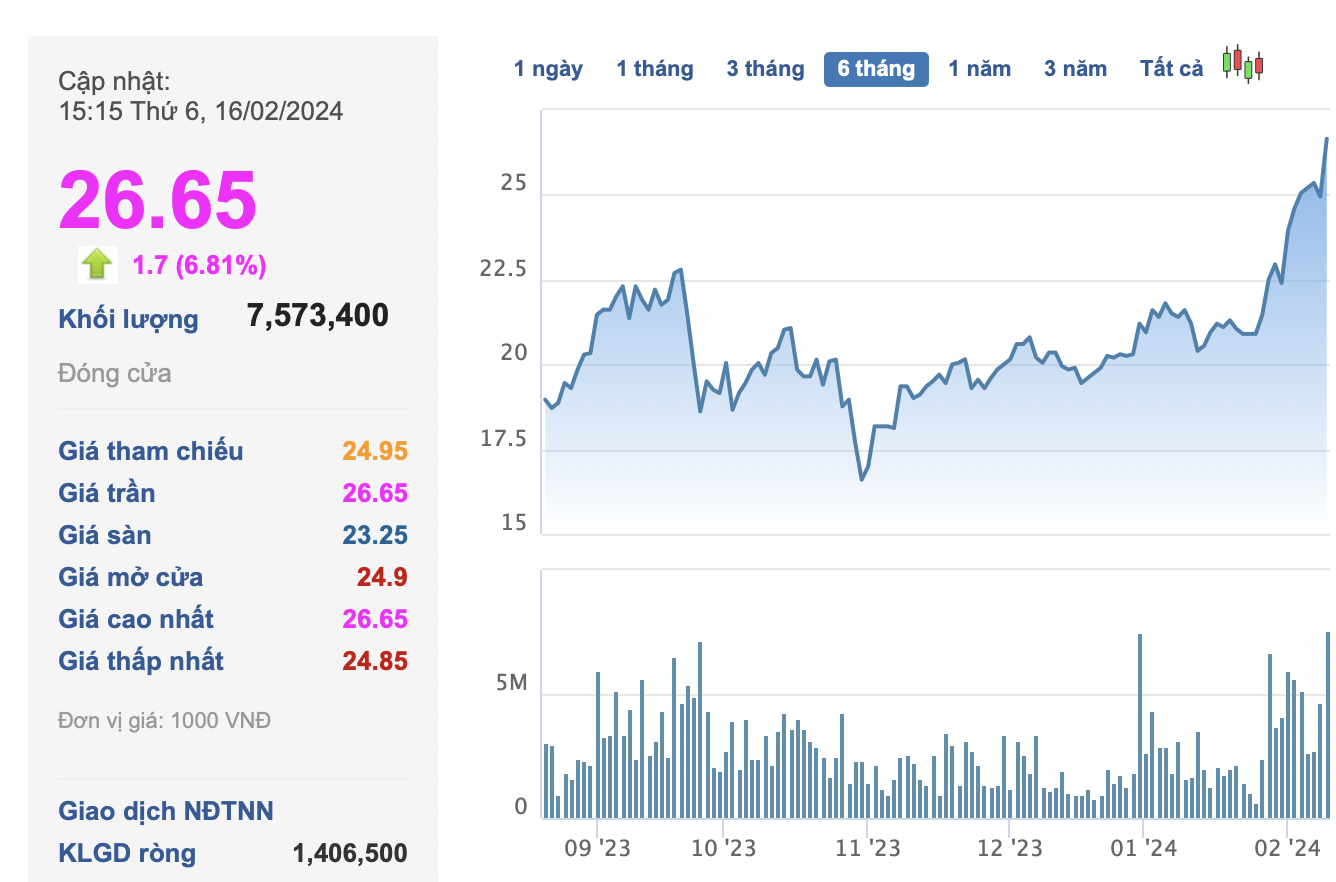

GVR stocks of the Vietnam Rubber Industry Group gained high ceiling levels to reach 26,650 VND/share in the session of 16/2, extending a streak of strong trading since the beginning of the year. The liquidity also increased dramatically with the trading volume reaching 7.5 million units.

Over the past month, this stock has increased nearly 31% to the highest level in 22 months. Compared to the bottom price in early November 2023, GVR shares have increased over 60%. The market capitalization value has increased by nearly 25,000 billion VND, reaching approximately 106,600 billion VND.

The price surge of GVR comes after the company announced the organization of the extraordinary shareholders’ meeting for 2024. Specifically, on March 29, GVR will organize the online shareholders’ meeting, and the deadline for registration to attend is February 28. However, the company has not yet announced the specific content and documents.

The Vietnam Rubber Industry Group was established in 2006, operating in 4 main fields: (1) Production and business of rubber latex, (2) Production and business of rubber products such as tires, (3) Wood processing activities, (4) Industrial zone development. GVR is currently managing nearly 400,000 hectares of rubber plantation land both domestically and internationally. Recently, GVR has been in the process of restructuring and focusing on industrial zone business thanks to the abundant land fund held by the group.

Under the industrial real estate development strategy for the 2021-2030 period, GVR plans to establish and expand more than 39,000 hectares from the conversion of rubber plantation land, including 48 industrial zones (nearly 37.4 thousand hectares) and 28 industrial clusters (nearly 1,800 hectares). New projects such as the expansion of Nam Tan Uyen Industrial Zone, An Dien, Minh Hung III,… are in the process of completing legal procedures for investment.

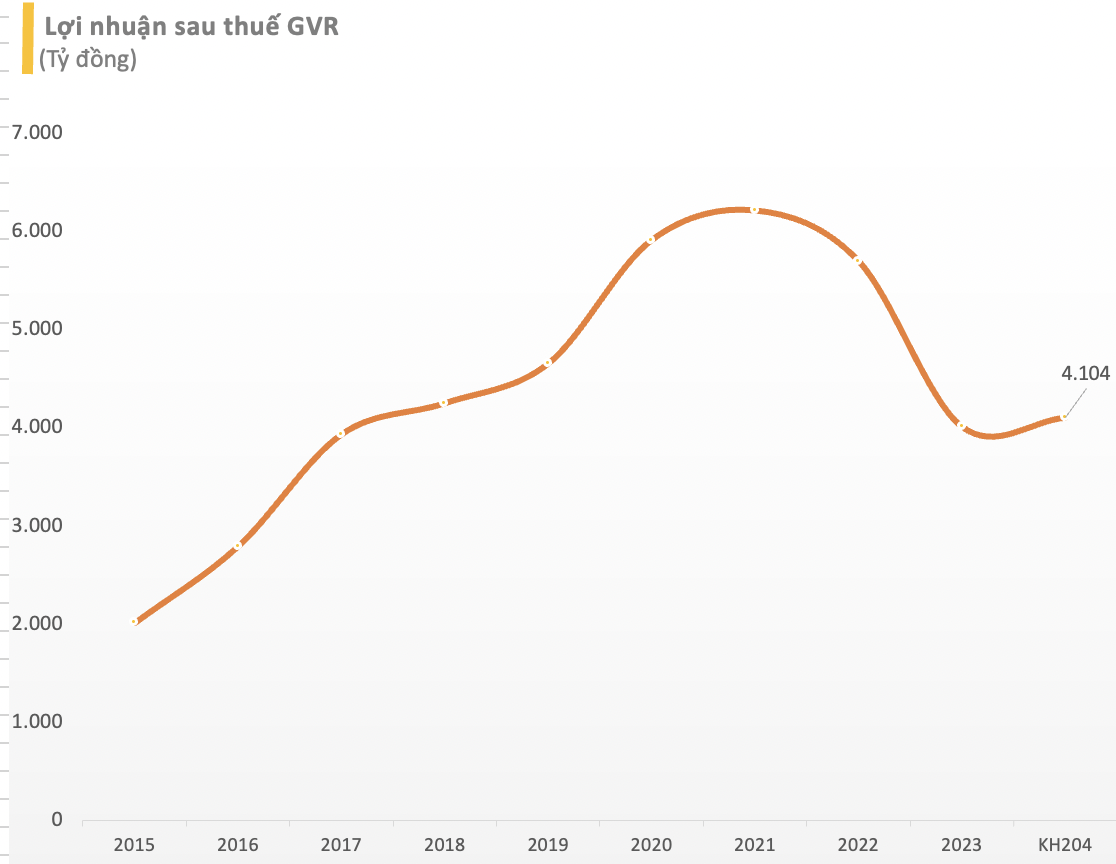

In 2024, the Vietnam Rubber Industry Group aims to achieve revenue of approximately 25,000 billion VND, an increase of 2.1% compared to 2023. Pre-tax and after-tax profits are expected to reach 4,104 billion VND and 3,437 billion VND, respectively, corresponding to a growth rate of 2.2% and 0.9% compared to 2023.

The group plans to allocate 7,503 billion VND for consolidated development investment, 2.1 times higher than in 2023. In the medium and long term directions, GVR continues to focus on investment in industrial zone projects in the eastern provinces.

Regarding the parent company’s targets, the revenue and other income are expected to reach 3,988 billion VND, an increase of 3% compared to the estimated result of 2023. The planned profit after tax is 1,454 billion VND, equivalent to 103.5% compared to the previous year. The dividend payout ratio in 2024 is 3%, the same as the previous year.

For development investment targets in 2024, the parent company plans to invest 1,146 billion VND, a multiple of the 13 billion VND realized in the previous year. GVR said that 1,146 billion VND will mainly be used for investment in the Hiệp Thạnh industrial zone, and for upgrading and renovating representative offices at 56 Nguyen Du (Hanoi) and 236 Nam Ky Khoi Nghia (Ho Chi Minh City).

According to Mr. Le Thanh Hung, CEO of GVR, in the first quarter of 2024, the Group will actively disburse and invest in industrial zone projects. Regarding organization matters such as establishing the Industrial Zone Development Board, Group branches, GVR representatives have suggested that the Committee consider and support approval soon in January 2024.

KBSV Securities believes that the inclusion of Nam Tan Uyen 3 – Industrial Zone in the significant economic area of Binh Duong – which was handed over at the end of May, has created a growth foundation in the short and medium term for GVR, expected to contribute to GVR’s business results from 2024.

KBSV estimates that NTU 3 can start recognizing revenue from 2024. According to Nam Tan Uyen, the Nam Tan Uyen 3 project will generate cash flow of over 600 billion VND/year and after-tax profit of about 400 billion VND/year until 2027 – 2028 when it starts operation, expected from 2024 onwards.

In addition, accelerating plans to expand the land fund of GVR’s industrial zones is expected to soon improve the supply shortage due to delayed legal procedures of both GVR and the industry in general, creating a continuous new supply, increasing profits from the industrial zone segment – the segment with the highest margin of GVR.