According to data from the Hanoi Stock Exchange (HNX), Hai An Transport and Stevedoring Joint Stock Company (mã HAH, HoSE exchange) has recently announced the results of issuing the HAHH2328001 bond batch.

Specifically, the HAHH2328001 bond batch was issued on February 2, 2024 with a volume of 500 bonds, a face value of 1 billion dong/bond, a total issuance value of 500 billion dong, and a term of 5 years.

Notably, the HAHH2328001 bond batch has a fixed interest rate of only 6% per annum. This is a record-low interest rate in the market for corporate bond capital mobilization. This is also the only bond batch currently in circulation by HAH.

This is a convertible bond batch, without warrants and with collateral. The collateral is a ship owned by Hai An Container Transport Co., Ltd. – a subsidiary company of the Issuer according to Certificate of Registration of the vessel number HP-CON-002314-2 dated July 4, 2017 issued by the Maritime Administration of Vietnam.

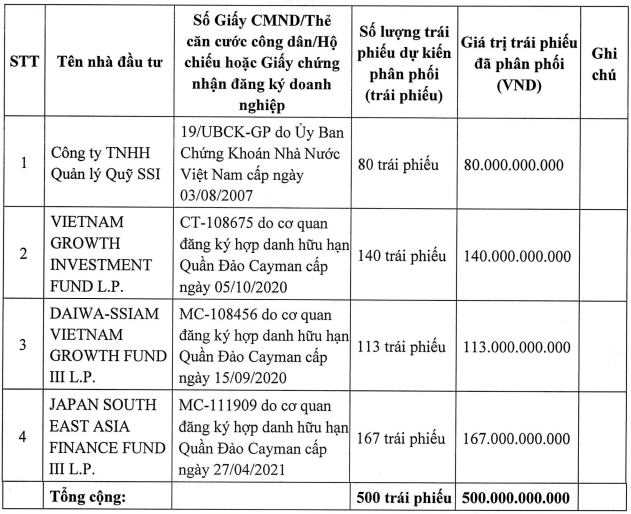

Prior to this, HAH had reported the results of the private placement of convertible bonds of the aforementioned bond batch. During the offering period from December 29, 2023 to February 2, 2024, there were 4 investors participating in the private placement of HAH’s convertible bonds. Among them, there were 3 foreign investors, accounting for 84% of the total value of the bond batch.

List of investors who purchased HAH’s private placement convertible bonds. Source: HAH

The above-mentioned list of investors has changed compared to the Board of Directors’ resolution dated November 22, 2023, with only one investor purchasing the entire bond volume being SSI Fund Management Co., Ltd.

The conversion price is 27,300 dong/share, determined based on the conversion price not lower than 1.1 times the book value of one share of the company based on the consolidated financial statements for the third quarter of 2023, which is 24,643 dong/share.

The bonds are restricted from transfer within 1 year for professional investors from the completion date of the private placement. The bond delivery is expected to take place in February 2024.

After deducting costs, HAH estimates a net proceeds of 489.6 billion dong from the private placement of convertible bonds.

In terms of business results, the audited consolidated financial statements for 2023 show that HAH recorded net revenue decreasing by 18.5% to 2,612.6 billion dong. The after-tax profit of the company is 358 billion dong, a decrease of 65% compared to the previous year.