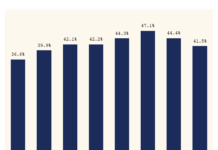

In the latest update report, SSI Securities stated that global equity funds continued to experience net inflows for the third consecutive month, but at a slower pace. The total value of capital inflows into equity funds reached $29.0 billion (a 23% decrease compared to December). The money flow into equity funds has been relatively steady over the past 6 months, although the trend has been much more positive than in the 2022 period and the first half of 2023 due to better-than-expected financial results of listed companies. However, the cautious message from the Fed during the February meeting has prompted the market to reassess the pace of interest rate cuts in 2024 and also consider the intensity of capital inflows into equity funds.

SSI assesses the asset allocation into Equity Funds to be at a neutral level, indicating that equity capital still has potential for breakthrough, especially if investors restructure from Money Market Funds as the trend of interest rate cuts becomes clearer. In addition, Equity Funds in non-U.S. markets may benefit from the story of economic recovery from the bottom.

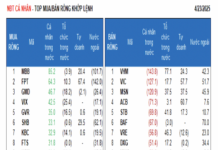

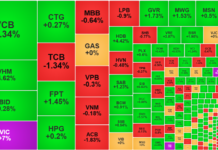

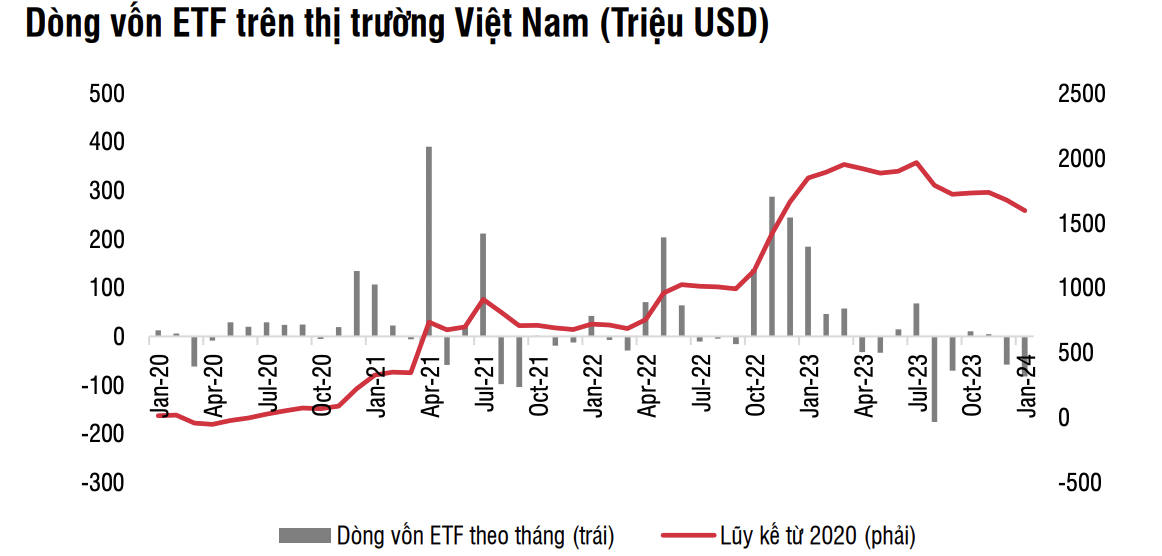

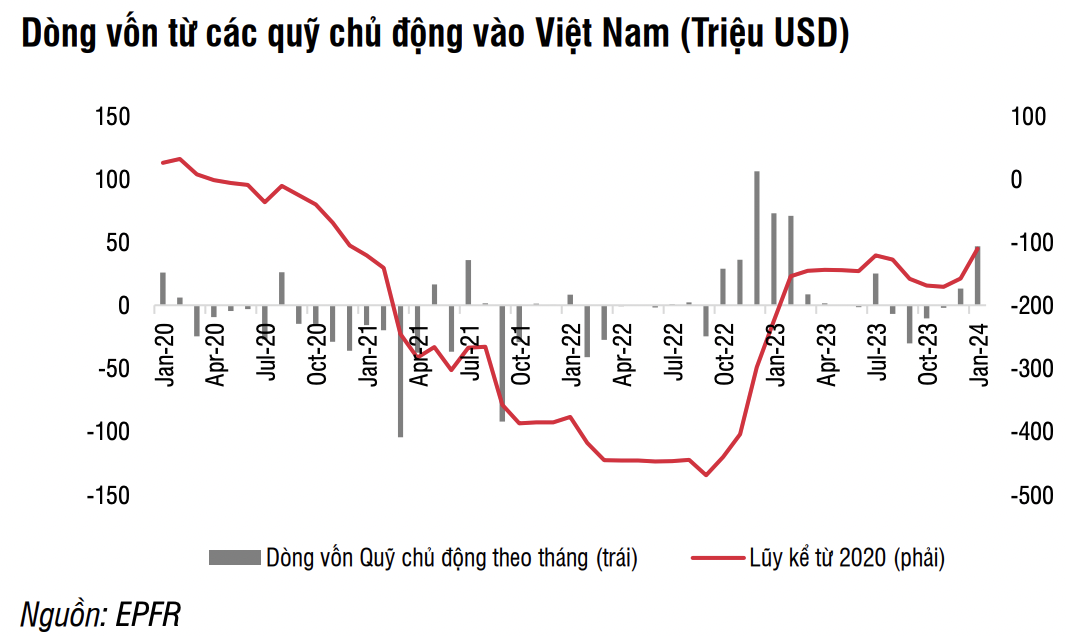

Regarding the Vietnamese stock market, investment capital inflows from funds to Vietnam have shown differentiation. Net selling is still the dominant trend of ETF funds in January, but the intensity has cooled compared to December. On the contrary, actively managed funds invested in the Vietnamese market pushed net buying to VND 1.1 trillion in January. In addition to the emergence of new open-ended funds since December 2023, the remaining actively managed fund groups have been much more active, possibly due to the seasonal trend at the beginning of the year.

In the medium term, SSI Research believes that investment capital inflows into the Vietnamese market may benefit from the shift of capital to developing markets, but this is likely to only occur after the Fed begins to cut interest rates. In addition, the market upgrade process also needs to be noted.

Currently, the biggest obstacle for Vietnam to be upgraded by FTSE Russell to an Emerging Market (EM) is the issue of pre-trade collateral for institutional investors. While domestic individual investors have already had a securities lending business to resolve this issue, under current regulations, institutional investors must all fully collateralize before trading, which is not in line with international norms.

To address this issue, SSI can implement two methods. Firstly, in the long term, by applying the Central Counterparty (CCP) Clearing Partner model. Secondly, in the short term, securities companies will provide payment support for institutional investors (Non Prefunding Solution – NPS). The Ministry of Finance plans to amend some relevant legal documents in 2024 to be able to implement the NPS model. FTSE Russell will rely on feedback from investors to assess the effectiveness of the NPS model.

SSI forecasts that the decision to classify Vietnam as an EM by FTSE Russell could take place as early as September 2024 (positive scenario) or March 2025 (base scenario) and would take effect 6 months later.

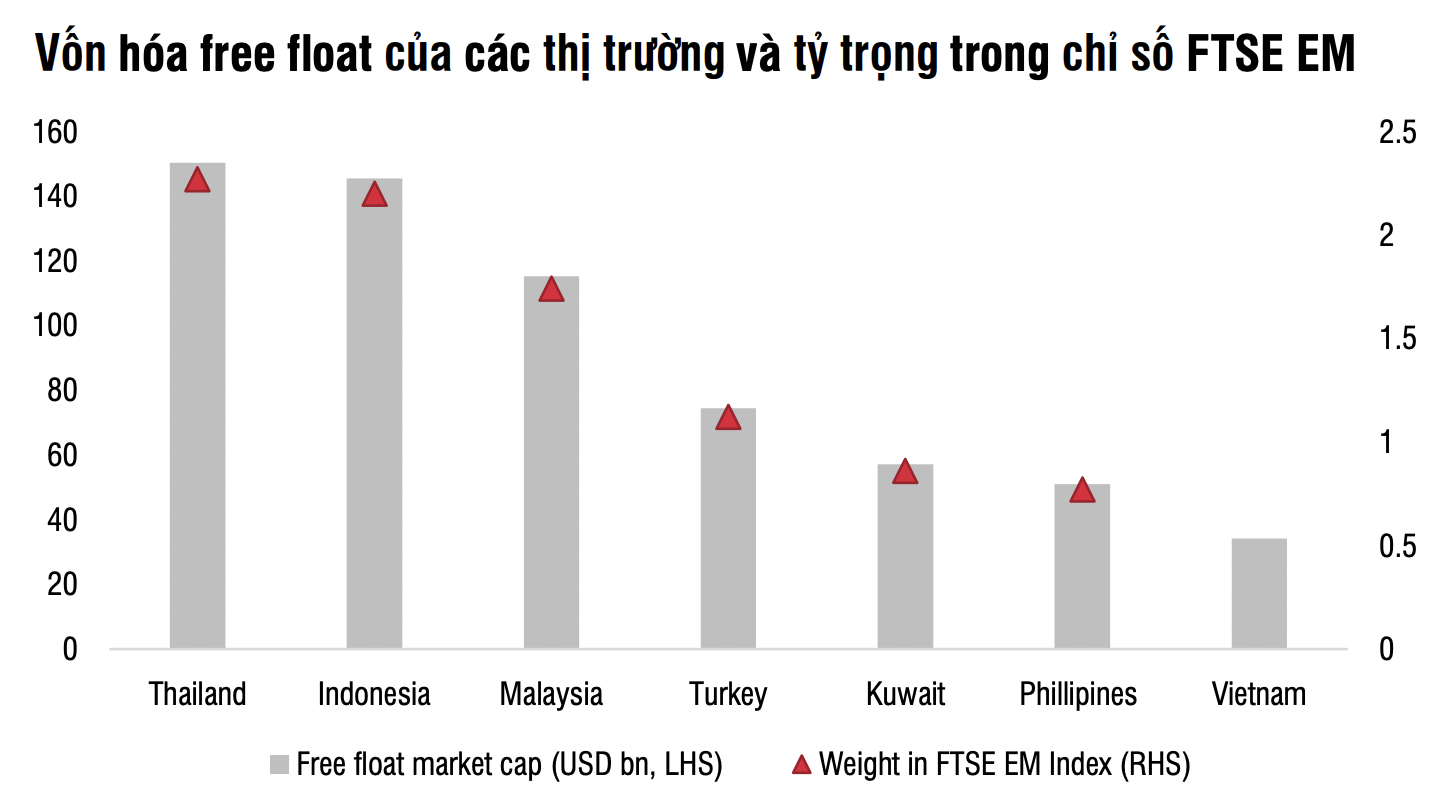

With the free float market capitalization of the Vietnamese market currently at around $35 billion – equal to about 1/4 of Indonesia and Thailand. From this, SSI estimates that Vietnam’s weight in the FTSE EM index would be around 0.7% – 1.0%, and in the FTSE Global index it would be 0.1%. This could immediately attract approximately $1.7 – $2.5 billion when the upgrade decision takes effect.