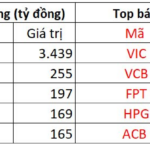

On February 1, 2024, S&P Global released a report on Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) for January 2024. The report highlighted 3 key points: an increase in both output and new orders, a decrease in selling prices despite significant input cost increases, and delays in transportation resulting in extended supplier delivery times.

INCREASE IN NEW ORDERS AND OUTPUT

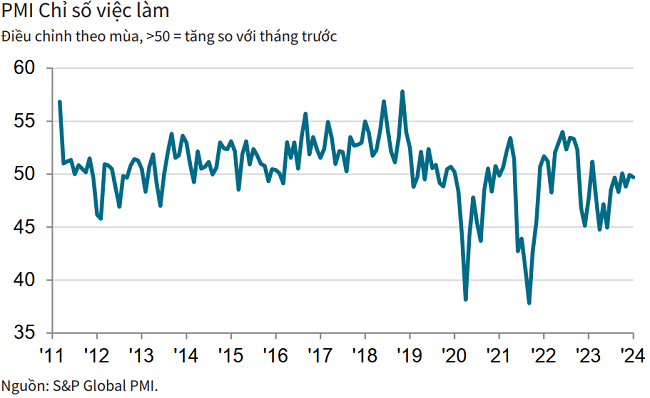

Vietnamese manufacturers experienced a rebound at the beginning of 2024, as initial signs indicated an improvement in demand, leading to an increase in both new orders and output. However, employment and purchasing activity decreased slightly, and business confidence also declined.

Reports show that delays in transportation have prolonged supplier delivery times and increased cost pressures. Despite higher input prices, companies have reduced output prices to stimulate demand.

As a result, Vietnam’s Manufacturing PMI returned above the 50-point threshold in the first month of the year, increasing to 50.3 from December’s 48.9. This indicates an improvement in the health of the manufacturing sector for the first time in months, although the improvement is only marginal.

The S&P Global report highlights that the overall improvement in business conditions is centered around the recovery of new orders and output. This is the first increase in three months in terms of total new orders, as there are signs of a demand recovery in both the domestic and export markets (new export orders also increased for the first time since October).

As a result, companies have increased production, signaling an end to the four-month period of declining output. The increase is only slight but the most significant since September 2022. The overall increase in output is concentrated in intermediate goods manufacturers.

With the mild increase in both output and new orders, companies have maintained employment and purchasing activity almost unchanged in the first month of 2024.

The relatively unchanged capacity utilization amid the increase in new orders has led to a second consecutive month of rising backlogs in January. Although mild, the pace of increase is the most significant since March 2022.

Some companies have decided to fulfill orders from existing stocks to customers. As a result, post-production inventories have decreased after remaining unchanged in the last month of 2023.

Inventory levels for purchased goods have also decreased as production demands increased while purchasing activity remained virtually unchanged. The decline in pre-production inventories is significant and the strongest since June last year.

PROMISING START FOR THE MANUFACTURING SECTOR

According to the S&P Global report, delays in transportation and issues in the logistics sector have contributed to extended supplier delivery times in January, resulting in the first deterioration in vendor performance in over a year. However, the extent of delivery time elongation is only marginal.

Transportation issues have also led to an increase in transportation costs at the beginning of the year, causing input costs to continue to rise significantly. Companies also reported higher fuel and freight costs.

Despite the significant rise in input costs, the desire to stimulate demand has led Vietnamese manufacturers to reduce selling prices. The easing of output prices has ended a prolonged period of price increases for the first time in several months.

Business sentiment regarding future output has reached its lowest level in seven months and is below the historical average of the PMI index as companies express concerns about economic conditions. However, overall manufacturers remain cautiously optimistic, hoping for improved demand and customer numbers, as well as plans to introduce new products.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, stated that this is a promising start for Vietnam’s manufacturing sector in 2024, witnessing positive improvements in both new orders and output. However, the corresponding increase levels are only marginal and not enough to convince companies to hire more employees or increase purchasing activity. Backlogs continue to rise as industry capacity remains stable.

“There have been some reports about transportation and delivery issues in January, resulting in delayed delivery times and increased costs. However, companies have lowered selling prices, reflecting relatively weak demand,” Andrew Harker commented.