property Management LLC (VND 139 billion), An Phu Dong Real Estate Development Investment LLC (VND 7 billion), and Tan Kim Yen Real Estate Investment LLC (VND 164 billion).

As a result of the Tan Kim Yen divestment, NVL also lost control over Gia Phu Real Estate LLC, in which Tan Kim Yen held a 99.99% stake.

In other developments, NVL utilized 47.06% of its shares in No Va Real Estate Investment Corporation and all 99.999% of its shares in An Phat Commercial and Real Estate Development Investment Corporation to contribute capital to Mega House LLC. This move aimed to restructure its investment portfolio and optimize capital structure.

Following this restructuring, NVL’s direct ownership in No Va Real Estate Investment Corporation decreased to 51.03%, and it no longer directly holds shares in An Phat. Its stake in Mega House LLC increased from 98.6% to 99.93%. NVL plans to sell its entire 99.93% stake in Mega House LLC once a suitable investor and market conditions are identified.

As of December 31, 2025, NVL’s total assets stood at nearly VND 250 trillion, a 5% increase from the beginning of the year. This growth was primarily driven by a nearly 5% rise in inventory value to VND 153.4 trillion, with the majority being real estate under construction for sale, valued at VND 145 trillion (up 5%).

Total liabilities remained stable at VND 191 trillion, while debt increased by over 9% to VND 67.2 trillion, mainly due to long-term bank loans. In contrast, bond debt decreased by nearly 33% to VND 25 trillion.

On the final day of 2025, four NVL subsidiaries—Aqua City LLC (TPAC), Unity Real Estate Investment LLC (UNIC), Lucky House Investment Services JSC (LKHC), and Gia Duc Real Estate LLC (GDUC)—completed the early repurchase of seven bond lots totaling VND 3.6 trillion. On the same day, NVL finalized the issuance of nearly 164 million shares to convert debt worth over VND 2,577 billion.

– 11:22 31/01/2026

Q4 Explosion: Bầu Đức’s Company Reports Record Profits

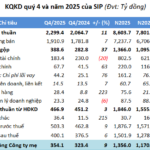

Following its official exit from accumulated losses in Q3/2025, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) continued its profit surge in Q4, doubling the previous quarter’s results. A significant contributor to this achievement was the reversal of expenses following the exemption from bond interest payments.