|

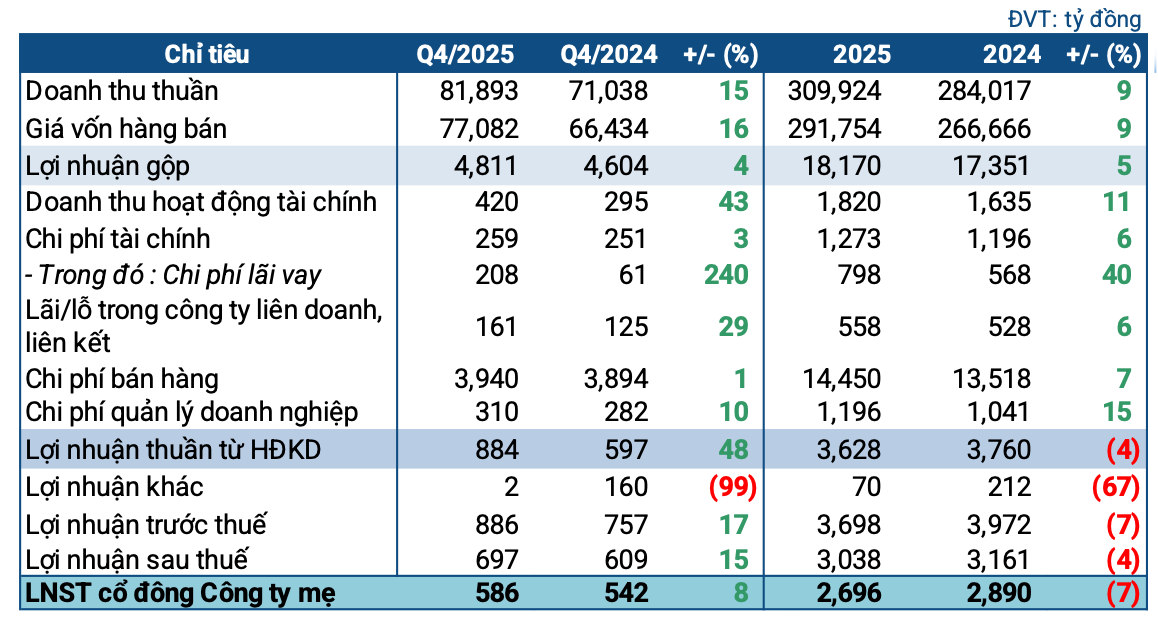

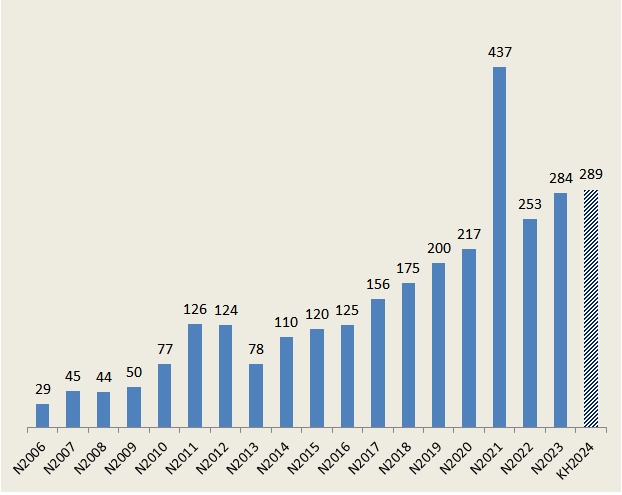

PLX’s Business Targets for Q4/2025

Source: VietstockFinance

|

In Q4/2025, Petrolimex achieved nearly VND 82 trillion in net revenue, a 15% increase year-over-year. Despite a slight rise in gross profit to VND 4.8 trillion, the gross profit margin narrowed from 6.5% to 5.8% due to faster-growing cost of goods sold.

Financial activities emerged as a highlight in Q4, with revenue reaching VND 420 billion, up 43%. However, interest expenses surged to VND 208 billion, 3.4 times higher than the same period last year. Selling expenses saw a modest increase, remaining the largest pressure point at over VND 3.9 trillion. Additionally, the company recorded minimal other income at VND 2 billion, compared to VND 160 billion in the previous year.

Ultimately, Petrolimex posted a net profit of VND 586 billion, an 8% increase.

For the full year 2025, Petrolimex set a record with nearly VND 310 trillion in revenue, up 10%; net profit reached nearly VND 2.7 trillion, down 7%. Compared to the plan approved by the Annual General Meeting, PLX exceeded its profit target by 15.6%.

Petrolimex’s financial picture at the end of 2025 remained robust. Total assets reached over VND 86 trillion, a 1% increase (equivalent to nearly VND 5 trillion) from the beginning of the year, primarily in current assets (nearly VND 60 trillion, flat year-over-year). Cash and deposits decreased by 5% but remained substantial at over VND 28.5 trillion, accounting for 33% of total assets. Inventory declined by 11%, to nearly VND 14 trillion.

On the funding side, total liabilities increased by over VND 4.6 trillion (9%), reaching VND 56.6 trillion. Of this, financial debt (short and long-term) stood at approximately VND 18.7 trillion, lower than the equity. The debt-to-equity ratio was around 0.63.

– 14:58 31/01/2026

Q4 Explosion: Bầu Đức’s Company Reports Record Profits

Following its official exit from accumulated losses in Q3/2025, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) continued its profit surge in Q4, doubling the previous quarter’s results. A significant contributor to this achievement was the reversal of expenses following the exemption from bond interest payments.

NCB Surpasses All 2025 Business Plans and Achieves Multiple Milestones at PACCL

By the end of 2025, National Commercial Bank (NCB) achieved remarkable business results, surpassing all targets and accelerating the completion of key milestones outlined in its restructuring plan (PACCL). This success underscores the bank’s strategic acumen and establishes a robust foundation for its upcoming growth phase.

Vietnam Airlines Achieves Record-Breaking Revenue of Over 121 Trillion VND in 2025

Consolidated after-tax profit surpassed 7.713 trillion VND, with the parent company’s after-tax profit reaching 5.509 trillion VND, doubling compared to the same period last year.