In an interview with VnEconomy, Nguyen The Viet, Deputy Director of the Customs Monitoring and Management Department (General Department of Customs), stated that in 2023, Vietnamese businesses faced more challenges than advantages in their import and export activities due to the unstable economic situation.

SHORTEN CUSTOMS CLEARANCE TIME, PRIORITIZE FRESH AGRICULTURAL PRODUCTS

Throughout 2023, the total import-export turnover is estimated to reach $683 billion, a 6.6% decrease compared to the previous year, with a 4.4% decrease in exports and an 8.9% decrease in imports, although the downward trend is gradually slowing down towards the end of the year.

Acknowledging the challenges at the beginning of the year, the General Department of Customs has been focused on implementing synchronized, determined, timely, and effective measures and solutions in accordance with resolutions to facilitate trade and overcome difficulties for businesses and fulfill state budget plans. Strengthening the control of local areas and enhancing internal management, the department is determined to meet important objectives on schedule.

At the beginning of the year, the General Department of Customs issued Directive No. 479/CT-TCHQ on February 6, 2023, regarding the synchronized and determined implementation of measures to facilitate trade and enhance the effectiveness of state management, avoiding revenue losses while implementing state budget tasks in 2023.

Notably, the General Department of Customs issued Decision No. 123/QD-TCHQ on January 31, 2023, specifying targets for administrative reform and streamlining customs procedures to facilitate trade in 2023.

Under this decision, customs authorities aim to reduce clearance time and cargo release by 10%, reduce the rate of red channel declarations by 5%, reduce the rate of yellow channel declarations by 10%, reduce the number of samples for analysis and inspection by 20%, increase the number of online price consultations by 50%, and submit all certificates of origin electronically.

“Priority will be given to customs clearance procedures for agricultural products and perishable goods. Local customs units will coordinate and align with their counterparts in neighboring countries to streamline customs clearance at northern border gates,” emphasized the representative of the General Department of Customs.

Currently, customs clearance at border gates in Lang Son province is from 7 am to 10 pm.

In 2023, import-export activities through Lang Son province will continue to be carried out at six border gates, including the Huu Nghi International Border Gate, Dong Dang International Railway Station, Chi Ma Main Border Gate, and the Tan Thanh, Coc Nam, and Na Hinh auxiliary border gates. The average daily volume of vehicles involved in import-export activities is around 1,100-1,300 units.

Estimated import-export turnover through Lang Son province in 2023 is nearly $5 billion, surpassing the plan by 129.6% and increasing by 60.9% compared to the same period last year.

Based on the actual implementation, the customs clearance of fruits and agricultural products has been smooth, with no congestion or backlog in the export holding area, ensuring bilateral trade stability and supply chain of goods.

IMPROVE LEGAL FRAMEWORK, PROMOTE DIGITALIZATION

In addition, to ensure the legal basis for implementing modern customs reforms in the near future, the customs sector has been focusing on improving and submitting legal documents to the Government and the Ministry of Finance to ensure compliance with legal procedures in customs administration using electronic and digital platforms.

Specifically, the Ministry of Finance issued Circular No. 33/2023/TT-BTC on May 31, 2023, which provides guidelines on determining the origin of exported and imported goods.

Furthermore, the customs sector is accelerating the improvement and submission of three draft decrees to the Government for approval in the customs field, which play a crucial role in promoting administrative reforms, creating favorable conditions for business operations, and supporting import-export activities. These decrees cover customs management for goods traded via e-commerce, customs procedures, and inspection of imported food quality and safety, and the amendment and supplementation of Decree No. 08/2015/ND-CP dated January 21, 2015, which regulates customs procedures, inspections, supervision, and control.

“Concurrently, the customs sector is constructing and perfecting the National Single Window and ASEAN Single Window systems, gradually deploying the digital transformation of these systems to integrate data with the electronic customs data processing system for optimizing their operations,” emphasized Nguyen The Viet.

All core customs procedures are currently conducted automatically through the Vietnam Automated Cargo and Port Consolidated System (VNACCS/VCIS) at all customs units nationwide. Other administrative procedures have also been made available online with a level 3-4 e-commerce service provided by the General Department of Customs.

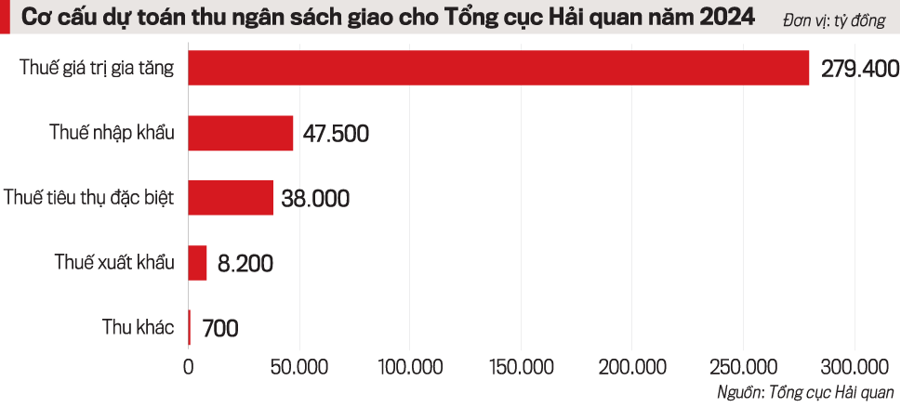

In 2024, the General Department of Customs has been allocated a state budget estimate of VND 375 trillion; balance of collections from import-export activities is projected at VND 204 trillion.

State budget revenue from import-export activities in 2024 is expected to face various global economic and social influences. Therefore, the General Department of Customs will continue to reform policies and customs procedures, ensuring state management in customs, preventing and combating trade fraud, and enhancing effectiveness in protecting national sovereignty and economic security. Additionally, the department will ensure the completion of legal frameworks for building and implementing digital customs and smart customs models, thereby facilitating import-export businesses and promoting trade, contributing to the nation’s economic growth objectives.

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-218x150.png)