Illustrative image.

Slight oil volatility

Oil prices were slightly volatile on Monday due to concerns about global demand weakness, although there are still concerns about increased tensions in the Middle East that could cause supply issues.

Brent crude contracts ended the session down 19 cents, or 0.2%, at $82.00 per barrel. US West Texas Intermediate (WTI) crude oil rose 8 US cents, or 0.1%, to $76.92, marking the third consecutive session that WTI closed at its highest level since January 30.

A survey of US consumer expectations for January showed that inflation prospects for both one and five years from now remain unchanged, maintaining the Fed’s 2% target – which could reduce oil demand due to slower economic growth.

Houthi forces in Yemen have targeted unmanned aerial vehicles and missiles since November. The US has led retaliatory attacks on Houthi missile sites since January.

The analysts at Ritterbusch and Associates energy consultancy said “we reiterate that global crude oil supplies have not been significantly disrupted by tension in the Middle East, and the rerouting of oil transportation around the Red Sea has not significantly reduced global crude oil supplies.”

Elsewhere in the Middle East, the Saudi Arabian Energy Minister said that the reason for the kingdom’s recent decision to put a halt to plans to expand oil production capacity is due to the energy transition process, adding that the country has sufficient spare capacity to support the oil market.

Gold decreases

Gold prices declined on Monday ahead of the release of US inflation data and comments from Federal Reserve officials that could provide further insight into the central bank’s interest rate plans.

At the end of the session, spot gold prices fell 0.2% to $2,020.97 per ounce; April 2024 gold futures dropped 0.3% to $2,033.

Jim Wyckoff, senior analyst at Kitco Metal, said the timing of rate cuts may be pushed back to the second half of this year due to the recent strong US economic data, which is too strong to justify rate cuts in May.

A Reuters poll expects US January CPI to rise 0.2% from the previous month, while underlying CPI is expected to increase by 0.3%.

US CPI data will be released on Tuesday, followed by US retail sales data on Thursday and producer price index (PPI) data on Friday, while markets are also awaiting comments from at least seven Fed officials this week.

Copper increases

Copper prices rebounded on Monday, following three previous sessions of declines, as traders and funds reduced their short positions betting that prices would fall further as the market awaits US inflation data – which could indicate when the Federal Reserve may cut interest rates.

On the London Metal Exchange (LME), three-month copper futures rose 0.9% to $8,241 per tonne. The widely used metal in the electricity and construction industry hit a three-month low of $8,127 last week due to concerns about demand prospects in the world’s top consumer – China.

A copper trader said: “Short covering has supported copper this morning.” “The weather has calmed down because of China’s holiday, and people are still worried about China’s consumption. What happens to the US dollar this week will be important in the context of China’s absence.”

Soybeans and corn rise from 3-year lows, wheat declines

US soybean prices increased on Monday due to bargain hunting and a weaker US dollar, but still near the lowest level in years as prices remain tangled around a technical resistance level.

Corn futures also rose in this session due to buying activity driven by technical factors. However, corn prices were also affected by timely and widespread rains in Argentina over the weekend along with expectations of a bumper corn harvest in South America.

Wheat futures mostly declined due to weak export demand and ongoing competition from the Black Sea region.

At the end of this session, on the Chicago Mercantile Exchange, soybean prices rose 9-1/2 US cents to $11.93 per bushel; corn rose 1-1/2 cents to $4.30-1/2 per bushel, while wheat rose 3/4 cents to $5.97-1/2 per bushel.

Coffee declines

Arabica coffee for May delivery fell 0.35 cent, or 0.2%, to $1.9115 per pound.

Brokers said there was very little coffee on offer from the world’s top coffee producer – Brazil – this week due to Carnival holidays on Monday, Tuesday, and Wednesday.

Brazil’s exports in January rebounded strongly despite tightening supply at ports.

Robusta coffee for May delivery fell 0.8% to $3,192 per tonne.

Cotton falls from over 1-year high

Cotton futures on ICE fell from over a 1-year high touched last Friday as traders booked profits.

May cotton contracts ended the session down 1.16 cent at 91.06 cents per lb, traded in a range of 90.87-92.18 US cents per lb.

Cotton prices reached their highest level since September 2022 in the previous session, supported by technical buying, rising oil prices, and increasing stock markets.

Jack Scoville, vice president at Price Futures Group in Chicago, said: “Going forward, prices could hold at around 88 US cents and possibly rise to 93 US cents.”

Last week, the US Department of Agriculture’s World Agricultural Supply and Demand Estimates (WASDE) report lowered its forecast for end-of-season cotton stocks in the country compared to the previous month’s forecast, with forecasted exports increasing and usage at mills decreasing while production remained unchanged.

“The export forecast is raised 200,000 bales to 12.3 million bales based on strong shipment pace and robust sales to date,” the report said.

Sugar declines

Raw sugar prices fell nearly 2% on Monday due to the likelihood of improving prospects for the upcoming sugarcane crop in South Central Brazil. At the end of the session, March raw sugar dropped 0.46 cent, or 1.9%, to 23.56 cents per lb.

“The weather in South Central Brazil remains the main focus in the market.

March white sugar declined 1% to $659 per tonne.

Cocoa falls from historic high

March cocoa futures on the London exchange fell £5, or 0.1%, to £4,610 per tonne in Monday’s session, after hitting a record high of £4,916 on Friday. This is the first decline in 12 recent trading sessions.

Cocoa futures for the same month on the New York exchange fell 0.3% to $5,583 per tonne.

Brokers said the sharp rise in recent days was due to concerns about supply after a subpar harvest in the world’s top cocoa-producing countries – Ivory Coast and Ghana.

Last week, there was no rain in most of the major cocoa regions in Ivory Coast, threatening development during the mid-crop – April to September – and raising concerns about supply and cocoa quality.

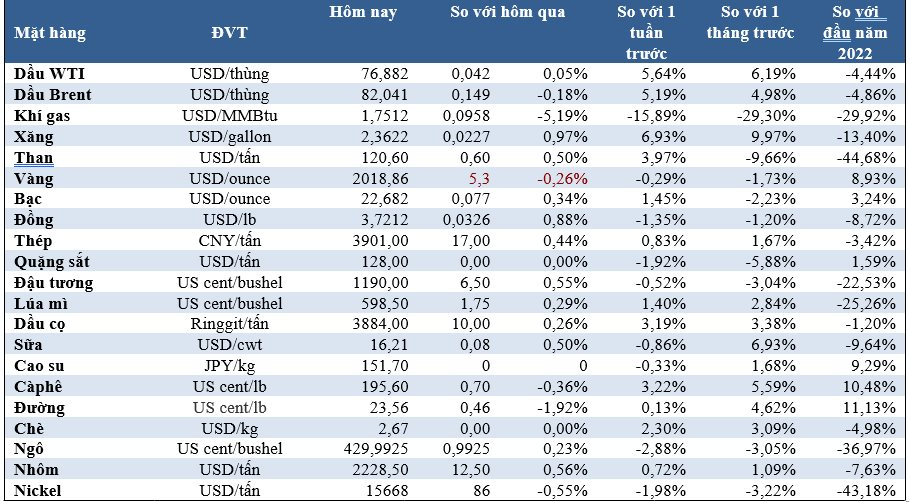

Prices of key commodities on the morning of 13/2