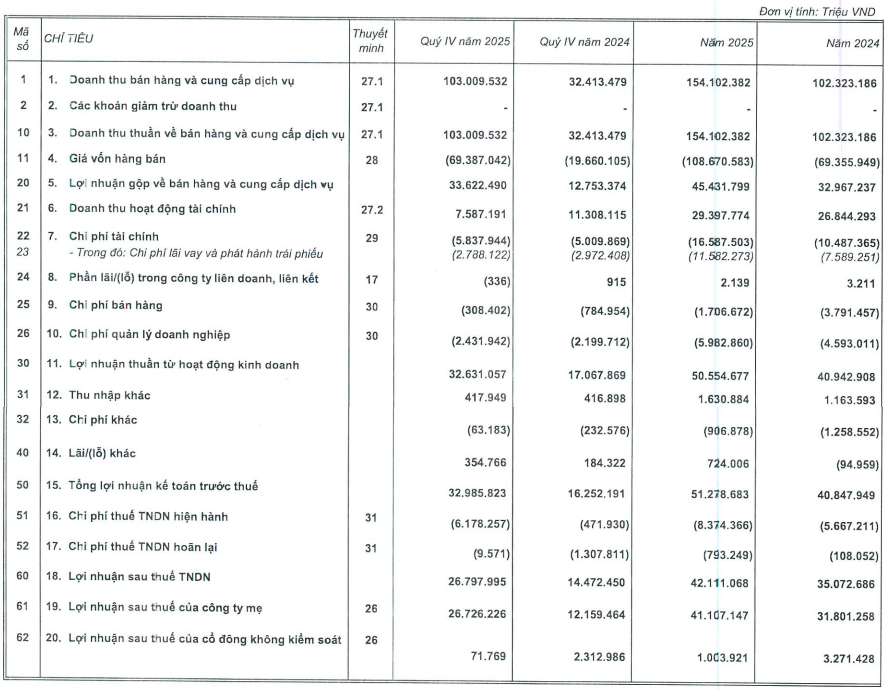

According to the Consolidated Financial Statements, in 2025, Vinhomes’ consolidated net revenue reached VND 154.1 trillion, a nearly 51% increase compared to the previous year. The total consolidated net revenue (including revenue from Vinhomes’ core activities and business cooperation contracts) exceeded VND 183.9 trillion.

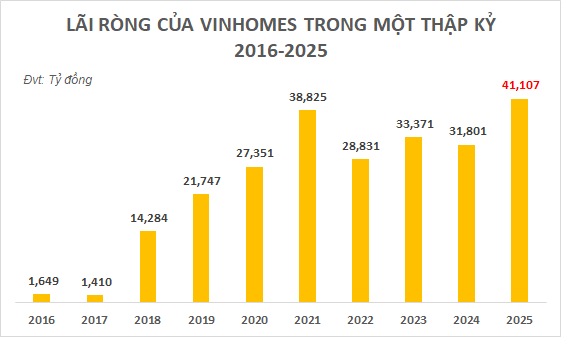

Thanks to the significant revenue growth, the company concluded 2025 with a record net profit of over VND 41.1 trillion, up more than 29%.

|

2025 Business Results of VHM

Source: Consolidated Financial Statements Q4/2025

|

Compared to the initial plan, VHM achieved its post-tax profit target of VND 42 trillion and surpassed the total revenue target of VND 180 trillion by 2%. This success primarily resulted from timely and ahead-of-schedule handovers at large-scale projects, demonstrating the company’s synchronized deployment capabilities and effective project management.

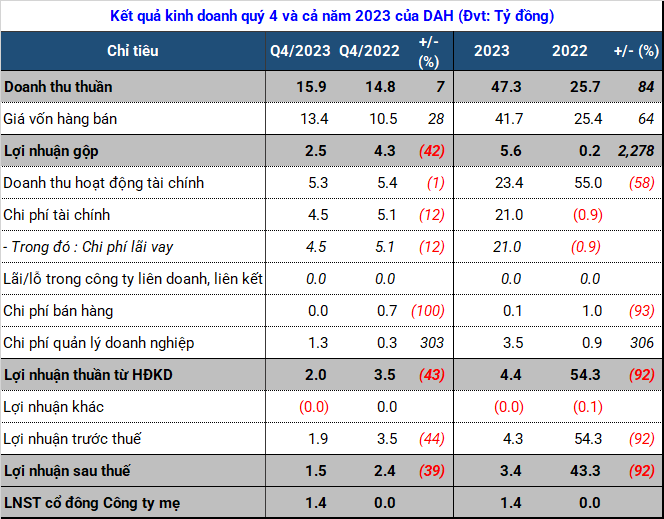

Source: VietstockFinance

|

Sales activities remained a highlight in 2025. Total sales reached VND 205.2 trillion, a 98% increase compared to 2024. This positive outcome stemmed from the simultaneous launch of 5 new projects in key markets, including Hanoi, Ho Chi Minh City, Hai Phong, and Tay Ninh, reflecting strong market demand and the effectiveness of Vinhomes’ product development and sales strategies. As of December 2025, unrecorded sales reached VND 186.4 trillion, up 98% from the end of 2024, providing a solid foundation for revenue and profit recognition in subsequent years.

Specifically, the 5 new projects launched by Vinhomes in 2025 were Vinhomes Wonder City (Dan Phuong, Hanoi), Vinhomes Green City (Hau Nghia, Tay Ninh), Vinhomes Golden City (Duong Kinh, Hai Phong), Vinhomes Green Paradise (Can Gio, Ho Chi Minh City), and Happy Home Trang Cat (Nam Trang Cat, Hai Phong). All projects recorded positive business results from the initial stages and are being constructed ahead of schedule.

As of December 31, 2025, Vinhomes maintained a safe financial structure with total assets of VND 786.4 trillion and equity of VND 247.9 trillion, increasing by 39% and 12%, respectively, compared to the end of 2024. Cash and cash equivalents reached VND 49.9 trillion, up nearly 74%, reflecting healthy operating cash flow.

– 15:44 30/01/2026

MB Targets 18% Pre-Tax Profit Growth by 2025 as Credit Surpasses 1 Million Billion Dong

In 2025, Military Commercial Joint Stock Bank (MB, HOSE: MBB) reported pre-tax profits exceeding VND 34,268 billion, marking an 18% year-on-year increase. This impressive growth is attributed to the bank’s robust core operations and a significant rise in service revenue, as reflected in its consolidated financial statements.

2025 Pre-Tax Profit Stagnates, Vietcombank’s NPL Ratio Improves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 44,020 billion in its latest consolidated financial statement, marking a 4% increase compared to the previous year. This growth is primarily driven by a significant rise in non-interest income. Notably, the bank’s non-performing loans (NPLs) decreased by 31% at year-end compared to the beginning of the year.

Vinhomes Records Staggering VND 42.111 Trillion Profit in 2025

In 2025, Vinhomes achieved a consolidated net revenue of VND 154,102 billion. The total consolidated net revenue, including core operations and joint business ventures, reached VND 183,923 billion, with a consolidated after-tax profit of VND 42,111 billion, setting new records. These figures surpassed the year’s initial targets, marking a 30% and 20% increase compared to 2024, respectively.

Stock Market Week 12-16/01/2026: Capital Rotation in Focus

The VN-Index rebounded in the final session of the week, capping off a volatile trading period marked by intense tug-of-war dynamics. Despite facing corrective pressures at elevated price levels, market breadth remained relatively balanced, supported by agile capital rotation across various stock groups. Moving forward, the VN-Index is likely to require additional time to absorb supply pressures and establish a new price equilibrium in the upcoming week.