Novagroup corporation has announced that they have successfully sold 12.4 million shares of NoVa Investment Group Joint Stock Company (Novaland – code NVL). The transaction was made through matching orders from 2-5/2.

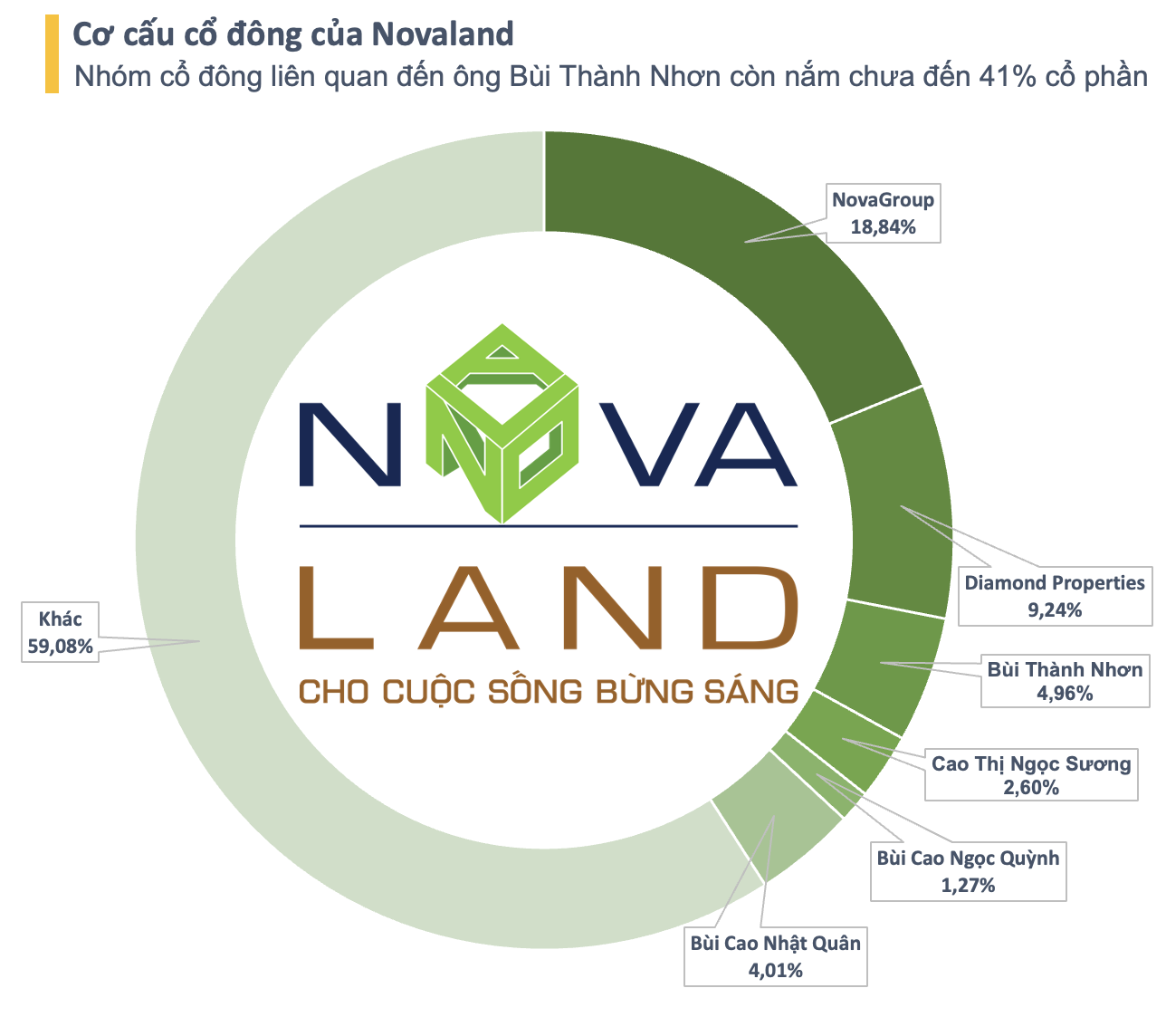

In addition, NovaGroup also had 159,400 NVL shares sold by a securities company. After these 2 transactions, the organization has reduced its ownership in Novaland to 367.4 million shares, equivalent to 18.84%, and still the largest shareholder.

With NovaGroup’s actions, the group of shareholders related to Chairman of the Board Bui Thanh Nhon currently holds less than 41% of the shares in Novaland. Compared to a year ago, the total ownership ratio of the group has decreased by about 11%, equivalent to 208 million NVL shares that have slipped out of the hands of shareholders related to Mr. Nhon.

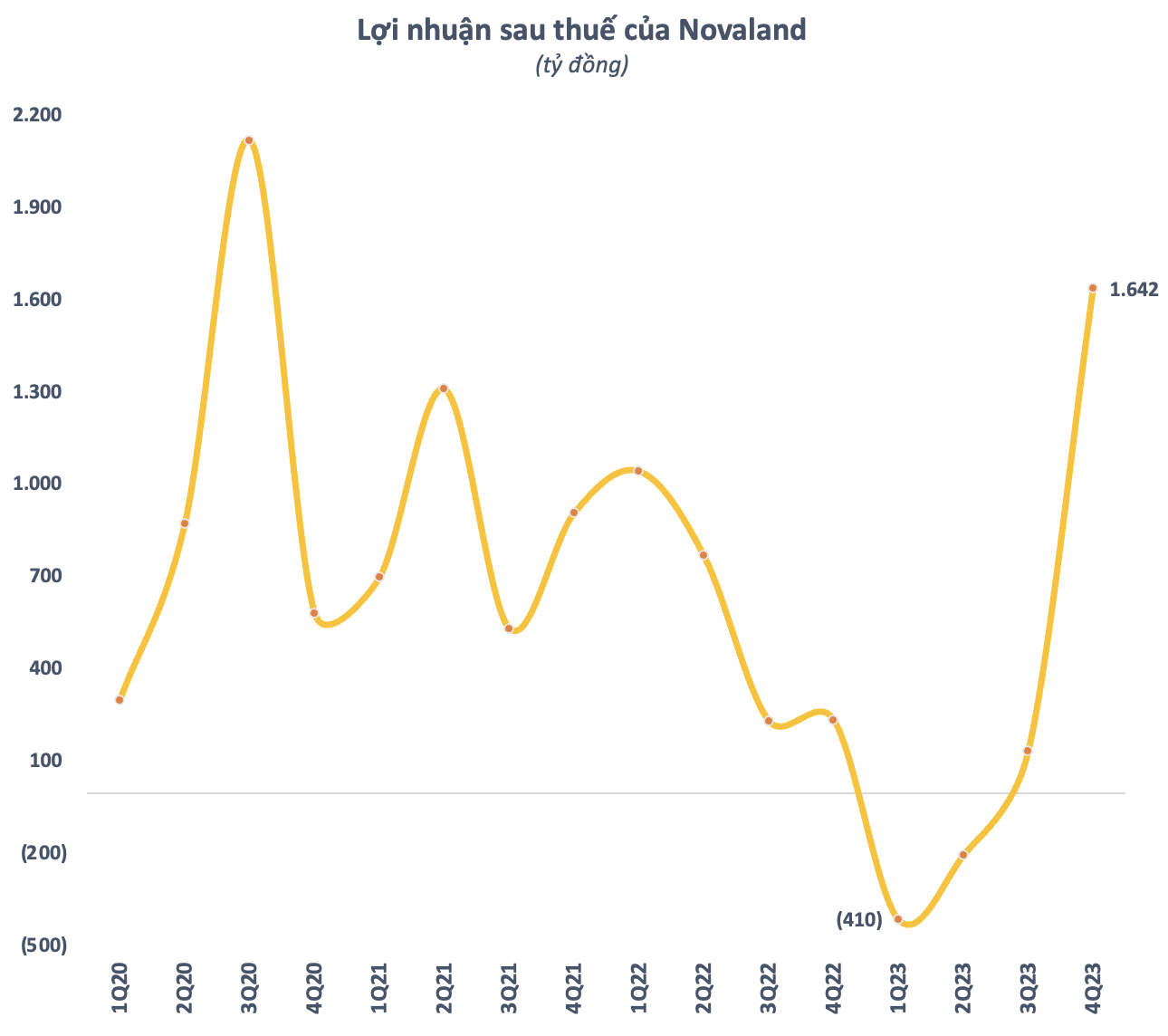

Regarding the business results of Q4/2023, Novaland reported a profit of VND 1,642 billion, 7 times higher than the same period in 2022 and the highest level in 3 years. However, the main profit comes from the extraordinary fluctuations of financial activities and other profits. Meanwhile, both revenue and gross profit decreased by 37% and 44% respectively compared to the same period in 2022.

Overall in 2023, Novaland’s net profit reached nearly VND 685 billion, only about 1/3 of the previous year 2022. In addition, the net cash flow from the business operations of this real estate enterprise was a heavy negative VND 3,182 billion. This means that Novaland had profit but did not actually receive money from its core business activities.

In the market, NVL shares ended the session on 6/2 at VND 17,250 per share, equivalent to the beginning of 2024, but about 12% higher than the same period a year ago. The corresponding market capitalization is about VND 33,800 billion.