BSC has just issued a report recommending the prospects of the import-export group of stocks, with the highlight that this is a reasonable time to buy and accumulate this group.

Accordingly, based on the data collected and the continued trend of consolidation after a difficult period when industry-leading companies (VHC, MWG, PNJ, etc.) and medium-sized enterprises that leverage their competitive capabilities (TNG, etc.) – have gained market share in 2023, combined with operational optimization, BSC expects that the business results in 2024 will recover from the low level of 2023 due to the recovery in demand.

However, the recovery level is gradually increasing: the import-export group benefits first, followed by the port and marine transportation group, and finally the consumer group in 2024.

BSC believes that this is a reasonable time to accumulate/buy stocks of the export-import group, especially the seafood and textile groups, as it has observed preliminary signs of recovery in these industries, such as recruitment of personnel in the textile industry, leather and footwear in the southern provinces, or narrowing supply-demand gap of tra fish exports in Q4/2023.

The seafood and textile groups are currently trading at PE FW 2024 levels of 9.6 times and 7.9 times respectively, which are reasonable levels to accumulate stocks for a new recovery phase in 2024. According to BSC’s observations, the stock prices of companies in these groups are relatively sensitive to order information and export prices, and will react ahead of the business results.

Therefore, BSC believes that this is a reasonable time to accumulate stocks for the Textile and Seafood groups as the valuations are only equivalent to the valuations at the beginning of the previous recovery cycle (end of 2020) and much lower than the average of the recovery period, at 9.3 times and 12 times respectively.

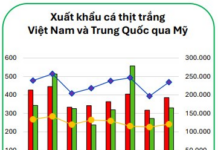

For the seafood group, BSC expects business results to recover thanks to the expected recovery in prices and export volume to major export markets, while the price of animal feed decreases. It is expected that the export volume will recover due to the gradual recovery of tra fish consumption, reduced inflation, increasing spending towards the end of 2024, 2025 due to domestic consumer stimulus policies, and tra fish enterprises penetrating the supermarket channel in China.

The export prices of tra fish to the US and China are expected to recover by 10% and 3% YoY respectively thanks to the recovery in tra fish demand, and the narrowing supply due to economically ineffective aquaculture households and unfavorable hydrology in the first half of 2024.

The textile group is expected to recover its business results thanks to the prospects of orders/price recovery as the demand in the US market gradually increases towards the end of 2024 and the reduction in interest costs in 2024.

The inventory pressure in the US is reduced. Clothing inventory in the US = $2.161 trillion, down 10% from the peak, returning to the inventory level in 2022 thanks to the focus on pushing and handling inventory in 2023; through end-of-year and beginning-of-year discount periods (Black Friday, Cyber Monday, etc.). Currently, BSC has noticed signs of returning orders as textile/garment and footwear companies begin to recruit again in the southern provinces and cities.

It is expected that the US clothing retail market will gradually recover towards the end of 2024 thanks to increased consumer spending as inflation continues to decline; the US economy is expected to recover in 2H.2024 – 2025; clothing retail sales have created a more optimistic new base than the end of 2022 and the beginning of 2023.

The export prices of textiles and garments have bottomed out in 2023 and are expected to recover in 2024 thanks to the recovery in garment demand, helping brands not to reduce prices to push inventory (ii) increasing the volume of high-value added, complex and difficult-to-produce goods (jackets, winter coats, etc.). The reduction in interest costs due to the low interest rate environment in 2024.

In general, in 2023, many textile companies were heavily affected by high borrowing costs, such as TNG, MSH, etc. In the following year, when borrowing interest rates have decreased, BSC expects that the reduction in interest costs will contribute to an additional 20% – 30% of the profit increase for MSH and TNG in 2024.