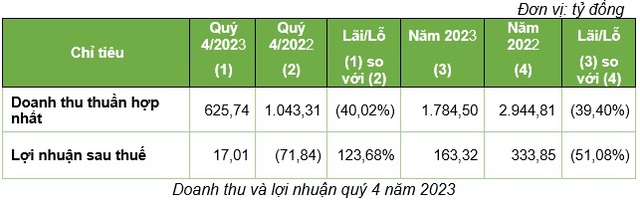

Tracodi Investment Development and Transport Corporation (TCD, HoSE: TCD) has just announced its financial report for the fourth quarter of 2023 with net revenue of VND 625.74 billion, a decrease of 40.02% compared to the same period in 2022. The after-tax profit for the fourth quarter of 2023 reached VND 17.01 billion. The company has effectively controlled input costs, resulting in a gross profit margin/net revenue ratio of 16.4% in the fourth quarter of 2024, higher than the same period last year by 6%.

For the full year 2023, Tracodi’s consolidated net revenue reached VND 1,784.5 billion, equivalent to 53.8% of the approved revenue plan at the Shareholders’ General Meeting. The revenue structure primarily comes from two core business areas: Construction (VND 997 billion – 56% share) and Quarrying (VND 753 billion – 42.2% share).

Tracodi’s construction activities only achieved 38.1% of the annual plan. However, the revenue from the company’s construction quarrying activities increased by VND 41.23 billion compared to 2022, corresponding to a growth rate of 5.8%. This is due to Tracodi’s participation in providing materials for some expressway projects in the Mekong Delta region. The quarrying segment is expected to continue its growth momentum in the coming years.

Tracodi’s after-tax profit for the full year 2023 reached VND 163.3 billion, equivalent to 61.08% of the plan. The real estate market still faces many difficulties and requires adjusting construction items to extend the project schedules so that investors can arrange capital, which is the main reason for the company’s decline in revenue and profit compared to 2022.

Thanks to the efforts in restructuring the workforce, closely controlling costs of raw materials, labor, and machinery, Tracodi’s gross profit margin in 2023 reached 17.6%, an increase of 4.6% compared to 2022. This is a relatively high gross profit margin compared to other businesses in the same industry.

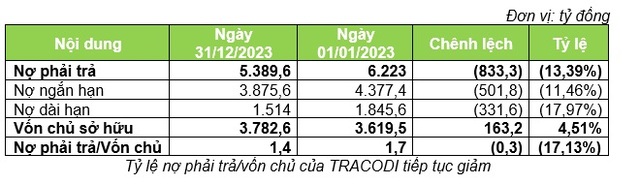

In addition to cost control, Tracodi also focuses on financial restructuring, actively recovering investment cooperation agreements to pay off debts, loans, and bonds in order to reduce risks in a volatile market period. The payable debt/owner’s equity ratio as of December 31, 2023, decreased by 29.45% compared to the beginning of the year, mainly due to a decrease in short-term debt of VND 501.8 billion, equivalent to an 11.46% decrease, and a decrease in long-term debt of VND 331.6 billion, equivalent to a 17.97% decrease.

At the end of 2023, Tracodi’s total debt/owner’s equity ratio continued to decrease to a safe level, from 1.72 times at the end of 2022 to 1.42 times. In addition, the debt/owner’s equity ratio officially decreased to 0.55 times, lower than many other construction companies in the industry.

In 2024, Tracodi will implement the construction of several projects: Section from Km174+000 to Km189+666.65 under Package No. 12 of the Chau Doc – Can Tho – Soc Trang Expressway Project, with a total contract value of over VND 300 billion; Duc Thinh Residential Area Project, Hiep Hoa District, Bac Giang Province, with a contract value of over VND 52 billion; Infrastructure and school projects in Dong Nai Province, with an estimated value of around VND 460 billion.

According to the company’s leadership, with the large projects currently being implemented and prepared, the value of Tracodi’s construction contracts ensures a source of revenue and profit growth for the company in the 2024-2025 phase. In addition, there is an expectation that the real estate market will gradually enter a recovery cycle, with policies being implemented to remove difficulties for the real estate market, as well as the government’s continued efforts in public investment, which sets Tracodi’s target for revenue growth of 12%-15% per year for the next 3 years. The expected after-tax profit/net revenue ratio of Tracodi in the next 3 years will be around 9%-12%.