|

Superstition in Investment

A new trend called spiritual investment in the stock market has emerged, in which the common characteristic is to view stock investment as a game of chance, with the outcome of winning or losing largely depending on luck. Notably in this trend is the influence of Feng Shui “experts,” who frequently appear on social media and mainstream media. They provide predictions and advice on buying and selling stocks, timing, and prices.

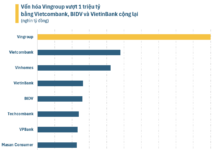

According to a recent study published in 2023 in the Journal of Comparative Economics by Dr. Pham Van Dai of Fulbright School of Public Policy and Management, superstition not only affects individuals but also companies in their investment decisions. The study shows that companies with directors aged 49-53 tend to reduce investments based on popular beliefs in bad luck and risks during this period. Interestingly, the influence of superstition is even greater as the level of education of company leaders increases.

Superstition in investment and business is not uncommon worldwide. For example, companies led by Chinese leaders often engage in high-risk investment activities such as mergers and acquisitions (M&A) or research and development (R&D). Alternatively, it is more common to avoid buying properties associated with beliefs of bad luck. Even avoiding license plates ending in the numbers 49 or 53 has become a topic of discussion in the Vietnamese National Assembly.

These examples highlight the fact that despite the increasing sophistication and modernity of society, superstition and beliefs in unscientific phenomena still persist and influence various economic and social behaviors.

A Bit of Spirituality

According to psychological studies on human behavior, spiritual beliefs can provide psychological stability in uncertain environments, creating a sense of security and enhancing autonomy and emotional control. For this reason, superstition can also have positive effects to some extent.

However, in the field of investment, superstitious behaviors often do not bring the desired luck. A study by Bhattacharya et al. in 2018 found that individual investors in the Taiwan futures market had a significantly higher percentage of limit orders with ending prices of 8, compared to orders with ending prices of 4. Unfortunately, the data showed that superstitious investors (those placing orders with 8) had lower investment returns due to poor timing and delayed updates of limit orders.

Naturally, in a market, one person’s misfortune can be another person’s opportunity. Superstitious investors who trade based on instincts and luck are often sources of profit for professional brokerage firms, institutional investors, and individuals with expertise in risk analysis and management. This explains why investment trends based on spirituality are promoted.

However, it must be acknowledged that these trends do not contribute positively to building a healthy and developed financial market or fulfilling the capital mobilization function of the economy. Instead, they increasingly create a gambling environment where players hope for profits through luck.

The Influence of Superstition on the Investment Behavior of Vietnamese Companies

A study on “The Influence of Superstition on the Investment Behavior of Vietnamese Companies” conducted by Dr. Pham Van Dai, a senior lecturer and researcher at Fulbright School of Public Policy and Management, was published in the Journal of Comparative Economics in November 2023. This journal is highly respected in the field of institutional economics and transitional economies.

The author summarizes the theories on the universal influence of culture, religion, customs, etc. on economic activities in different societies. The data shows that Vietnam is one of the top three countries with the highest percentage of atheists, but at the same time, it is strongly influenced by folk beliefs and indigenous practices.

To determine the causal relationship between superstition and investment behavior, the study used regression discontinuity design (RDD) and two-stage difference-in-differences (2SDD) approaches, along with quantitative economic analysis techniques with a sample of Vietnamese companies during the period 2016-2020.

The study drew several important conclusions, including:

Companies with directors aged 49-53 tend to reduce investments in fixed assets. This reduction is not accompanied by a decrease in labor, thereby eliminating the market and business environment factors as causes.

The influence of folk beliefs regarding the “limit age” of 49-53 is not found in companies with foreign directors, thus eliminating suspicions of health/biological issues at this age.

The influence of folk beliefs regarding the “limit age” of 49-53 is smaller in companies with good governance structures, such as large-scale and listed companies.

Contrary to common thinking, the degree of influence of superstition was found to be stronger in the group of directors with higher education levels.

Anh Dan