Based on the closing price of the HAH stock on January 30th at 38,000 VND per share, it is estimated that Vietnam Container Corporation (Viconship, HOSE: VSC) has spent nearly 82 billion VND on this deal.

In addition, there were also 2 million HAH shares traded in a block deal during this session, with a value of nearly 82 billion VND, equivalent to 40,000 VND per share. If we consider the case of executing both market orders and block deals, Viconship has estimated to spend nearly 86 billion VND.

|

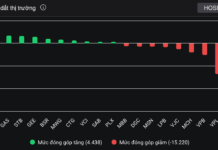

On January 30th, there were both market orders and block deals executed for HAH shares

Source: VietstockFinance

|

Recently, another development related to the ownership of HAH shares has attracted attention from investors, as Maserco Joint Stock Company (Maserco, HNX: MAC) – an organizational shareholder, registered to sell all of its 1.5 million HAH shares (1.42% stake) from January 3rd to February 2nd, 2024.

In terms of the relationship, Mr. Tran Tien Dung – a member of HAH’s Board of Directors and also a member of MAC’s Board of Directors. Currently, Mr. Dung is also the Chairman of the Supervisory Board of TM Holding Company Limited – an organization that holds nearly 4.6 million MAC shares, equivalent to over 30% of the capital.

HAH stock price increased by 63% in one year, Maserco registered to divest its capital

Returning to HAH, the company specializing in vessel operation is going through a difficult business period with a net profit of only 63 billion VND in the fourth quarter of 2023, a decrease of 63% compared to the same period last year, marking the 5th consecutive negative growth quarter, and also the lowest net profit in the past 12 quarters.

Explaining the above result, HAH noted that both ocean freight rates and vessel charter rates have decreased compared to the same period, leading to a sharp decline in vessel operation profitability.

Accumulated for the whole year, HAH achieved a net profit of nearly 385 billion VND, a decrease of 53% compared to the previous year and unable to fulfill the annual plan approved at the Annual General Meeting of Shareholders in 2023, which was 492 billion VND.

Lowest net profit in 12 quarters, HAH has 5 consecutive negative growth quarters

Despite the unfavorable business situation and some fluctuations in shareholders, the HAH stock price has seen an impressive increase of nearly 47% in the past year, reaching 37,200 VND per share at the end of January 31st.

| HAH stock price performance over 1 year |